[ad_1]

If you had to choose just one chipmaker to bet on in 2024, which would it be? Not everyone would choose Intel (NASDAQ:INTC), but it’s actually a great processor maker that’s somewhat undervalued on Wall Street. Overall, I’m bullish on his INTC stock and poised for a rise in the stock price this year.

Intel is a well-known American chipmaker that could benefit from a revival in the personal computer (PC) market. This could happen if AI-enhanced PCs become more widespread this year.

Additionally, Intel stands out among U.S. chipmakers because it has its own foundry business. This is Advanced Micro Devices (NASDAQ:AMD), Taiwan Semiconductor (New York Stock Exchange:TSM) to manufacture microchips. This advantage will allow Intel to significantly grow its business in the coming quarters.

This insider continues to buy INTC stock.

I like to keep a close eye on analyst ratings (more on this later), as well as insider buying and selling activity. When we see company insiders buying shares in a company, it’s a sign of confidence and makes us want to consider the stock.

So it’s important to know that Intel CEO Pat Gelsinger is buying stock in the company. On January 29, Mr. Gelsinger reportedly purchased 3,000 shares of Intel stock (through his trust and/or his own personal account) for $130,100. Then, on February 1, the CEO purchased an additional 2,800 shares of INTC stock for $119,700.

After these purchases, Mr. Gelsinger’s holdings in Intel stock include 66,386 shares in his personal account and another 456,915 shares in various trusts.No explanation in filings with the Securities and Exchange Commission (SEC) why Gelsinger bought all of these Intel shares, but the CEO’s apparent confidence should make reluctant investors wonder if a positive catalyst is coming for Intel.

It’s also worth noting that Mr. Gelsinger bought all of these shares shortly after INTC stock’s earnings plummeted on January 25th. As you may recall, Intel beat his 2023 Q4 consensus earnings estimate of $0.45 per share. Actual earnings were $0.54 per share. Still, the market dumped Intel stock because investors felt the company’s forward guidance wasn’t optimistic enough.

I like to see the CEO of a company buying stock when everyone else is selling stock. It’s clear that Gelsinger is fully committed to Intel’s future growth and is ready to be with the company for the long term.

Intel could win $10 billion in prize money from US government

The U.S. government would no doubt prefer powerful AI-compatible chips to come from American foundry companies rather than Taiwan Semiconductor. This is an issue that concerns not only America’s national security, but also the future of America’s finances.

To this end, the Biden administration signed the Chips and Science Act of 2022. The law provides government funding to support domestic production of certain products, including chips.

So how will Intel, as a domestic chip foundry business, benefit from the Chip and Science Act? According to some sources, the company could receive a large award soon. bloomberg Citing “people familiar with the matter,” the report said the Biden administration was “in talks to award more than $10 billion in subsidies to Intel.”

This is good news for Intel, especially after the company appeared to suffer a setback when it announced it would postpone the opening of its Ohio chip manufacturing plant. Admittedly, this announcement, along with Intel’s aforementioned financial guidance, disappointed some investors.

Don’t get me wrong here. Either way, Intel plans to move forward with its plans to become a global chip foundry business. Intel, for example, is reportedly considering raising more than $2 billion to fund a semiconductor manufacturing facility in Ireland.

But there is no doubt that the Biden administration wants Intel to produce its processors domestically and create jobs in the United States. Therefore, it would not be surprising if the US government were to provide significant financial support to Intel in the near future.

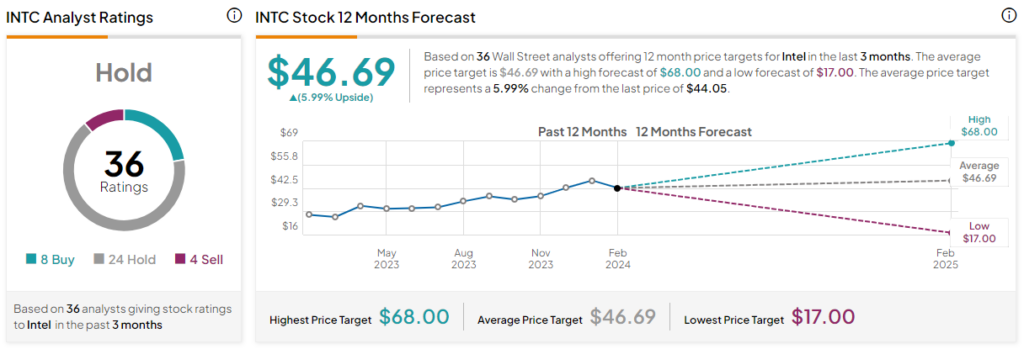

Is Intel stock a buy, according to analysts?

TipRanks shows INTC as a Hold based on 8 Buy, 24 Hold, and 4 Sell ratings assigned by analysts over the past 3 months. Intel’s average price target is $46.69, suggesting 6% upside potential.

Bottom line: Should you consider Intel stock?

The market has not reacted positively to Intel’s financial guidance recently. But at the same time, Intel’s CEO is buying his own stock.

Additionally, Intel may soon receive a financial award from the US government. Intel is a leading chipmaker with its own domestic foundry operations, which sets it apart from some competitors while also making it eligible for government funding. That’s why I remain bullish on INTC stock and am considering a long position this year.

disclosure

[ad_2]

Source link