[ad_1]

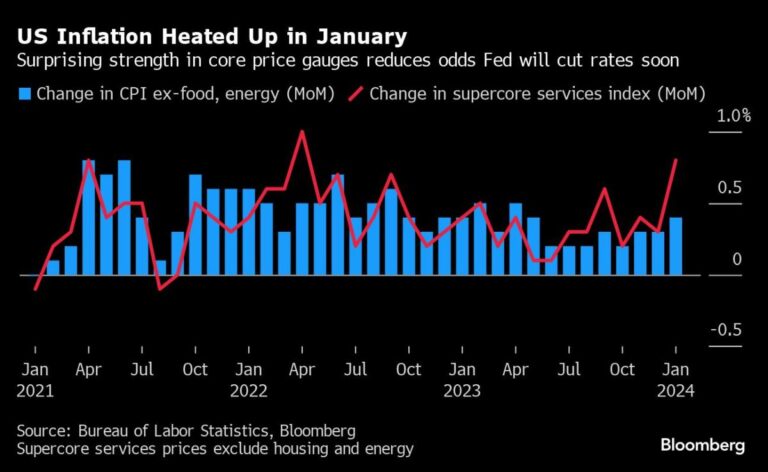

(Bloomberg) — European stock futures follow Wall Street’s decline as better-than-expected U.S. inflation data fuels expectations the Federal Reserve won’t cut interest rates as quickly as expected. did.

Most Read Articles on Bloomberg

There was good news on Wednesday for UK traders looking forward to policy easing from the Bank of England. UK inflation is lower than expected in January, and underlying price pressures have not risen as much as markets and the BoE had feared. The data caused the pound to reverse earlier gains.

Coming soon: Sign up for the Hong Kong edition for an inside guide to the money and people rocking Asia’s financial hub.

Stock prices in South Korea, Japan, and Australia fell, with Asian stocks mainly falling. Hong Kong indexes reversed early losses as trading resumed after the Lunar New Year holiday, with investors focused on what more the Chinese government can do to stem the collapse. U.S. stock futures edged higher after Wall Street’s selloff on Tuesday.

The yen rebounded slightly from Tuesday’s selloff after Japan’s top foreign exchange official, Masato Kanda, warned that recent movements have been rapid and that authorities are prepared to take action if necessary. His comments were immediately reinforced by Finance Minister Shunichi Suzuki.

“The authorities’ comments probably put a cap on the dollar-yen today, but it wasn’t strong enough to change the direction of the dollar-yen,” said Yukio Ishizuki, senior currency strategist at Daiwa Securities. A slight decline in the dollar and a rebound in the yen have halted the decline in US bond yields and Japanese stocks in Asia. ”

Treasury yields stabilized after spiking on Tuesday as traders scaled back bets that the Fed would cut rates early. U.S. inflation data erased the last remnants of a global bond rally that began in December on hopes that the Fed had finally eased. Japan’s 10-year government bond yield rose to its highest level since December.

The Golden Dragon index of U.S.-listed Chinese companies fell 2.7% on Tuesday, its steepest decline in nearly a month, as China remained closed for the Lunar New Year holiday. Swaps traders are gradually lowering their expectations for Fed rate cuts through July, while the stock market’s “fear gauge” VIX index ended above 15 for the first time since November.

U.S. consumer price index (CPI) data was disappointing for investors, after recent downward pressure on prices helped raise expectations for interest rate cuts this year. The numbers also lent credence to the wait-and-see approach emphasized by Chairman Jerome Powell and the chorus of Fed speakers.

Swap contracts referencing the Fed’s policy meetings, which as recently as mid-January fully priced in a May interest rate cut and 175 basis points of easing through the end of the year, were disrupted. The probability of a rate cut in May has fallen to about 32% from about 64% before the inflation data was released, and expectations for a rate cut this year are less than 90 basis points.

Consumer prices rose 4% in January from a year earlier, the Office for National Statistics said on Wednesday, at the same pace as December. The BOE and private economists had expected inflation to rise to 4.1%.

In Japan, the world’s first sovereign transition bond attracted strong demand due to its novelty, despite skepticism among foreign investors about the bond’s environmental rating. Sony Group has announced it will list its financial arm in October 2025, preparing a major capital injection as the media conglomerate weakens prospects for its core gaming division.

In Hong Kong, shares of Wuxi AppTec and WuXi Biologics (Cayman) Inc. fell as a bipartisan group of U.S. lawmakers called for a formal investigation that could put both companies on a sanctions list. Meituan rose after local media reported that as of February 11, off-site meal orders on delivery platforms during the Chinese New Year holiday increased by 29% year-on-year.

The Organization of the Petroleum Exporting Countries (OPEC) and the IEA gave contrasting outlooks for the global oil market, while oil prices edged lower after mixed U.S. inventory reports. Gold is trading in a narrow range after falling below $2,000 an ounce for the first time in two months, while Bitcoin is trading around $50,000.

This week’s main events:

-

Eurozone industrial production, GDP, Wednesday

-

BOE Governor Andrew Bailey testifies before the House of Lords Economic Committee on Wednesday

-

Chicago Fed President Austan Goolsby speaks Wednesday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Wednesday

-

Japan’s GDP, industrial production, Thursday

-

US manufacturing industry, number of new unemployment insurance claims, industrial production, retail sales, business inventories, Thursday

-

ECB President Christine Lagarde speaks on Thursday

-

Atlanta Fed President Rafael Bostic speaks Thursday

-

Fed Director Christopher Waller speaks Thursday

-

ECB Chief Economist Philip Lane speaks on Thursday

-

U.S. Housing Starts, PPI, University of Michigan Consumer Sentiment, Friday

-

San Francisco Fed President Mary Daly speaks on Friday

-

Fed Vice Chairman for Supervision Michael Barr speaks on Friday

-

ECB board member Isabel Schnabel speaks on Friday

The main movements in the market are:

stock

-

As of 7:18 a.m. London time, S&P 500 futures were up 0.2%.

-

Nasdaq 100 futures rose 0.3%

-

Dow Jones Industrial Average futures little changed

-

MSCI Asia Pacific Index falls 0.5%

-

MSCI Emerging Markets Index falls 0.2%

currency

-

Bloomberg Dollar Spot Index little changed

-

The euro was almost unchanged at $1.0711.

-

The Japanese yen rose 0.3% to 150.40 yen to the dollar.

-

The offshore yuan was almost unchanged at 7.2271 yuan to the dollar.

-

The British pound fell 0.1% to $1.2576.

cryptocurrency

-

Bitcoin rose 0.3% to $49,702.91

-

Ether rose 0.6% to $2,648.84

bond

-

The 10-year Treasury yield fell 3 basis points to 4.28%.

-

Germany’s 10-year bond yield rose 3 basis points to 2.39%.

-

The UK 10-year bond yield rose 9 basis points to 4.15%.

merchandise

This article was produced in partnership with Bloomberg Automation.

–With assistance from Yumi Teso and Rob Verdonck.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link