[ad_1]

-

dividend: Vitesse Energy Inc (NYSE:VTS) declares a quarterly cash dividend of $0.50 per share.

-

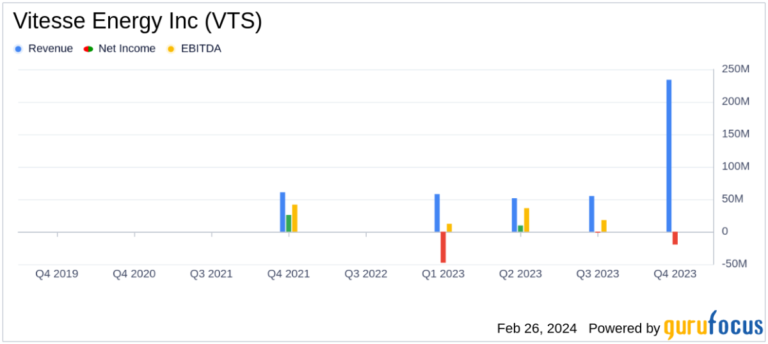

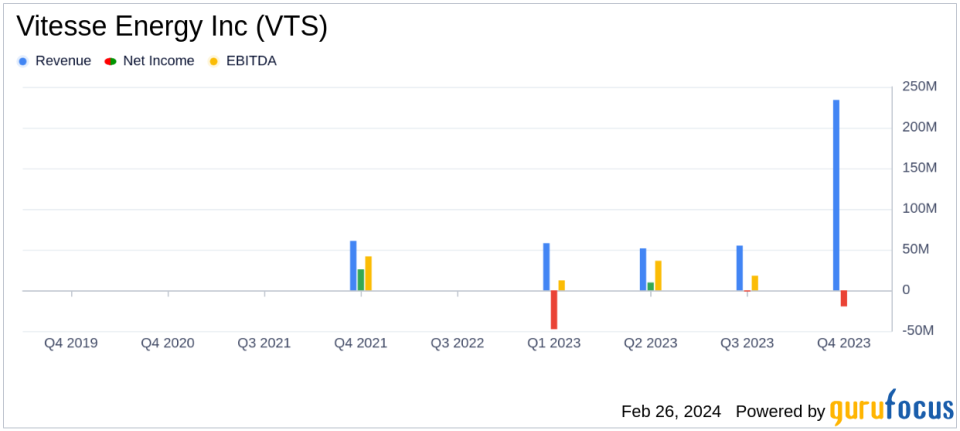

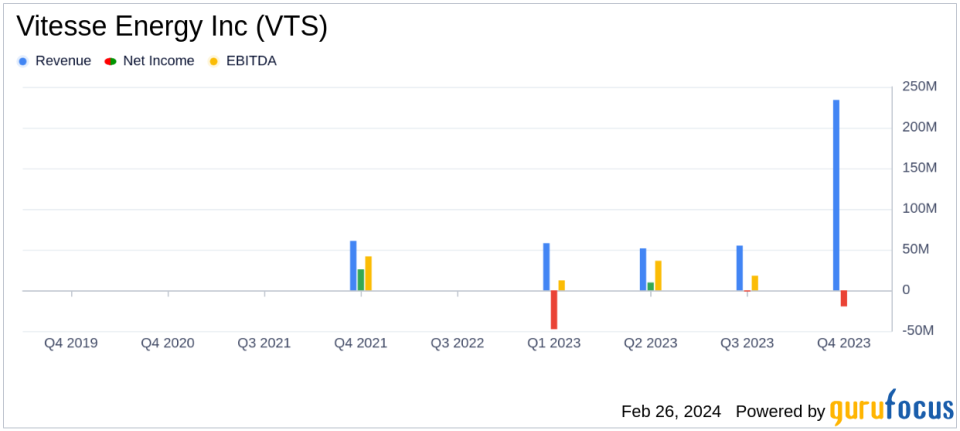

net loss:Reported a net loss of $19.7 million for the full year 2023.

-

Adjusted net income: Adjusted net income was $53.6 million.

-

Adjusted EBITDA: Recorded adjusted EBITDA of $157 million.

-

Increased production: Production increased 15% year over year to an average of 11,889 Boe per day.

-

capital expenditure: Spent a total of $120.5 million on development and acquisitions.

-

debt indicators: Total debt at the end of the period was $81 million, with a net debt-to-adjusted EBITDA ratio of 0.51.

On February 26, 2024, Vitesse Energy, Inc. (NYSE:VTS) released its 8-K filing, announcing its full-year 2023 financial and operating results, along with the declaration of a quarterly cash dividend. Vitesse Energy Inc is an independent energy company focused on the acquisition, development and production of non-operating oil and natural gas assets in the United States, with significant presence in the Bakken and Three Forks formations in North Dakota’s Williston Basin. It shows the feeling. Not only in Montana, but also in the Central Rockies.

The company reported a net loss of $19.7 million for the year, compared to adjusted net income of $53.6 million and adjusted EBITDA of $157 million. Net loss is an important metric because it reflects the challenges facing the company, including the impact of lower realized prices for oil and natural gas. However, adjusted net income and EBITDA, excluding certain non-recurring items and non-cash expenses, highlight the company’s ability to generate profits and manage expenses.

Vitesse Energy’s financial results, including increased production and maintaining a conservative leverage profile, are critical in the volatile oil and gas industry. These results demonstrate the company’s operational efficiencies and strategic capital allocation, which are essential to sustaining growth and shareholder returns in a sector characterized by volatile commodity prices and regulatory changes.

Financial performance analysis

The company’s production increased to an average of 11,889 barrels of oil equivalent per day, an increase of 15% year-on-year, with oil accounting for 68% of total production. This increase in production, especially for oil with higher market prices, is a positive indicator of Vitesse’s operational success and focus on high-margin areas.

Despite the net loss, Vitesse’s financial position remains strong, with a net debt to adjusted EBITDA ratio of 0.51, reflecting a manageable level of debt relative to earnings. The company’s reported liquidity was $99.6 million as of December 31, 2023, giving it financial flexibility to address future market conditions.

Lease operating expenses for the year were $39.5 million, or $9.11 per Boe, and general and administrative expenses were $23.9 million, or $5.52 per Boe. These expenses are important metrics for investors because they provide insight into a company’s cost and operational efficiency.

Vitesse’s 2023 capital expenditures totaled $120.5 million, primarily for development and acquisitions in North Dakota. This strategic investment is aimed at expanding the company’s asset base and fostering future growth.

In terms of reserves, Vitesse reported that proven and developed reserves increased by 5%, while total proven reserves decreased by 7%. A company’s reserves are an important asset because they represent future production potential and are an important factor in a company’s valuation.

Commenting on the results, Bob Gerrity, Chairman and Chief Executive Officer of Vitesse, said: Additionally, directing capital toward the highest return opportunities resulted in annual production growth while maintaining a conservative leverage profile. Looking ahead, we believe that the large inventory of our organic development sites and access to attractive self-sourcing deal flows position us both for continued positioning. Drive capital return strategies and pursue growth opportunities. ”

For investors and analysts interested in further details, Vitesse Energy will host a conference call on February 27, 2024 to discuss the earnings report and provide additional insight into the company’s performance and strategy.

For more detailed financial information and a complete earnings report, please visit Vitesse Energy Inc’s website or access its 8-K filing.

For more information, please see the full 8-K earnings release from Vitesse Energy Inc here.

This article first appeared on GuruFocus.

[ad_2]

Source link