[ad_1]

What is the most exclusive club on Wall Street? I would argue that this is the “trillion dollar club,” consisting of six stocks each valued at more than $1 trillion. microsoft, apple, Nvidia, alphabet, Amazonand meta platform.

By 2035, this club will have expanded significantly, reaching the $1 trillion level with companies from a wide range of sectors. So let’s take a look at the stocks that could reach his $1 trillion valuation by 2035. Palantir technology (NYSE:PLTR).

Palantir’s current status

To get an idea of what Palantir’s valuation will be, let’s start with its current size. As of this writing, Palantir has a market capitalization of $51.6 billion. The company is ranked #350 among U.S. companies.

Needless to say, Palantir has a long way to go if it wants to break into the $1 trillion club. The company needs to grow by nearly 2,000%, or 20 times, by 2035. This means a compound annual growth rate (CAGR) of approximately 32%. Interestingly, Palantir has generated a CAGR of 31% since its debut through its 2020 initial public offering (IPO).

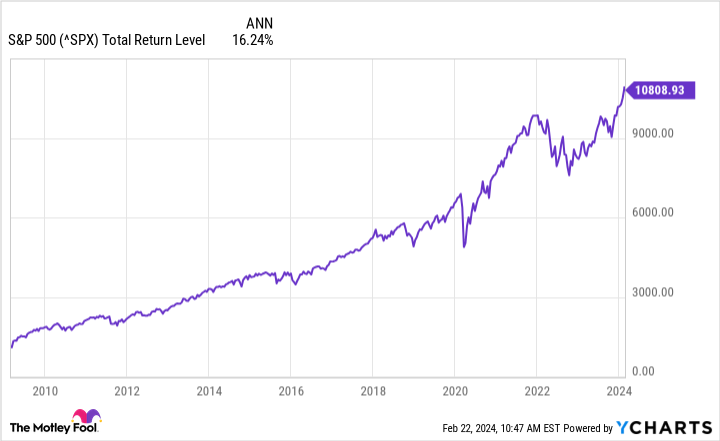

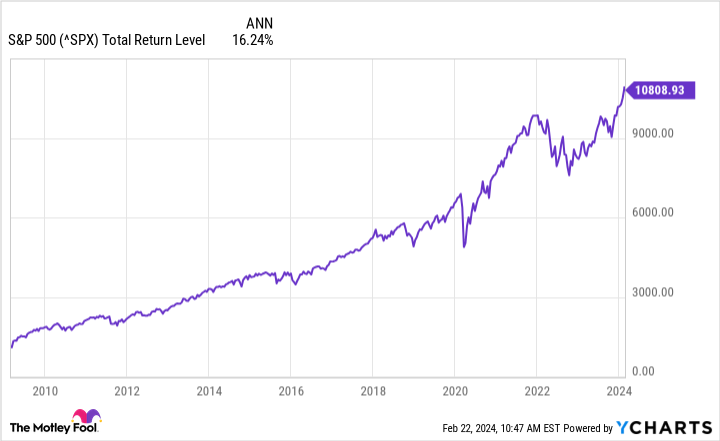

Such a level of growth may seem unattainable over a longer period of time. After all, if you look at the benchmark index, S&P500, its lifetime total return CAGR over 70 years is only 10%. Even if he chooses a shorter, more bullish period, his CAGR for the S&P 500 improves, but still falls well short of 30%.

For example, from March 2009 to today, during a period when the stock market as a whole was very bullish, the S&P 500’s CAGR was only 16%.

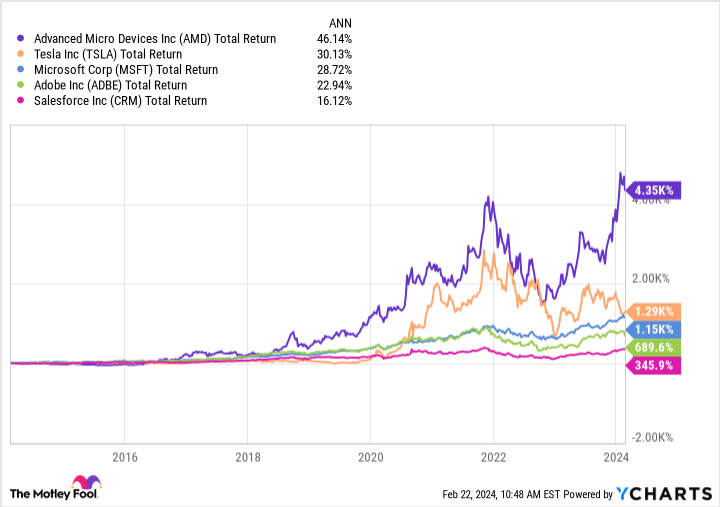

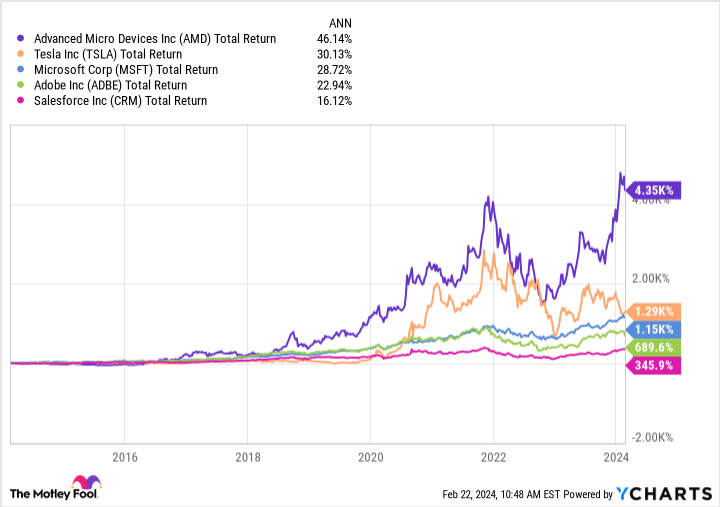

However, the S&P 500, like other stock market indexes, is less volatile than individual stocks. Examining the stocks one by one, it becomes clear that it is possible to achieve and maintain his CAGR of 30%.

As you can see from the graph below, advanced micro deviceMicrosoft, and tesla All companies achieved a CAGR of 28% or more over the past 10 years. As an example, his 10-year CAGR for AMD is 46%. Much of this high growth rate is due to the ever-increasing demand for artificial intelligence (AI). but, adobe and sales force (companies that are very similar to Palantir due to their software-centric business model) had lower CAGRs of 23% and 16%, respectively. This doesn’t mean Palantir can’t reach his $1 trillion mark by 2035, but even for a well-performing company, achieving and sustaining his 30% CAGR will be difficult. It is worth noting that.

Will Palantir’s business support a $1 trillion valuation?

First things first: What does Palantir do?

In short, the company is building a software platform that helps customers work with their own data and realize real efficiencies. Given the amount of data generated every day, more organizations than ever need this type of service.

Take the UK’s National Health Service (NHS) for example. This is a large system that collectively serves more than 56 million people and interacts with nearly 1.6 million patients each day. Each of these interactions generates new data that needs to be recorded, making it difficult to analyze in the field. Administrators instead rely on top-down postmortems, which are costly and often yield little real-time improvement.

However, the NHS has achieved impressive results using Palantir’s software. For example, his two London-based hospitals saw a 28% reduction in inpatient waiting lists after adopting Palantir’s software. Additionally, operating room utilization increased by 5.7%.

Now, as Palantir leverages AI to enhance its software programs, there are even more opportunities to grow its customer base. However, it will take time to know exactly what form that growth will take over the next decade.

Will Palantir reach $1 trillion by 2035?

Despite a solid business model and popular software, It won’t be easy for Palantir to cross the $1 trillion mark by 2035.

The company must continue to grow its revenue and customer base. As of the most recent quarter (three months ending December 31, 2023), Palantir grew commercial revenue by 32% year-over-year. Similarly, the number of corporate customers increased by 55% year-on-year. These gains in the commercial business, rather than the slower-growing government-focused sector, could support the company’s 30% CAGR. Additionally, Palantir’s growth rate could accelerate as demand for AI-powered tools and big data analytics continues to rise.

However, I’m not optimistic that the company will reach a $1 trillion valuation within 11 years. I still think Palantir is a great company and a solid investment, but I don’t think it has what it takes to get past the very high hurdle of $1 trillion by 2035. That would require a steady level of explosive growth, which would be unrealistic for Palantir. most companies.

Either way, Palantir remains a stock worth considering for long-term buy-and-hold investors.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palantir Technologies wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 20, 2024

Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Jake Lerch has worked at Adobe, Alphabet, Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Adobe, Advanced Micro Devices, Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, Salesforce, and Tesla. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

Will Palantir Technologies become a $1 trillion stock by 2035? Originally published by The Motley Fool

[ad_2]

Source link