[ad_1]

-

net investment income: Net investment income per share increased to $0.45 in the fourth quarter and $1.98 for the full year.

-

Net asset value (NAV): As of December 31, 2023, NAV per share decreased to $9.71.

-

portfolio yield: The annual yield of the bond portfolio in 2023 was 16.6%.

-

committed backlog: HRZN ended the year with a backlog of $218 million.

-

distribution: Monthly distributions declared through June 2024 total $0.33 per share, with a special distribution of $0.05 per share payable in April 2024.

-

investment activities: Total investment income in 2023 increased by 43.3% to $113.5 million.

-

Liquidity: Available liquidity as of December 31, 2023 was $103.9 million.

On February 27, 2024, Horizon Technology Finance Corporation (NASDAQ:HRZN) released an 8-K filing detailing its financial results for the fourth quarter and year ended December 31, 2023. . HRZN is a specialized financial company that provides funding to venture companies. Capital-backed companies from a variety of industries including technology, life sciences, health information and services, and sustainability.

Financial performance and challenges

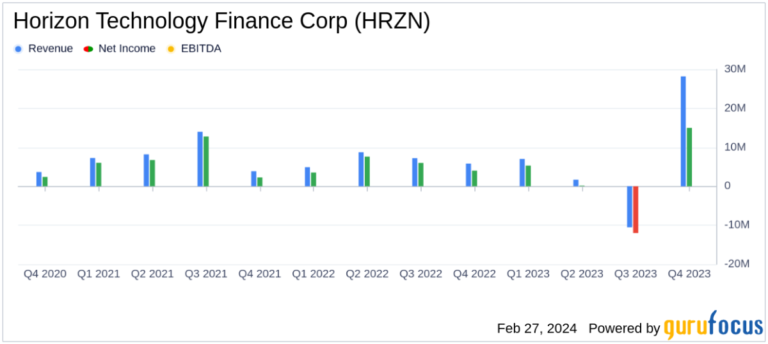

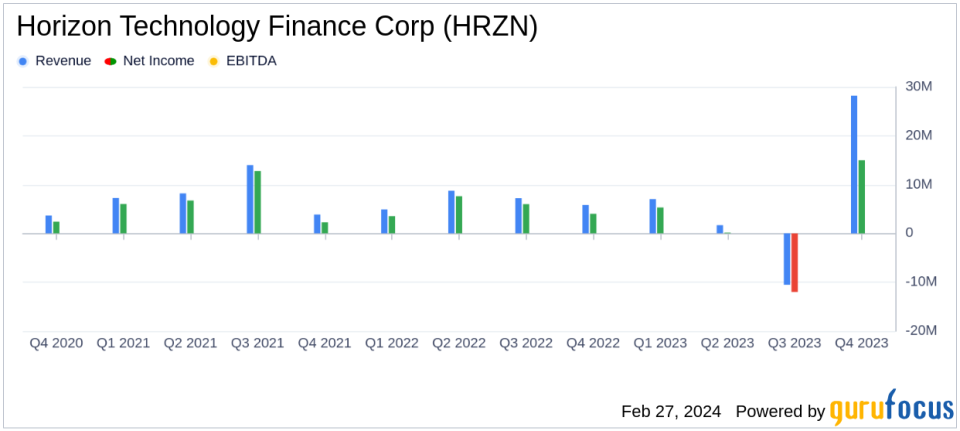

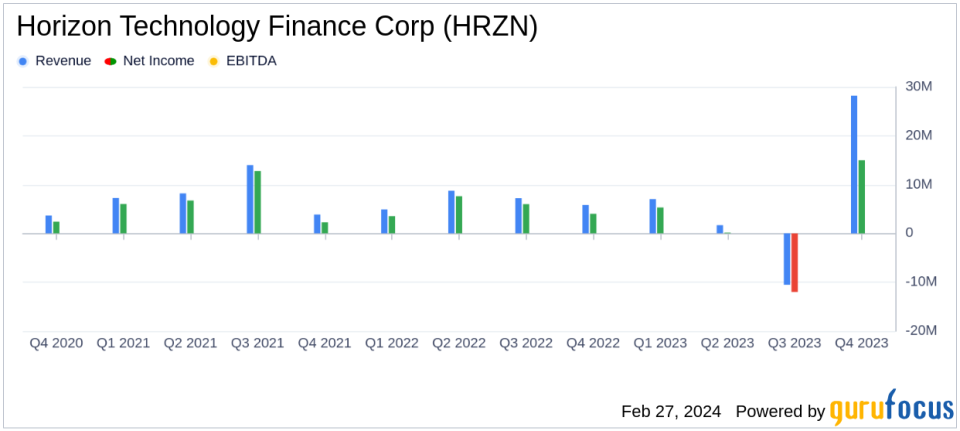

HRZN’s fourth quarter net investment income per share was $0.45, up from $0.40 in the year-ago period. For the full year, net investment income per share was $1.98, a significant increase from $1.46 in 2022. However, the company’s NAV per share declined, ending the year at $9.71 compared to $11.47 as of December 31, 2022. NAV can be attributed to focused investments in challenging venture markets.

Despite these challenges, HRZN’s fixed income portfolio has a high annual yield of 16.6%, reflecting the company’s ability to generate income from fixed income investments. The Company also announced a monthly regular dividend totaling $0.33 per share through June 2024, with an additional special dividend of $0.05 per share scheduled to be paid in April 2024.

Financial performance and materiality

HRZN’s 2023 financial results include a 43.3% increase in total investment income to $113.5 million due to higher interest and fee income on investments. This growth is important to HRZN as it demonstrates the company’s ability to expand its fixed income investment portfolio and leverage key investments to generate returns in the asset management industry.

Portfolio and liquidity

As of December 31, 2023, HRZN’s debt portfolio consisted of 56 secured loans with a total fair value of $670.2 million, and the company held investments in 102 portfolio companies with a total fair value of $38.9 million. ing. The Company maintained a strong liquidity position with $103.9 million in available liquidity, including cash and available funds under credit facility commitments.

Horizon CEO Robert D. Pomeroy Jr. commented on the results:

We ended 2023 with a quarter in which our fixed income portfolio continued to generate net investment income in excess of its dividends, while also originating new venture bond investments to add to our portfolio and committing outstanding balances. . ”

He also emphasized that the company is focused on actively managing its investments and maximizing capital returns in a difficult market.

HRZN performance analysis

HRZN’s 2023 results reflect its strategic focus on revenue generation and portfolio growth. The company’s ability to maintain high bond portfolio yields and increase investment returns is commendable. However, the decline in NAV per share indicates the impact of market volatility and the need for careful management of investment risk. Going forward, HRZN’s prudent portfolio growth and capital recovery efforts will be key to navigating the uncertain venture market and maintaining financial health.

For more detailed information and to view the complete financial statements, investors and interested parties are encouraged to read the entire 8-K filing.

Horizon Technology Finance Corp will hold a conference call on February 28, 2024 to discuss financial results and company developments and provide an opportunity for investors to gain further insight into the company’s performance and strategy.

For more information, see Horizon Technology Finance Corp’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link