[ad_1]

-

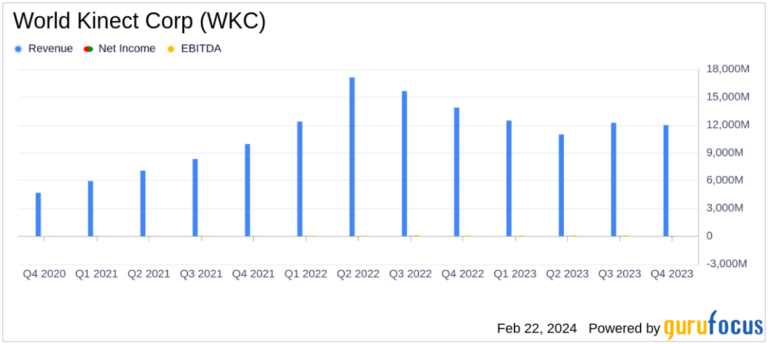

Revenue: Fourth-quarter sales fell 14% to $12 billion. Full-year revenue fell 19% to $47.7 billion.

-

Net income: Fourth quarter net loss of $34.8 million compared to fourth quarter 2022 net income of $21 million. Full-year net income decreased 54% to $54 million.

-

gross profit: Gross profit for the fourth quarter decreased 18% to $232.4 million. Full-year gross profit decreased 3% to $1.06 billion.

-

Adjusted EBITDA: Fourth quarter adjusted EBITDA decreased 6% to $99.8 million. Full-year adjusted EBITDA increased 2% to $386.4 million.

-

Earnings per share: Fourth quarter diluted loss per share was $0.58. Full-year diluted earnings per share decreased 53% to $0.86.

-

Operating cash flow: Operating cash flow for the year was $271 million.

-

Segment performance: The aviation division’s gross profit increased, while the land and shipping division faced a decline.

February 22, 2024 World Kinect Corp (NYSE:WKC), a leading global energy management company, releases its 8-K report detailing its fourth quarter and full year 2023 financial performance . Fulfillment, energy procurement advisory services, and trade and payment management solutions faced significant headwinds during the period.

Financial performance summary

WKC’s fourth-quarter revenue was down 14% year-over-year to $12.0 billion, and full-year revenue was down 19% to $47.7 billion. The company’s gross profit for the quarter fell 18% to $232.4 million, and its full-year gross profit fell 3% to $1.06 billion. However, adjusted gross profit for the year showed a slight improvement of 2%, indicating some resilience in the company’s core business.

Net income including non-controlling interests for the fourth quarter was reported as a loss of $34.8 million, down significantly from a profit of $21 million in the year-ago period. Net income for the full year was down 54% to $54 million. His diluted earnings per share reflected these challenges, with a loss of $0.58 for the quarter and a 53% decline for the year to his $0.86.

Operational challenges and achievements

WKC’s results were particularly affected by erroneous bidding in the Finnish electricity market, which resulted in extraordinary losses. Nevertheless, the company’s aviation division’s gross profit increased by 19% during the quarter as a result of its strategic focus on increasing revenue. However, due to factors such as increased competition and slowing demand due to the impact of global macroeconomic conditions, the onshore and offshore segments experienced a decline in gross profit of 51% and 21%, respectively.

Michael J. Kasbar, Chairman and Chief Executive Officer, acknowledged the non-recurring financial impact but highlighted the strong performance of the company’s core businesses and progress in its portfolio and platform. CFO Ira M. Burns highlighted that operating cash flow of $271 million was generated for the year, supporting WKC’s strong liquidity profile and providing continued support for business operations and shareholder returns. He emphasized that it makes investment possible.

Upcoming Investor Day will provide an update on the company’s unique position in a large growth market, clear strategy to capture opportunities across three business segments, and financial objectives to drive attractive long-term shareholder returns I’m looking forward to what we can do,” Kasbar said. .

Financial statement highlights

The balance sheet reflects a decrease in total assets from $8.16 billion in 2022 to $7.38 billion in 2023. Current assets decreased primarily due to decreases in accounts receivable and inventory. Total debt decreased from $6.17 billion to $5.43 billion due to reductions in long-term borrowings and other long-term debt. Shareholders’ equity also decreased slightly from $1.99 billion to $1.94 billion.

According to the cash flow statement, the company managed to generate positive operating cash flow despite the net loss, although there was a decrease in cash and cash equivalents by the end of the period.

Analysis and outlook

Although WKC faced significant challenges in 2023, the company’s efforts to drive operating efficiency and strong liquidity position could provide the foundation for recovery and growth. Adjusted EBITDA growth and aviation sector profitability are positive signs amid the economic downturn. However, the onshore and offshore segments may require strategic adjustments to address current market volatility and competitive pressures.

Investors can look forward to the company’s Investor Day to gain further insight into WKC’s strategy to address these challenges and capitalize on market opportunities, particularly in the areas of conventional and renewable energy products and services. I’m sure you’re doing that.

For a detailed analysis of World Kinect Corp’s financial results, please visit GuruFocus.com.

For more information, please see the full 8-K earnings release from World Kinect Corp here.

This article first appeared on GuruFocus.

[ad_2]

Source link