[ad_1]

Alibaba stock (New York Stock Exchange:Baba) continues to suffer from tireless bearish sentiment that shows no signs of recovery. Although the S&P 500 (SPX) has risen 20% over the past year, while the Chinese e-commerce giant’s stock has fallen 28% over the same period. Despite BABA’s improved earnings and capital returns, I think the stock could continue to underperform unless total shareholder return becomes significantly higher and global sentiment toward Chinese stocks changes. Therefore, I am neutral on the stock.

Unraveling Alibaba’s poor business performance – what is the cause?

It’s difficult to pinpoint the cause of Alibaba’s poor performance, given the likely interaction of several factors. However, these include a deep-seated investor distrust of Chinese companies listed on U.S. exchanges, an unprecedented bearish mood surrounding Chinese stocks, including those listed on Asian exchanges; And I think that includes things like the lack of a real return on capital relative to Alibaba’s profits. This may be contributing to this rather paradoxical situation.

The overall lack of favorability for Alibaba stock is not new. This is a common theme that negatively impacts all Chinese companies listed on US exchanges. In a way, that’s fair. why? My extensive research on Chinese companies over the years has led me to the conclusion that they operate with fundamentally different values. Unlike their American counterparts, Chinese companies are often uninterested in maximizing shareholder value.

In stark contrast to U.S. standards, Chinese company executives appear to be indifferent to their own stock prices. There are many examples of companies listed on Chinese exchanges trading at three to four times their profits without buying back their own shares. It is not uncommon for Chinese stocks to expand their profits. However, dividends fluctuate significantly from year to year, and in some cases are even reduced without any explanation.

Because these events occur so frequently, combined with general skepticism about Chinese companies’ accounting standards and corporate governance, stock prices often trade at depressed levels.

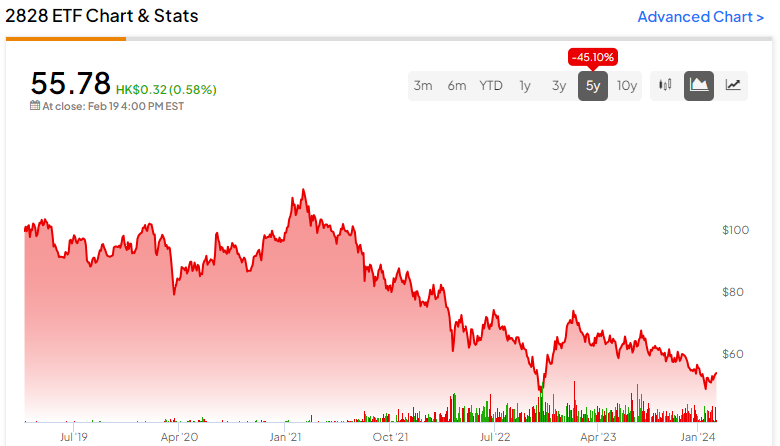

In addition, I mentioned earlier that the unprecedented bear market surrounding Chinese stocks continues, with the Hang Seng Index declining for four consecutive years in 2023. Take a look at the Hang Seng China Enterprise Index ETF (Hong Kong:2828), one of the largest ETFs, has followed the index’s decline every year since 2020.

But what makes Alibaba a special case compared to the average Chinese stock is that it is a huge company with annual sales of more than $130 billion. Unlike obscure Chinese stocks run by relatively unknown executives, Alibaba is a global giant that attracts the attention of many investors and funds around the world. The stock is held by a number of institutions run by reputable investment managers. That’s why the company’s consistent underperformance relative to its improving financial profile is so interesting.

Nevertheless, even in Alibaba’s case, we continue to see some of the very same signs that trouble investors in Chinese stocks generally. For example, even though management has acknowledged the undervaluation of the stock and addressed the issue by pledging to engage in share buybacks, share buyback rates remain overwhelmingly low for no apparent reason. Specifically, during the 2023 calendar year, Alibaba repurchased a total of $9.5 billion worth of its own stock. However, this means a buyback yield of only about 5% on the stock’s current market capitalization.

In another move reflecting management’s commitment to making the stock more attractive to investors, Alibaba announced its first dividend as part of its second-quarter results. This measure aimed to close the valuation gap by providing investors with a real tangible return on capital, thereby enhancing the overall predictability of the stock’s investment proposition.

However, the dividend yield of $1.00 per declared ADR works out to be a somewhat underwhelming 1.4% at the stock’s current level. Admittedly, Alibaba has consistently appeared to be a surprisingly cheap stock, but its 6.4% (dividend + share buyback) combined yield is hardly enough to generate much enthusiasm. This is especially true as investors are certain to seek significantly higher blended yields from Alibaba given the inherent risks associated with Alibaba’s investment deals.

The evaluation gap may not be closed for a long time.

With no real total shareholder return to reward investors, Alibaba’s valuation gap is very likely not to close for a long time. On the other hand, Alibaba’s P/FCF is 8.6x, and the forward P/E and P/E ratios are trading at 1.4x and 8.8x, respectively, indicating that the stock is undervalued.

On the other hand, this situation has continued for several years, and stock prices have fallen below the composite index each time. So regardless of the underlying financials, it’s unlikely the stock price will behave this way over the next year.

In my view, one or both of the following scenarios will need to unfold for Alibaba stock to gain significant momentum and more optimistic market sentiment.

- Alibaba achieved a blended yield of over 10%. I think this combination of share buybacks and dividends with a solid yield could grab investors’ attention and essentially force them to revalue the stock. Even considering the inherent risks associated with stocks, the rich and tangible return on capital cannot be ignored.

- Significant recovery in Chinese stocks, especially the Hang Seng Index. If the Chinese market recovers, Alibaba’s Hong Kong listing will likely see significant gains, which will likely lead to an uptick in its New York Stock Exchange listing.

Is BABA stock a buy, according to analysts?

Despite the stock’s performance, most Wall Street analysts remain bullish on Alibaba’s prospects. The stock received a “Strong Buy” consensus rating based on 15 Buys and 3 Holds. BABA’s average price target is $101.49, suggesting attractive upside potential of 34.3%.

Take-out

Overall, it’s clear that Alibaba’s continued underperformance despite improving financials reflects broader challenges facing Chinese stocks on both U.S. and Chinese exchanges. Despite management’s efforts to address low stock valuations through share buybacks and dividends, the impact has so far been modest and has not significantly changed investor sentiment.

So while many investors are claiming that Alibaba’s stock price rally is just around the corner, I doubt Alibaba stock will achieve even higher blended yields or benefit from a broader recovery in Chinese stocks. I came to the conclusion that it was necessary. Until then, a long experience of disappointment had taught me to expect little.

disclosure

[ad_2]

Source link