[ad_1]

Global credit bureau market

DUBLIN, Feb. 26, 2024 (Globe Newswire) — The “Credit Bureaus Global Market Report 2024” report has been added. ResearchAndMarkets.com Recruitment.

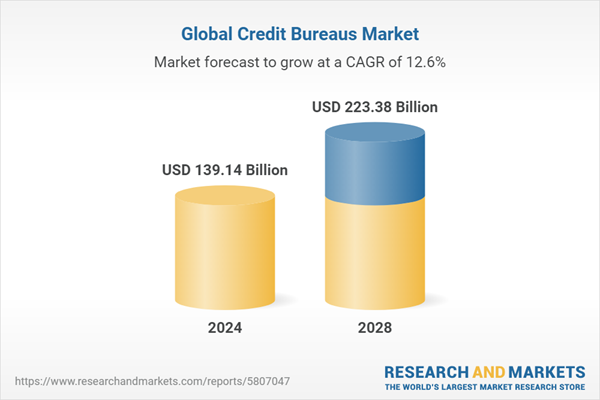

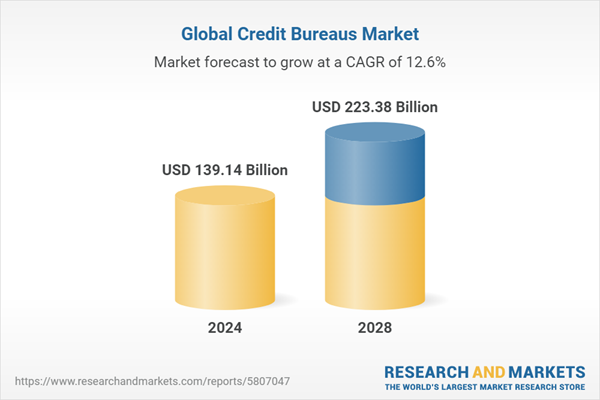

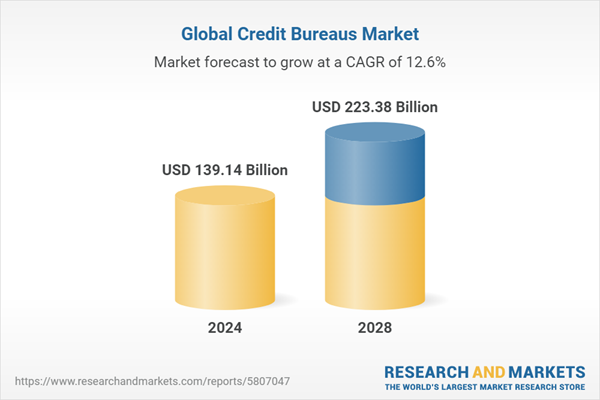

The market size of credit bureaus has grown rapidly in recent years. It is expected to grow from $122.44 billion in 2023 to $139.14 billion in 2024, at a compound annual growth rate (CAGR) of 13.6%. The expansion observed during this historic period has been attributed to growth in the lending industry, efforts towards financial inclusion, compliance with regulatory and reporting requirements, emphasis on risk management within financial institutions, and increased consumer awareness regarding credit. It’s possible.

The expected growth in the credit bureau market is driven by rising unemployment rates nationwide. Rising unemployment rates mean that a large proportion of the workforce is actively seeking work but are unable to secure it, indicating economic hardship and potential social consequences. ing. This trend can have a significant impact on credit bureaus due to the financial hardships faced by the unemployed, resulting in delayed bill payments and increased credit utilization. For example, as of November 2023, the U.S. Bureau of Labor Statistics (BLS) reports that the national unemployment rate is 3.7%. The BLS also provides comprehensive historical data, including unemployment rates by state, available in the State Employment and Unemployment Summary Report. These valuable data sources enable a deep understanding of labor market trends, serve as an important tool for credit bureaus to assess credit risk, and provide comprehensive credit reporting to businesses and lenders. Offers.

Blockchain adoption stands out as a key trend gaining traction within the credit reporting market. Leading players in the industry are focusing on implementing cutting-edge technologies to strengthen their market position. Blockchain, known for its immutable shared ledger, facilitates seamless transactions between various parties by enabling the instant, transparent, and secure exchange of encrypted data. For example, in May 2021, TransUnion, a prominent US-based consumer credit reporting company, partnered with Spring Labs, a US-based software company, with the aim of facilitating the secure exchange of information. We have launched a blockchain-driven trust data sharing platform. Confidential information. TransUnion’s use of blockchain technology on its data sharing platform strengthens network effects, allowing credit bureaus and other entities to more accurately predict an individual’s creditworthiness through a robust data ecosystem.

Leading companies in the credit bureau market are leading the way in developing cutting-edge products that leverage advanced technologies such as API platforms. These platforms act as software frameworks and provide a set of tools and services for creating and managing application programming interfaces (APIs). They streamline the process for developers to efficiently build, test, and deploy APIs, ensuring seamless integration and communication across different software systems and applications. For example, in August 2021, Bloom Credit, a New York-based credit bureau and fintech platform, introduced Furnish by Bloom Credit. This automated furniture solution allows businesses to report consumer activity to all three of his major credit bureaus (Equifax, Experian, and TransUnion) simultaneously. The primary goal of this innovative product is to help lenders significantly reduce credit reporting errors and ultimately reduce the negative impact these inaccuracies have on consumers.

Some of the companies mentioned in this report include:

-

Fidelity Information Service

-

Intuit Inc.

-

S&P Global Co., Ltd.

-

Global Payments Co., Ltd.

-

Experian

-

Moody’s Corporation

-

Global Database Co., Ltd.

-

Equifax Co., Ltd.

-

Transunion LLC

-

LexisNexis Risk Solutions

-

dun & bradstreet

-

Coface SA

-

Core Logic Co., Ltd.

-

Credit Karma LLC

-

Fair Isaac Co., Ltd.

-

Questsoft Co., Ltd.

-

identity guard

-

Innobis Service Co., Ltd.

-

Credit Information Bureau (India) Limited

-

Privacy Guard LLC

-

Creditinfo Group plc

-

FreeCreditReport.com

-

identity force

-

Illion Data Registries Pty. Ltd.

-

Shufa Holding AG

-

true identity

-

ID analytics

-

compscan

-

Bureau van Dijk SA

-

ARXivar SpA

For more information about this report, please visit https://www.researchandmarkets.com/r/4asz5l.

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of international market research reports and market data. We provide the latest data on international and regional markets, key industries, top companies, new products and latest trends.

attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900

[ad_2]

Source link