[ad_1]

-

Net income: reported $0.30 per share for the fourth quarter and $1.15 per share for the full year.

-

Funds from operations (FFO): Fourth quarter FFO was $0.51 per share and full year FFO was $2.06 per share.

-

Adjusted funds from operations (AFFO): AFFO reached $0.57 per share in the fourth quarter and $2.25 per share for the year.

-

investment activities: A record $326.3 million was invested in 81 properties in 2023.

-

Growth in rental income: Basic rental income increased by nearly 10% compared to the previous year.

-

balance sheet strength: Total debt is $760 million, and credit rating is high.

-

Guidance for 2024: AFFO guidance reaffirmed from $2.29 to $2.31 per diluted share.

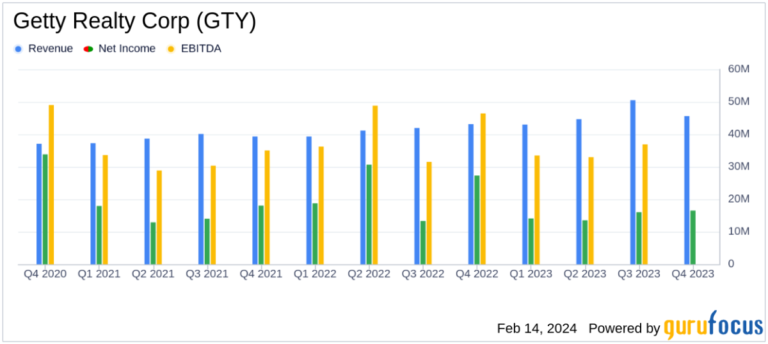

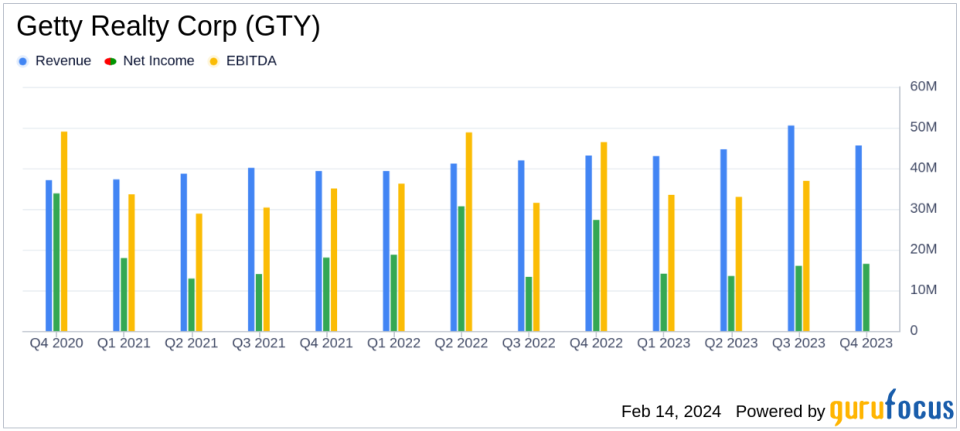

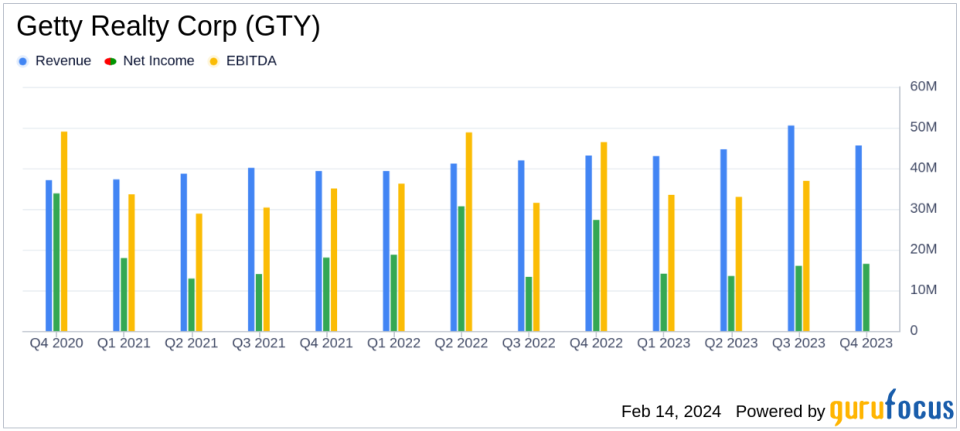

On February 14, 2024, Getty Realty Corporation (NYSE:GTY) released its 8-K report detailing its financial and operating results for the fourth quarter and full year ended December 31, 2023 . USA specializes in the acquisition, financing, and development of convenience, automotive, and other single-tenant retail properties. The company’s portfolio includes a variety of properties, including convenience stores, car washes, and auto service centers, and it derives the majority of its revenue from rental income.

Financial performance and challenges

Despite the challenging market environment, GTY achieved strong results in 2023. His net income per share for the fourth quarter was $0.30, down from $0.57 for the same period in 2022. For the full year, net income per share was $1.15, down from the prior-year period. Last year it was $1.88. This performance reflects the firm’s solid execution of its growth strategy, including record investment activity of $326.3 million for 81 properties, double his previous year’s investment activity.

FFO for the fourth quarter was $0.51 per share and FFO for the fourth quarter of 2022 was $0.63, while annual FFO decreased from $2.44 to $2.06 per share. However, AFFO increased from $0.55 per share to $0.57 in the fourth quarter, and annual AFFO increased from $2.14 per share to $2.25 per share. Growth in AFFO per share of 5% or more is especially important for a REIT like GTY, as it demonstrates the company’s ability to generate sustainable cash flow from its operations.

Financial performance and industry importance

The nearly 10% year-over-year increase in base rental income is a testament to GTY’s financial performance. This growth was driven by increased revenues from recently acquired properties, contractual rent increases and rent initiations from completed redevelopments, partially offset by property sales. For value investors, rental income growth is an important metric because it reflects the underlying health and performance of a company’s real estate portfolio.

Additionally, the company’s disciplined underwriting standards and strategic investments position it well within the REIT industry. GTY’s ability to raise his nearly $300 million in new equity and debt capital to actively fund investments is a strong indicator of the company’s financial prudence and market confidence.

Key financial indicators and materiality

The key metrics in GTY’s financial statements are:

-

Rental revenue for the fourth quarter increased to $41.1 million from $37.7 million in the same period in 2022 and for the full year from $147.2 million to $161 million.

-

Interest on notes and mortgage receivables increased significantly due to development capital advances and higher interest rates.

-

Real estate expenses for the year increased primarily due to an increase in refundable real estate taxes.

-

Environmental charges varied and included credits related to the removal of reserves for unknown environmental remediation obligations in the prior year.

These metrics are critical as they provide insight into a company’s revenue streams, cost controls, and potential environmental liabilities, all of which are important to investors considering GTY’s sustainability and growth prospects. It is an element.

Analysis of company performance

Gettys President and CEO Christopher J. Constant expressed pride in the company’s financial results, highlighting growth in base rental income and AFFO per share. He highlighted the company’s success in capital deployment and portfolio strengthening amid market challenges. Looking ahead to 2024, GTY aims to continue its selective investment strategy and leverage its strong credit profile to provide shareholders with sustainable returns and dividend growth.

Overall, GTY’s performance in 2023 demonstrates its resilience and strategic focus on growth. The company’s record investment activity, combined with steady growth in rental income, positions it well for future success. With GTY reaffirming his 2024 AFFO guidance, investors can expect continued stability in the company’s financial position and growth potential.

For more detailed information regarding Getty Realty Corp.’s financial results, investors and interested parties are encouraged to review the entire 8-K filing.

For more information, see Getty Realty Corp’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link