[ad_1]

Thomas Durkin, CEO and president of AG Mortgage Investment Trust, Inc. (NYSE:MITT), has purchased a significant stake in the company, according to a recent SEC filing. On February 23, 2024, an insider acquired 50,000 shares of a real estate investment trust that specializes in mortgage assets, other real estate-related securities, and financial assets. This transaction is notable because it reflects insider commitment to the company’s future.

AG Mortgage Investment Trust Inc operates as a real estate investment trust (REIT) focused on investing in, acquiring and managing a diversified portfolio of mortgage assets, other real estate-related securities and financial assets. The Company is externally managed by AG REIT Management, LLC, a subsidiary of Angelo, Gordon & Co., LP, a leading alternative investment firm.

Insider transactions are closely monitored by investors as they can give an inside view of a company. Insider purchases, like the one made by Thomas Durkin, can signal confidence in a company’s prospects, and often indicate a positive outlook from those most familiar with the business.

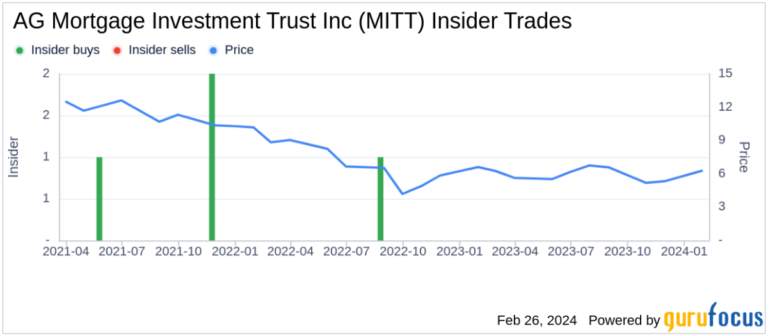

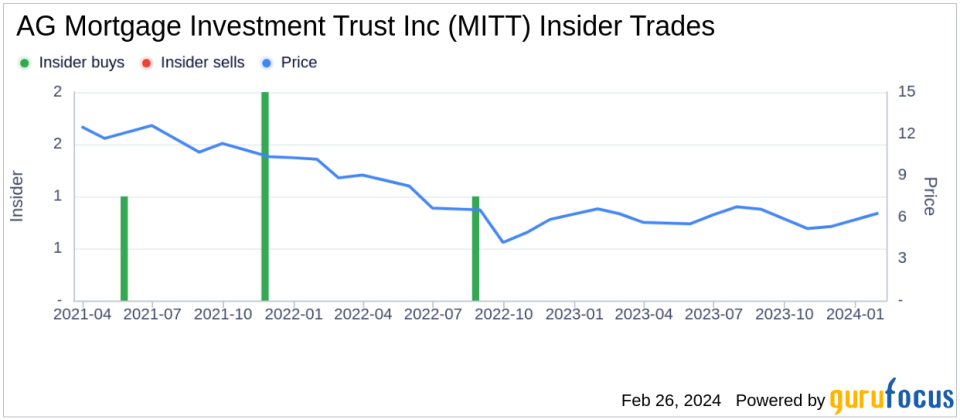

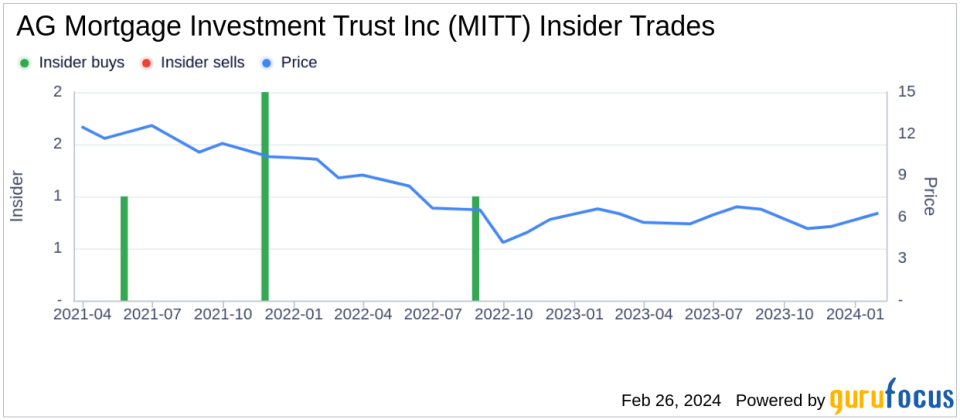

Over the past year, Thomas Durkin has bought a total of 50,000 shares and hasn’t sold a single share, indicating he’s bullish on the company’s trajectory. AG Mortgage Investment Trust Inc’s overall insider trading history shows a pattern of more insider buys than sells, with 1 insider buy and 0 insider sells over the past year. .

On the day of the most recent insider purchase, shares of AG Mortgage Investment Trust Inc. were trading at $6.12, giving it a market cap of $184,274,000. The company’s price-to-earnings ratio of 11.38 is lower than the industry median of 16.95, suggesting it may be undervalued relative to its peers.

Further, AG Mortgage Investment Trust Inc’s stock price is $6.12 and GuruFocus Value is $7.85, giving it a Price to GF Value ratio of 0.78. This indicates that the stock is considered moderately undervalued according to the GF Value metric. GF Value is GuruFocus’ proprietary estimate of intrinsic value, which takes into account historical trading multiples, GuruFocus’ adjustment factors based on past earnings and growth, and analyst estimates of future performance.

Recent purchases by insiders are consistent with current valuation metrics, suggesting that insiders view the stock’s current price as an attractive entry point. Investors often focus on insider purchasing trends as signals of a stock’s potential value, and Thomas Durkin’s acquisition could be interpreted as a positive sign for AG Mortgage Investment Trust’s future performance. There is sex.

For detailed information on insider transactions and stock performance, investors are encouraged to review the entire SEC filing and consider the broader market situation.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link