[ad_1]

Fans trump finances BundesligaThis should lead to a reconsideration of the role of private equity in society.

energy wende It became a German word like . schadenfreude, used all over the world.perhaps verein (association) is another word that anyone interested in democracy, soccer, finance, or all of the above should learn across Europe.for verein The German football model has once again shown its strength, although it remains under threat.

Last year, German soccer league DFL sought to bring in private equity investors to help market soccer globally. Bundesliga. The original plan called for an investment of more than 2 billion euros. Fans protested over issues such as kickoff times, fearing undue influence from investors. This plan failed to garner the required two-thirds majority among the 36 clubs that make up Clubs One and Two. Bundesliga.

But rather than give up, DFL tried again just a few months later. It narrowed the scope of the agreement to approximately 1 billion euros over 20 years and argued that there were “red lines” that investors were not allowed to cross, such as kickoffs. Fans believed nothing of the sort, especially since previous DFL promises were broken.

Financial experts such as 1.FC Köln vice chairman Eckhard Sauren pointed out that there are less risky alternatives.and civil society organizations such as: Finanzwende He pointed out that the nature of private equity is to seek influence. He collaborates with other financial professionals to Finanzwende He argued that it is simply impossible for the DFL to promise that its “red line” will remain in place for 20 years, come hell or high water.

unstable mission

A two-thirds majority of clubs was just achieved in a secret ballot in December, with exactly 24 of 36 clubs agreeing to the amended plan. Many clubs have since announced how they voted. verein, they had a duty to be transparent with their members. It was therefore immediately clear which 10 clubs had voted against it (2 clubs abstained).

Become a member of Social Europe

Support independent publishing and progressive ideas by becoming a Social Europe member for less than €5 a month. Your support makes all the difference!

The problem for the DFL leadership was that members of the Hannover 96 had instructed their representative, Martin Kind, to vote against it. But Kind didn’t just refuse to talk publicly about how he voted. Once it turned out that 10 clubs had voted no, it was very likely that his vote would have been yes, thus making it crucial to achieve the required weighted majority.

Thus, the mandate for the DFL leadership to negotiate with private equity investors was shaky from the start and considered unwarranted by the majority of organized soccer fans in Germany. Kind’s actions, and the DFL’s apparent dependence on his vote, ultimately threatened one of German football’s unique selling points: control over clubs remains with the member states. verein.

This system is also known as the “50+1 rule.” To obtain a license, a club must own a full or majority of a football team. This rule is intended to ensure that club members retain overall control by owning at least 50%+1 of the club’s shares and to protect members from the influence of outside investors. And here was the possibility that the DFL could use Kind’s apparent violation of the rules as a basis to negotiate a controversial investment contract that had already been rejected by fans months ago!

creative protest

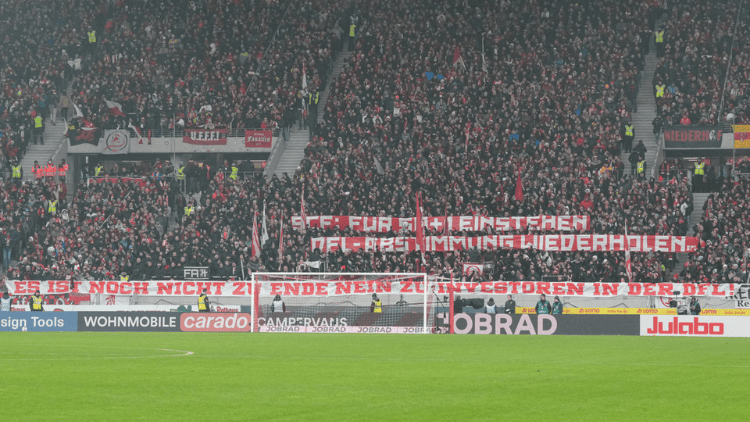

As a result, protests at stadiums have intensified since December. Many games were canceled and delayed and were broadcast live on television. Some games had to wait more than 30 minutes, and on several occasions referees considered stopping play altogether. Fans have been incredibly creative in their protests. He threw lemons onto the field while holding a banner that read, “Private equity investors make us uncomfortable.” They manage to drive a remote control car with flares up and down the pitch – “Why a toy car?” Well, we won’t be remotely controlled. ” And again and again, they threw tennis balls to interrupt the match.

The DFL tried to dismiss the protests as simply being supported by a minority of extremists. But polls show that most soccer fans (which happens to be two-thirds) fully support it. And sympathy went out beyond fans, especially when it became clear what kind of investors were behind the plan. The bidding process would be left to either Blackstone or CVC, subjecting it to public scrutiny that private equity firms seek to avoid.

The fact that they used funds from Saudi Arabia’s sovereign wealth fund in their investments was critically discussed. Their business models were similar, aiming for extremely high returns, whether investing in risky startups, healthcare or soccer. Suddenly fanzines are interviewing financial experts, corporate lobbying is being discussed on major sports shows, the 50+1 rule is being explained on the news, and fan representatives are challenging private equity’s business model on talk shows. chanted.

civil society won

Blackstone withdrew from the process as more clubs called for a new vote or withdrew their support from the deal. Hannover 96 itself questioned the legitimacy of Kind’s December vote. DFL leadership briefly floated the idea of lowering the criteria for success to a simple majority of clubs and holding another vote. However, the DFL abandoned the deal after fans made it clear that this would be interpreted as further escalation of the conflict.

Last Wednesday, a specially called meeting of the DFL Members’ Council voted to end the bidding process. In subsequent statements, DFL members also reaffirmed their support for the 50+1 rule. However, some wealthy clubs have since made it clear that they believe the rule puts them at a competitive disadvantage compared to clubs in England and Spain, so the challenge to the rule has given rise to concerns that fans and It is expected to be the next big battle between football’s governors.

But what is certain is that civil society will win this round and they will not make private equity investments. Bundesliga Marketing in the near future. The protests were successful, but private equity giants (CVC manages 388 billion euros) did not get their way despite aggressive lobbying. One journalist called it “the most successful social movement protest in recent years.”

It was successful because it brought together people with very different political beliefs.because verein The foundations of German soccer governance give fans a say, and attempts to force a deal through against their will quickly caused an uproar. Ultimately, this battle pitted community, democracy, and other widely shared social values against excess profits, the power of a few elite soccer coaches, and the power of large financial corporations.

Private equity or public goods

Therefore, this victory is important not only for football fans, but also for everyone who wants to prevent every aspect of their daily life from being monetized. It seemed inevitable to most people just a few weeks ago that private equity interests would overwhelm the public interest and that they would come into conflict. But Hwang showed that even the biggest financial players can be thwarted. There is nothing “natural” about the ever-increasing financialization of social and cultural goods such as football, health, and housing.

The victory in Germany should therefore give hope that, with good governance, the financial system can be tamed more broadly and made to serve people and the real economy rather than become excessively profiteering. . In recent weeks, there has been growing awareness in Germany of the dangers posed by private equity’s expectations of profit in areas to which it does not naturally belong. That recognition now needs to lead to a reconsideration of the role of private equity in society as a whole.

Daniel Mittler is a football fan and verein Member and co-executive director of SC Freiburg Finanzwende.

[ad_2]

Source link