[ad_1]

Newmont shares fell 6% on Thursday, on track to hit their lowest in nearly five years, but the gold miner plans to sell assets and cut its dividend as it refocuses its portfolio. In response to the announcement that it is standing.

stock

Nemu

was trading around $31, with the May 22, 2019 closing price of $31.32 in sight.

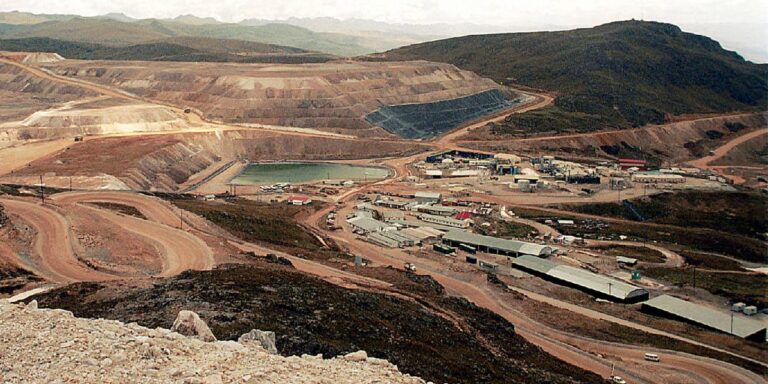

The Denver-based company completed its acquisition of Australia’s Newcrest Mining in November and is currently taking a hard look at assets and projects to maximize returns.

The $15 billion deal is the largest in gold mining history, creating the world’s largest gold miner with a “robust copper option,” the company explained in a statement Thursday. Copper is currently an attractive commodity given its use in EVs and renewable energy infrastructure.

Newcrest has added five active mines and two advanced projects to Newmont’s global footprint, which includes mines in Ghana, Canada and Australia.

See also: Alcoa’s stock price soars after President Trump threatens to impose high tariffs on Chinese imports

The company plans to focus on its Tier 1 portfolio, which includes 11 managed Tier 1 and emerging Tier 1 assets and three unmanaged businesses. The company is seeking to sell six non-core assets, including the Éléonore, Musselwhite, Porcupine, CC&V, Akyem and Telfer businesses, and two non-core projects, Havieron and Coffee.

Tom Palmer, Chief Executive Officer, said: “This portfolio provides shareholders with exposure to the most concentrated Tier 1 assets in the sector. Each asset has the scale and mine life to generate strong free cash flow. “We are fully equipped to do so, and all are located in some of the most favorable mining jurisdictions in the world.” said in a statement.

The company expects to produce 6.7 million ounces of gold by 2028.

As part of its new capital allocation strategy and capital return framework, Newmont plans to reduce its debt by $1 billion to approximately $8 billion through free cash flow and sale proceeds. The company is committed to maintaining an investment-grade balance sheet and targets approximately $7 billion in available liquidity, including $3 billion in cash and an increased $4 billion five-year corporate revolving credit facility. It is said that

The company plans to limit capital expenditures to about $1.3 billion annually and will reward shareholders with a $1 billion stock repurchase program over the next 24 months. However, the quarterly dividend was lowered from the previous 40 cents to 25 cents. Dividends will be paid on March 28th to shareholders listed on the shareholder register as of March 5th.

The company announced the move when it reported its fourth quarter results, with a loss of $3.139 billion, or $3.22 per share, compared to a loss of $1.477 billion, or $1.86 per share, in the year-ago period. Expanded. The loss included a $1.9 billion impairment charge recorded at the end of the year and a $427 million charge related to the Newcrest integration.

Excluding one-time items, earnings per share were 50 cents, beating the FactSet consensus of 44 cents.

Revenue rose from $3.25 billion to $3.957 billion, also beating the FactSet consensus of $3.436 billion.

The company also completed the change of COO after a five-month handover period. New chief operating officer (COO) Natasha Vilhoen will replace Rob Atkinson, who is also leaving the executive team on May 2.

Over the past 12 months, stocks have fallen about 30%, while the S&P 500 SPX has risen 25%.

[ad_2]

Source link