[ad_1]

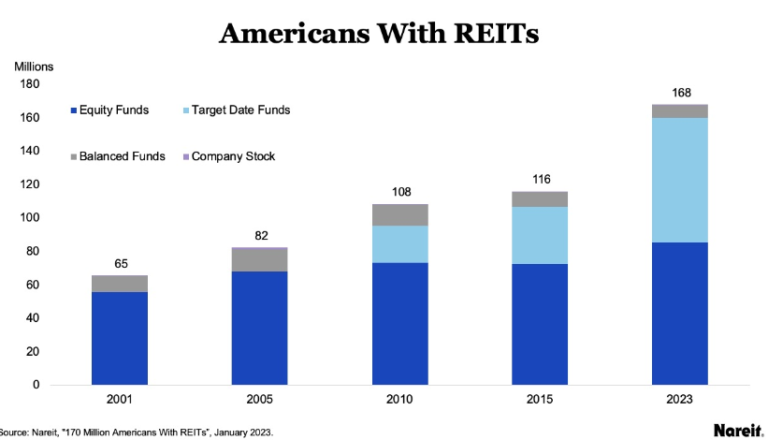

New research from Nareit estimates that 168 million Americans, or about 50% of U.S. households, will be invested in REIT stocks by 2023.

This analysis estimates the number of U.S. households and Americans who own REIT stocks directly or indirectly through mutual funds, ETFs, or target-date funds. This is a 12% increase from the estimated 150 million Americans in 2022, driven primarily by increases in stock investments across the United States, especially employer-sponsored retirement savings plans.

The basis for this estimate is the Survey of Consumer Finances (SCF), which is compiled every three years by the Federal Reserve Board (Fed). The SCF is a comprehensive overview of American household finances, including income, net worth, and debt. The latest estimate of Americans owning REITs is derived from the percentage of Americans with equity investments reported in his 2022 SCF. The latest SCF reflects major changes in U.S. household finances due to the pandemic since the last report in 2019.

The graph above shows the percentage of households with any assets from 2001 to 2022. This percentage varies from study to study, but averages around 51% before 2022. Surveys in 2010 and 2013 after the Great Financial Crisis showed that the share had fallen below 50%. Pandemic stimulus and spending cuts in 2020 and 2021 led to a surge in savings in the United States. This enabled more households to invest their new savings in the stock market, raising the share of stock exposure to 58%. Direct ownership of stocks increased from 15.2% of households in 2019 to 21.0% in 2022. Most households’ stock investments are made through tax-deferred retirement accounts, increasing from 50.5% of households in 2019 to 54.3% of households in 2022. The 2025 survey regresses toward the mean, reversing some of the increases.

The estimates for the number of households and Americans investing in REITs reflect the growing number of households investing in the stock market through retirement accounts. The Employment Benefits Research Institute (EBRI) divides retirement savings into four mutually exclusive categories: stock funds, balanced funds, target date funds, and corporate stocks.

The graph above shows the estimated number of Americans who invested in REITs by fund category, with the percentage of all Americans with REITs in that year displayed above the bar. The creation and popularity of target date funds since 2007 has reduced the percentage of retirement assets held in equity and balanced funds. Since 2001, approximately 86% of these REIT holdings have come from equity funds associated with retirement accounts, and the remaining 14% have come from equity funds associated with retirement accounts. % of balanced funds associated with a retirement account. By 2010, 79% of Americans invested in REITs through stock and balanced funds, and 21% invested in REITs through target-date funds. The proportion invested through target-date funds continues to grow, reaching 44% in 2023, leading to an increase in the number of Americans owning REITs. The recent increase in Americans owning REITs has been driven primarily by an increase in equity investments since the pandemic and an increase in the share of target-date funds.

(First published on NAREIT website)

related

[ad_2]

Source link