[ad_1]

The following is an excerpt from last week’s edition of the Alaska Political Report written by Neil Steininger. Click here for more political reporting. Subscription is $1,299 per organization per year. Discounted pricing is available to nonprofits and government organizations. Our budget coverage begins with the governor’s budget proposal in mid-December, and we closely track everything throughout the process. If you have any questions or would like to subscribe, please email jeff@akpoliticalreport.com.

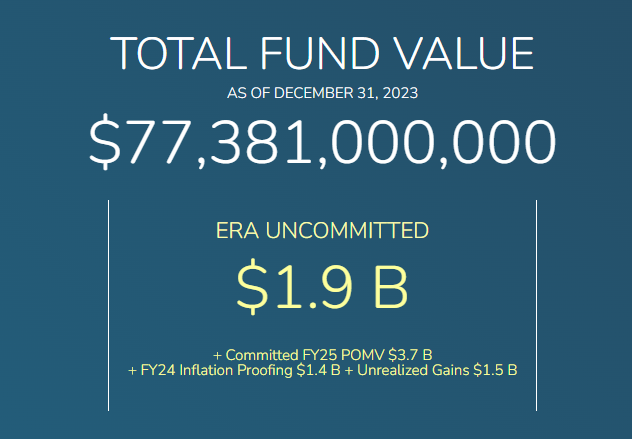

During recent legislative hearings, the director of the Legislative Finance Department (LFD) and the executive director of the Alaska Permanent Fund Corporation (APFC) separately alerted the Finance Committee to potential concerns. LFD Director Alexi Painter said it most succinctly. According to the department’s analysis, there is a 54% chance that states will run out of revenue reserve accounts (ERAs) over the next 10 years, leaving them with no resources to pay for state services. APFC Executive Director Deven Mitchell expressed similar concerns in his testimony. The Alaska Political Report seeks to determine how this problem arose, whether it is truly a significant concern to Alaskans, and what Congress and the APFC can do to avoid it. , investigated this issue.

To examine and understand the causes of this problem in an objective manner, it is important to set aside the social, political, and cultural legacy surrounding the ERA and the Endowment Fund. At the most basic level, the Earnings Reserve Account (ERA) is a state savings account managed by the APFC and available to councils for unrestricted use. The Permanent Fund Corpus was established by voters in the Alaska State Constitution in 1976, a law first drafted in his ’70s and later amended, but it was not established that its revenues would be transferred to the ERA. Directed. This follows the “return and principal” structure that was popular in the 1980s when the fund was established.

The Constitution prohibits diversions (expenditures) from the fund corpus. The body of the fund consists of $734,000 deposited in 1977, appropriations to other extraordinary and discretionary funds made by Congress, such as constitutionally mandated rents and fees, anti-inflation protection, and additional It consists of usage fee contributions. To ensure a stable real value for the corpus, Congress annually makes appropriations from the ERA to address the effects of inflation on the fund’s value.

The Alaska Constitution does not prohibit the Legislature from spending money from the ERA. However, Alaska’s statute includes a formula for setting a sustainable withdrawal rate from the fund. Since the early 1980s, the available draw formula has been 21% of the most recent five years of income deposited into the fund, with half of that draw designated for the Permanent Fund Dividend (PFD) program. In 2018, we added a formula that defines the allowed distribution from ERA as 5% of the past 5-year average of both ERA and corpus values. This draw is commonly referred to as Percentage of Market Value (POMV) and follows the modern donation model.

The state has never exceeded either lottery limit, and prior to 2018, Congress appropriated only the portion of the lottery designated for the PFD program. The changes in 2018 came as states were forced to adapt to declining oil revenues and the need for alternative sources of recurring revenue.

What would have happened if Congress had not passed the POMV bill, SB 26, in 2018? If states had simply followed the historical formula and started spending the half earmarked for the PFD, they would have effectively used up all of the fund’s revenue. , will be exposed to fluctuations in the investment market. The 1980s formula protects the nominal balance of the corpus, but if fully withdrawn, the fund loses value over time to inflation. The 1980s formula was a sustainable lottery because Congress had the means to spend no more than half of the available funds.

To ensure that further utilization of the Fund is sustainable, the state introduced POMV through SB26, which is calculated to protect the real value of the Fund. But in making that change, rather than restructuring the entire fund and statute to fit the new model, Congress left the previous lottery formula and structure of the fund in place.

This makes it clear that the main cause of the concerns expressed by the LFD and APFC is the no longer aligned fund structure and lottery rules. In addition to that structural disconnect, changes in investment strategies over the decades have exacerbated the problem.

APFC’s method of investing funds is designed to protect the Fund’s principal and maximize return, but is not specifically designed to generate income for deposit into ERA. Over time, the APFC has moved investments away from liquid markets and into longer-term, less liquid investments, reducing its ability to “churn” investments in a way that generates income that can be used by states within the ERA. These long-term investments have the potential to generate significant returns for the state, but may not generate income for years. As a result, expected deposits into ERA are expected to decrease, although the value of the fund may increase.

Following the POMV model eliminates the need for inflation protection. This is done by setting a withdrawal rate that is the expected return minus the expected inflation. In other words, you only withdraw the real returns of the fund. Nevertheless, the APFC continues to advocate anti-inflationary practices, and Congress continues to appropriate such appropriations each year. This is a legacy of two account structures that require inflation protection to ensure funds are not misappropriated. The concern of the APFC and Congress is that without these transfers, future Congresses will make unsustainable withdrawals and reduce the value of the Fund. In a further effort to protect the Endowment Fund from overdrawing, several budgets have been earmarked in recent years to transfer more than $8 billion of his money from the ERA to the Corpus.

Concerns about overdraw are valid, with the Dunleavy administration proposing to withdraw an additional $3 billion from the ERA in addition to the POMV calculation in fiscal year 2022, and the Dunleavy administration’s current 10-year plan is It has been suggested that overdraw will begin in the fiscal year.

The combination of an illiquid investment strategy that maximizes returns and the separate prudent elements of protecting funds within the corpus can reduce the value of the ERA to the point where it does not hold enough funds to pay the annual POMV. Sexuality increases.

There are several ways policymakers can avoid this risk.

- First and foremost, it is important to strictly adhere to the statutory POMV withdrawal limits.

- Withdrawals in excess of POMV will erode future state revenues and increase the likelihood of depletion of the ERA balance.

- The most powerful thing that APFC is advocating is constitutional reform. This amendment would replace current language that provides Congress with access to spend 100% of fund revenues with language that restricts access to POMV calculations.

- Achieving constitutional reform presents many political challenges, including high voting standards and the need for statewide elections. Political considerations also make it very difficult to address account structure without addressing PFD programmatic issues.

- Legislative changes that redefine what constitutes Permanent Fund income may be implemented. While not as powerful as a constitutional amendment, this would reduce the voting hurdle. The current definition of statutory net income is unique to the state of Alaska and is not based on any external accounting regulations. But sensible legal solutions to constitutional problems don’t always work when tested in court.

- Limit the use of inflation protection in operating budgets. Last year, Congress capped transfers to prevent inflation.

- The main challenge is that this strategy leaves excess ERA balances at risk of simple majority diversion in the future, a risk some may not want to take given the current budget proposals. .

- The APFC Board may direct fund managers to consider fund structure and state uses in investment decisions. This would, in effect, direct a reduction in the proportion of fund assets allocated to illiquid investments.

- The APFC has warned that this will put at risk the level of long-term benefits that companies can provide to the country.

The good news is that as long as organizations like the LFD and APFC continue to monitor and report on this concern to the Treasury Board, we will see the failure of the ERA in the years ahead. Unfortunately, the most powerful solutions are tied to a political quagmire where countless attempts at solutions have failed over the past decade. Alaska has the wealth and opportunity to support a strong system of government based on enduring rules, but only if it can resolve the social, political, and cultural legacy that we set aside at the beginning of this article. limited to.

[ad_2]

Source link