[ad_1]

Alphabet stock (NASDAQ:Google) (NASDAQ:GOOG) is currently my largest technology holding, accounting for about 8% of my portfolio. I’ve added to my position a number of times recently as Alphabet’s fourth quarter results showed strong sales growth, margin expansion, sharply rising profits, and increased capital gains. Furthermore, even though Alphabet maintains double-digit revenue and bottom-line growth prospects, the stock looks cheap on its own and compared to Magnificent Seven stock. Therefore, I maintain a bullish view on the stock.

Q4 results strengthen my confidence in the stock

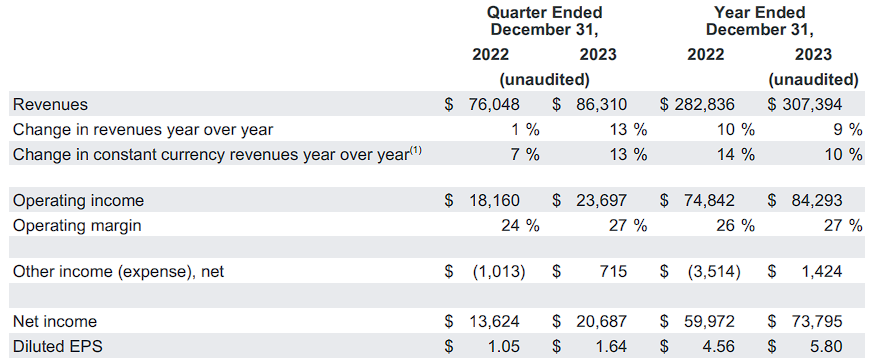

I’ve increased my position in Alphabet multiple times recently, and its Q4 results further strengthened my belief in the stock’s bull run. First, Alphabet recorded reaccelerated revenue growth to $83.6 billion, an increase of 13%. This is a notable increase from 11% last quarter and 1% last year.

Additionally, Alphabet’s operating margin widened from 24% to 27%, which boosted its bottom line, resulting in a 56% increase in EPS to $1.64. In particular, fourth-quarter revenue and EPS exceeded consensus estimates by 1.2% and 2.5%, respectively, exceeding market expectations. Let’s take a closer look.

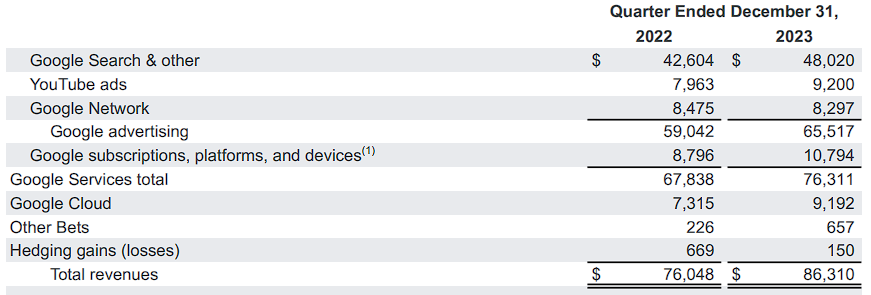

Google and YouTube fuel powerful advertising momentum powered by AI

Strong performance from Google and YouTube were the main drivers of Alphabet’s revenue growth in the fourth quarter. Google search revenue rose 13% to $48 billion, and YouTube ad revenue even more significantly increased 16% to $9.2 billion. This result benefited from an improved advertising environment, particularly in the retail industry, and, interestingly, from Google’s investments in AI over the past year.

During the fourth quarter earnings call, Google CEO Sundar Pichai highlighted the transformative impact of AI on the company’s growth across various platforms. Pichai highlighted the important role of generative AI in improving search. By leveraging generative AI, Search addressed a broader range of information needs and responded to new queries with diverse perspectives. This has significantly enhanced advertising performance metrics for advertisers.

And at YouTube, the company continues to benefit from prioritizing a creator-first economy within its platform. YouTube has become the preferred growth channel for many creators by providing them with unparalleled opportunities to monetize their content and build their own businesses. This led to an influx of content, increased viewership, and increased advertising revenue.

Once again, the power of AI, especially Google’s generative AI, is pushing these capabilities to incredible levels. please think about it. With just a smartphone, anyone can easily change the background, remove unnecessary elements from the background, and easily translate videos into numerous languages without spending a large studio budget. The success of these efforts is evidenced by the impressive numbers on YouTube, where short videos now boast more than 2 billion logged-in users per month and 70 billion views per day.

Google Cloud: Profits are snowballing

Alphabet’s Google Cloud division has also posted impressive numbers, and the biggest highlight for me is that its profits are snowballing. Google Cloud’s unit economics continued to improve, with the fourth quarter marking the division’s fourth consecutive profitable quarter. Specifically, Google Cloud’s revenue growth was an impressive 26%, accelerating from Q3’s 22% revenue growth and driving strong economies of scale. As a result, the operating profit margin of this division rose to 9.4%. Last year it was negative.

With Duet AI, Google Cloud’s AI-powered collaborator, the company is now powering top brands like PayPal (NASDAQ:PYPL) and Deutsche Bank (New York Stock Exchange:DB) significantly increases developer productivity. At the same time, cloud-delivered AI capabilities allow Aritzia (OTC:Atzaf) and Gymshark understand their customers by analyzing valuable insights. Alphabet uses Google Cloud to meet the needs of its customers, and we believe that momentum will continue.

Record EPS and capital returns, but stock prices remain cheap

Alphabet’s strong revenue growth and overall profit expansion led the company to record quarterly EPS of $1.66 in the fourth quarter and record annual EPS of $5.84 in fiscal 2023. As a result, the company can afford to increase its capital gains to reward shareholders, with annual share buybacks reaching a record $61.5 billion, up from $59.3 billion last year.

At its current market cap, this represents a 3.5% share repurchase yield, which I think is quite large considering Alphabet is expected to continue to grow at double digits. Specifically, consensus estimates for fiscal 2024 are calling for revenue of $342.41 billion and EPS of $6.76, implying year-over-year growth of 11.4% and 16.6%, respectively.

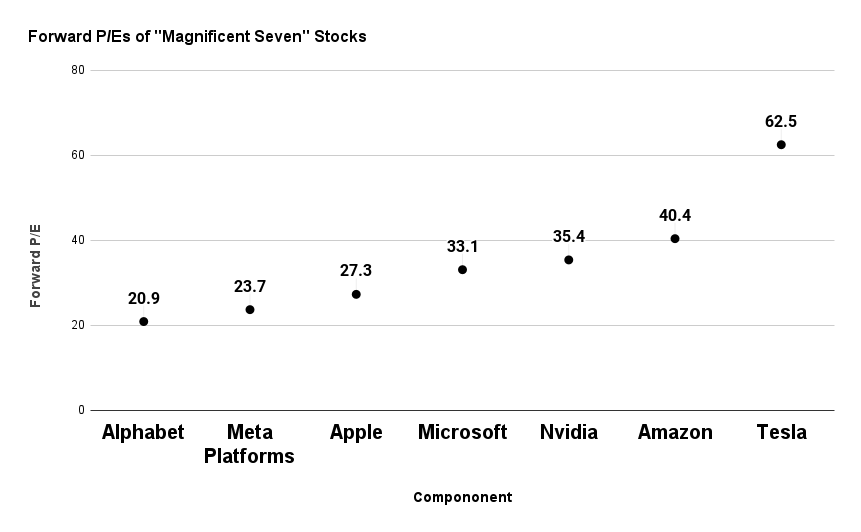

This goes back to the important point I highlighted earlier in this article. Here we have Alphabet, which has returned more than 3.5% annually through share buybacks, grown double digits, and is at the forefront of the AI boom, but whose stock is currently trading at just under 21 times Wall Street’s annual EPS estimates. It is rated as. .

Notably, Alphabet is perhaps the cheapest stock in the glorified Magnificent Seven. I don’t like to directly compare the Magnificent Seven like many investors do, because their business models are very different. But this analogy highlights that Alphabet stocks don’t have the same excessive investor enthusiasm as most companies in this group. This is their future PER.

Alphabet’s below-average valuation points to future upside as opposed to valuation contraction that could impact the rest of the Magnificent Seven, especially if revenue growth falls short of current high expectations. may act as a powerful catalyst for

Is GOOGL stock a buy, according to analysts?

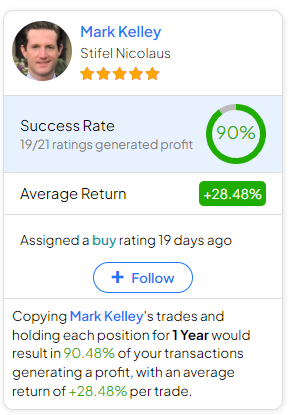

Regarding Wall Street’s view on the stock, Alphabet features a consensus rating of “Strong Buy” based on 29 Buys and 8 Holds assigned over the past three months. Alphabet’s average price target is $164.56, suggesting 17.11% upside potential.

If you’re wondering which analysts to follow when buying or selling GOOGL stock, the most profitable analyst covering this stock (over a 1-year period) is Mark Kelley of Stifel Nicolaus, with 1 The average return per year is 28.48%. The rating and success rate is 90%. Click on the image below for more information.

Take-out

Overall, Alphabet’s fourth-quarter results, featuring accelerated sales growth, margin expansion, and record EPS, solidified my bullish stance on the stock.

While Google’s AI-driven innovations, particularly search and YouTube, continue to fuel advertising momentum, Google Cloud’s snowballing profitability reflects its growing importance in Alphabet’s business mix. doing.

Despite its strong performance and rising capital returns, Alphabet appears to be undervalued both when valued on its own and when compared to the Magnificent Seven. This adds a layer of safety to the investment case and also contributed to my recent decision to increase my position in stocks. Therefore, Alphabet will remain a technology pillar in my investment portfolio.

disclosure

[ad_2]

Source link