[ad_1]

Blended finance has often been hailed as the industry’s new impact finance child. And that’s no surprise. Since the formal launch of the system in 2015 with an OECD and WEF primer, it has become a powerful driver in every development finance toolbox, from KfW to SDC, IDB Invest and many other financial institutions around the world. It becomes.

But to harness the superpowers of new tools and make an impact, practitioners need to know that blended finance is not a one-size-fits-all solution to every development challenge. “It’s easy to get excited about these new tools, but it’s important to recognize that they don’t fit every situation or problem,” Nalini Tarakeshwar and Cheryl Fofaria of the UBS Optimus Foundation recently wrote. stated in an opinion article.

Done well, blended finance can leverage public and philanthropic funds to mobilize much-needed capital from the private sector, also known as (impact) investors, towards sustainable development. can. Targets include large-scale projects in developing countries that address one or more of the SDGs, as well as small-impact ventures that provide solutions to specific social or ecological problems. . The trick behind blended finance: Injecting catalytic capital can reduce the risk or increase returns on a particular deal, attracting more commercially minded investors.

These structured approaches come in many shapes and sizes, from tiered blended funds to design-stage grants, guaranteed technical assistance funds, and impact-linked funding approaches. We have a wide selection of powerful driver designs. But in practice, aligning the different animals of planetary finance to their different risk, return, and impact desires can be difficult. However, important goals justify additional complexity. It is about closing the SDG funding gap, which is a staggering US$3.9 trillion a year. According to estimates by the global network Convergence, around US$202 billion has been mobilized through blended finance to date.

Impactful Entrepreneurs: Real First Movers

But what’s often forgotten is that high-impact entrepreneurs have been using the same approach for decades. Often, but not necessarily by design, a lack of funds has led them to make do with a mix of financial instruments from different capital providers, albeit on a much smaller scale.

High-impact entrepreneurs have been using the same approach for decades…they have been combining different financial products from different capital providers to make ends meet.

A 2022 research report by the Blended Finance Initiative, sponsored by the Catalytic Capital Consortium, finds similar results. They are building their own bottom-up blended finance solutions by blending grant and concessional capital with investments from a range of impact investors, development finance institutions and foundations. ”

In some cases, this combination spans the entire lifecycle of a company. For example, grants from foundations provide funding at a very early, high-risk stage, and different types of investors come in with instruments that can be repaid when the situation is a bit more stable. You can also use the same combination within a single funding round. And the blended approach is also called “hybrid finance” and brings unique characteristics to the mix. For example, additional influence elements such as outcome-based mechanisms can provide financial rewards to companies that achieve predefined impact goals. As Impact Europe highlights in his 2017 Hybrid Finance Report, this gives companies “greater flexibility and autonomy.”

So if you ask, “Who invented blended finance?”, impact entrepreneurs would have every right to raise their hands.

secret sauce in the mixer

But inventorship aside, “public and commercial funding can go together very well,” Joost van Engen, founder of Healthy Entrepreneurs, believes from first-hand experience. Healthy Entrepreneurs and Ignitia are both success research series created by FASE that aim to highlight how impactful ventures have successfully scaled using blended/hybrid finance. is part of. One of the key ingredients in a blender is catalytic capital. A rather unusual type of investment capital that is patient, risk-tolerant, concessional and flexible, typically offered by impact-first or impact-only investors such as development agencies, foundations, family offices, and development finance institutions (DFIs). will be done. ).

Impact venture Healthy Entrepreneurs has discovered that public and commercial funds can work very well together.

In the case of Healthy Entrepreneurs, this catalytic capital came in the form of a grant from the Nationale Postcode Loterij. Hybrid financing has proven to be the best approach in his two funding rounds to date to help the company pursue its vision of access to basic healthcare in rural sub-Saharan Africa it was done. “The merging of public and commercial funding is suitable for high-impact business cases in the health sector, but also in other areas of the sustainability sector,” points out Van Engen.

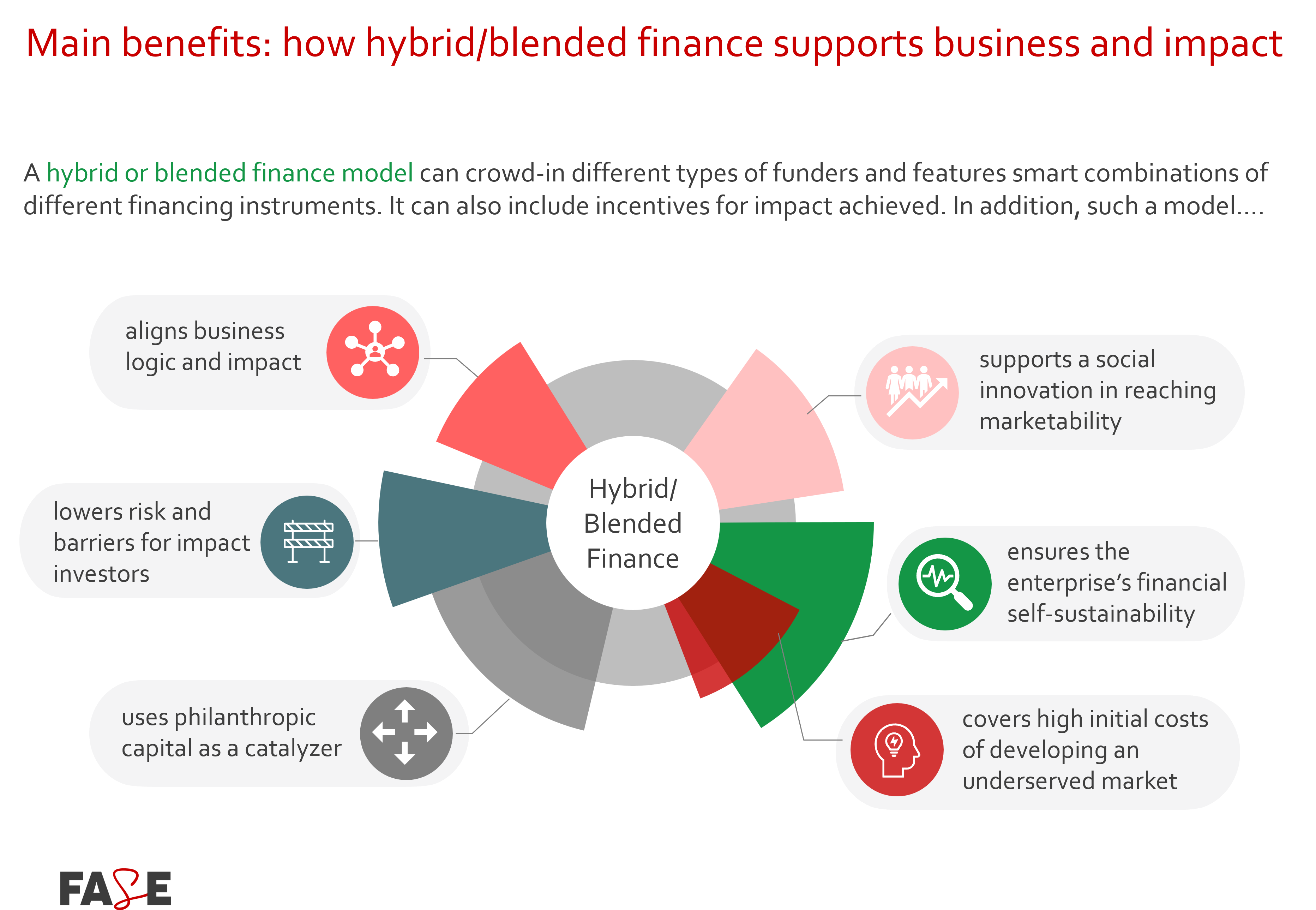

Until now, hybrid or blended finance has empowered many influential entrepreneurs and brought them various benefits.

Catalytic capital is indeed a powerful element when dosed correctly, not too much, not too little. For Ignitia, the recoverable grant from the DEG Upscaling Program added spice to the mix of funders and financial instruments in his USD 4.2 million round in 2021. Funding from the European Social Innovation and Impact Fund (ESIIF), combined with equity investments from Novastar Ventures, IKEA Social Entrepreneurship and several other companies, will help Sweden-based climate intelligence and agribusiness forecasting Being a pioneer, the company was able to achieve a subscriber base of 2.6 million farmers by March 2023. Ignitia’s influence grew even more. 79% of the company’s active users say they appreciate the usefulness of data, agronomic advice and facilitating easier decision-making to improve farm yields and productivity .

Healthy Benefits for Impact Entrepreneurs

Ignitia and Healthy Entrepreneurs are just two impact ventures using this blended approach. Until now, hybrid or blended finance has empowered many influential entrepreneurs and brought them various benefits. FASE has been advising high-impact corporate clients on these approaches since 2013 and has crystallized the most important benefits.

- High-impact companies can cover the high upfront costs of tapping into underserved markets. Financing gaps are often particularly large when exploring new markets or business models. Catalytic capital can fund this volatile stage and prepare the ground for other investors to join.

- Impactful companies can better align their business logic with impact. Rather than struggling between impact and profit growth, high-impact companies can benefit from a more aligned consortium of investors. This reduces tension and reduces the risk of mission drift.

- How companies can achieve marketability of innovative solutions. Hybrid financial models can adequately fund companies until they reach proof of concept and are ready to bring their products or services to market.

- Impactful companies can lower the barrier to other investors. Catalytic capital from public and philanthropic funders can reduce risk or increase the overall return on a funding round. This could lead to a flood of investors looking for a better risk-return profile who would otherwise shy away from the trade.

- Impactful companies can secure long-term financial independence and increase their impact. When outcome-based mechanisms are part of hybrid financial transactions, entrepreneurs can be incentivized with financial rewards for achieving more ambitious impact goals. This increases their impact and generates additional revenue streams that support companies in achieving financial break-even and sustainability.

In imperfect financial markets that cannot meet the specific needs of high-impact companies, there are many benefits to be gained from applying innovative approaches such as hybrid and blended finance.

Part 2 of this series focuses on another smart blending solution for high-impact corporate lending portfolios. We will explain the structure of tiered/blended funds in detail, so please look forward to it!

Thank you for reading our story. If you’re an entrepreneur or investor yourself, you know that producing quality work isn’t free. We rely on subscribers to sustain our journalism. So if you think there’s value in having an independent, specialist media platform covering social enterprise stories, please consider subscribing. You will also be purchasing social. Pioneers Post is itself a social enterprise and reinvests all profits into helping our customers do better business.

[ad_2]

Source link