[ad_1]

-

A comprehensive SWOT analysis of FNF’s latest SEC 10-K filings.

-

Insights into FNF’s competitive advantages, market opportunities, and potential challenges.

-

Strategic assessment of FNF’s financial health and operating strategy.

-

A forward-looking perspective on FNF’s plans to leverage its strengths and address industry threats.

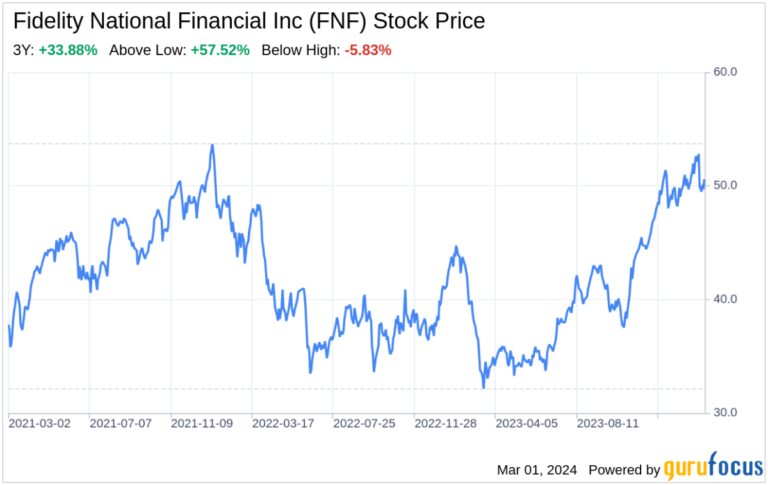

On February 29, 2024, Fidelity National Financial, Inc. (NYSE:FNF) filed a 10-K with the SEC, providing a detailed view of its operations and financial performance. As a leading provider of title insurance, escrow and other title-related services, FNF operates through its Title segment, F&G segment, Corporate and Other segments, with Title segment being its primary source of revenue. The company is well positioned in the US market due to his extensive network of over 5,200 agents and strong brand recognition across multiple title brands. The financial statements in the filing reveal a strong financial position, with competitive operating margins and a focus on disciplined cost management contributing to its industry-leading position. This SWOT analysis of his aims to analyze the strategic and financial nuances of FNF and give investors a comprehensive understanding of its potential.

Strengths

Brand awareness and market presence: FNF’s multiple title brands, including FNTIC, Chicago Title and Commonwealth Land Title, have cultivated strong brand recognition and enabled the company to access a broader customer base. This multi-brand strategy has allowed FNF to attract customers who are loyal to a particular brand and strengthen its market presence and competitiveness. With an extensive agency network, the company’s title division is one of the largest in the United States, providing a solid foundation for sustained growth and increased market share.

Operational efficiency and profitability: FNF has demonstrated industry-leading margins and a disciplined operational focus, which helps it maintain competitive operating margins. The company’s efficient structure results in lower overhead costs and higher profitability compared to industry competitors. FNF’s management team has a track record of successfully completing acquisitions and navigating business cycles, further strengthening the company’s financial strength.

Weakness

Regulatory risk and geographic concentration: FNF relies heavily on California and Texas for title insurance premiums, exposing the company to regulatory risks and economic downturns specific to those states. Approximately 13.0% and 14.3% of FNF’s title insurance premiums come from California and Texas, respectively. Adverse regulatory developments or economic challenges in these states could materially affect FNF’s operations and financial results.

Competitive industry landscape: The title insurance and financial services industry is highly competitive, with many players possessing greater financial resources and broader product ranges. FNF faces challenges in maintaining its market position and profitability in the face of intense competition, which may result in decreased sales and increased expiration of existing products.

opportunity

Technological advances and product innovations: FNF is committed to improving its products and technology to meet evolving industry standards. The company focuses on implementing new information systems technology and enhancing real estate transaction processes, providing opportunities for growth and efficiency improvements. By anticipating industry changes and providing innovative solutions, FNF can strengthen its competitiveness and attract new customers.

Strategic acquisitions and market expansion: FNF has a history of strategic acquisitions that have contributed to growth and expanded service offerings. The company’s approach to acquiring high-quality companies with strong management teams and growth opportunities increases value for shareholders and allows FNF to enter new markets or enhance current offerings. Make it.

threat

Cybersecurity risks: As a company that relies heavily on information technology, FNF faces significant cybersecurity risks. Despite comprehensive risk management strategies, the threat of data breaches and cyberattacks is a constant concern and can lead to business interruption, financial loss, and reputational damage.

Economic and market volatility: FNF operates in a cyclical industry and its title division is particularly susceptible to fluctuations in the real estate market. Economic downturns, changes in interest rates and other macroeconomic factors could adversely affect demand for title insurance and related services and threaten FNF’s revenue and profitability.

In conclusion, Fidelity National Financial Inc (NYSE:FNF) has established a strong position in the market due to its diversified brand portfolio and operational efficiencies that drive its profitability. However, regulatory risks, competitive pressures, cybersecurity threats, and economic fluctuations pose ongoing challenges. FNF’s strategic focus on market expansion through innovation, product development and acquisitions positions it to capitalize on opportunities and mitigate threats. By leveraging its strengths and addressing its weaknesses, FNF is poised to navigate the dynamic landscape of the title insurance and financial services industry.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link