[ad_1]

It’s hard to get excited about Only World Group Holdings Berhad’s (KLSE:OWG) recent performance, with its share price down 4.7% over the past three months. However, we decided to take a look at the company’s financials to determine if it has anything to do with the price drop. Fundamentals usually drive market outcomes, so it makes sense to study a company’s financial health. In this article, we decided to focus on Only World Group Holdings Berhad’s ROE.

Return on equity or ROE is an important factor to be considered by a shareholder as it indicates how effectively their capital is being reinvested. Simply put, it is used to evaluate a company’s profitability compared to its equity.

Check out our latest analysis for Only World Group Holdings Berhad.

How do you calculate return on equity?

of Formula for calculating return on equity teeth:

Return on equity = Net income (from continuing operations) ÷ Shareholders’ equity

So, based on the above formula, Only World Group Holdings Berhad’s ROE is:

4.9% = RM12m ÷ RM235m (Based on trailing 12 months to September 2023).

“Revenue” is the income a company has earned over the past year. Another way to think of it is that for every RM1 worth of shares, the company allowed him to earn a profit of RM0.05.

What is the relationship between ROE and profit growth rate?

So far, we have learned that ROE measures how efficiently a company is generating its profits. Now we need to assess how much profit the company reinvests or “retains” for future growth, which gives us an idea about the company’s growth potential. Assuming all else is equal, companies with both higher return on equity and higher profit retention typically have higher growth rates when compared to companies that don’t have the same characteristics.

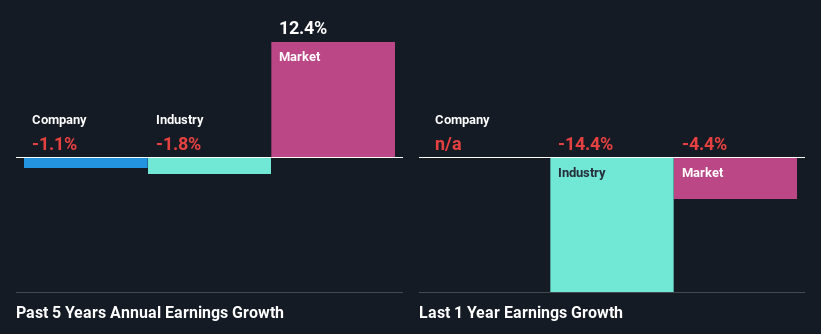

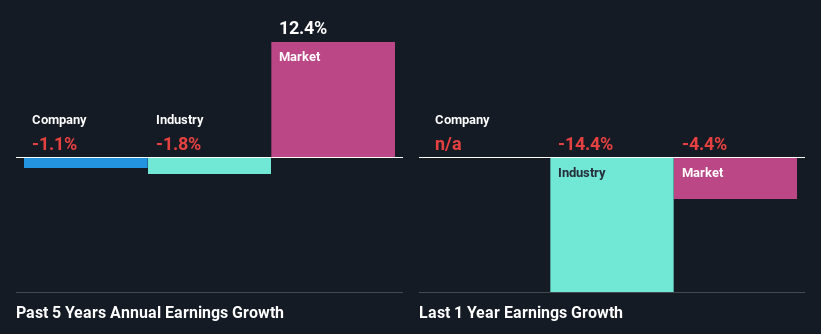

A side-by-side comparison of Only World Group Holdings Berhad’s earnings growth and ROE 4.9%

It’s hard to argue that Only World Group Holdings Berhad’s ROE is very good in and of itself. Comparing with the industry, we find that the company’s ROE is about the same as the industry average of his ROE of 4.6%. Therefore, the low ROE is the reason behind Only World Group Holdings Berhad’s flat net income growth over the past five years.

We then compared Only World Group Holdings Berhad’s performance with the industry and found that the company’s profits have been shrinking at a slower rate than the industry, whose profits have shrunk by 1.8% over the same five-year period. This isn’t particularly good, but it’s also not particularly bad.

Earnings growth is an important metric to consider when evaluating a stock. Investors should check whether expected growth or decline in earnings has been factored in in any case. This will help you determine whether the stock’s future is bright or bleak. Is Only World Group Holdings Berhad fairly valued compared to other companies? These 3 metrics may help you decide.

Is World Group Holdings Berhad the only company that utilizes its profits efficiently?

Only World Group Holdings Berhad does not pay a dividend. This means that you retain all of your profits. Considering this, the question arises as to why the company generates so little growth even though it retains so much of its profits. There appear to be several other reasons explaining the lack in this regard. For example, your business may decline.

conclusion

Overall, we feel that Only World Group Holdings Berhad’s performance leaves a lot of room for interpretation. Although the company has a high reinvestment rate, a low ROE means that all that reinvestment is not generating returns for investors, and even has a negative impact on earnings growth. means. Until now, we’ve only skimmed the surface of the company’s past performance by looking at the company’s fundamentals.So it might be worth checking this free Detailed graph Analyze Only World Group Holdings Berhad’s historical earnings, revenue, and cash flow to gain deeper insight into the company’s performance.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link