[ad_1]

berkshire hathaway CEO Warren Buffett has achieved incredible investment wins over the years by selecting great companies with strong competitive advantages. To put Oracle’s track record in Omaha into perspective, if Mr. Buffett bought $1,000 worth of Berkshire stock in May 1965 when he bought a controlling interest in the business and became CEO; This means he owns approximately $34.3 million worth of stock.

Of course, given Berkshire’s current massive size, it’s unlikely that its stock will perform like that again this century. With a market capitalization of $889 billion, it ranks as the 8th most valuable company in the world. At that level, exponential growth becomes much more difficult to achieve.

But even snippets of Buffett’s investment strategy can be a great way to earn market-beating returns, and two Motley Fool contributors recommend the following two stocks from the Oracle of Omaha. We believe following his lead can be a great way to strengthen your portfolio.

The AI revolution brings big wins to Amazon

Keith Noonan: Amazon (NASDAQ:AMZN) is the world’s largest online retail company. It is also a leading provider of cloud infrastructure services.

Amazon’s e-commerce business makes up a large portion of the company’s revenue, but it doesn’t actually account for most of its profits. Profit margins in the online retail sector are relatively low due to high operating costs. The company’s Amazon Web Services (AWS) cloud business is much more profitable, contributing about 67% of the company’s $36.9 billion in operating profit last year.

But Amazon should be able to achieve much better returns from its e-commerce business by continuing to leverage economies of scale and leveraging new technology. In particular, widespread use of artificial intelligence (AI) should provide an incredible performance boost for already highly successful companies.

AI could pave the way for increased automation in the company’s warehouses. It could also open the door to self-driving cars and autonomous delivery technology. As a result, Amazon’s e-commerce operating costs could drop dramatically and profits could soar.

Meanwhile, the growing demand for AI is already driving strong AWS performance. AI applications are built, launched, and scaled on the company’s cloud infrastructure. Demand for cloud infrastructure will continue to increase as more applications are created and used.

For long-term investors looking for an AI growth stock that offers an attractive risk-reward profile, Amazon has a great buy right now.

Coca-Cola has strong customer relationships

Paluev Tatevosyan: For me, to be able to easily invest in a stock, I have to have confidence that the company will be around for at least another 20 years. coca cola (NYSE:KO) Certainly fits the bill. The beverage giant has been delighting customers for nearly a century, and it’s reasonable to think it’ll be around for at least a few more decades. Importantly, Coca-Cola serves its customers in a way that benefits its shareholders.

In 2023, sales totaled $45.7 billion and operating income totaled $13.0 billion. This means that after incurring all the costs necessary to provide the delicious beverage that customers have come to love, Coca-Cola’s operating profit margin was a staggering 28.4%. To do.

Our proven ability to generate billions of dollars in sales at competitive profit margins goes a long way toward alleviating investors’ concerns about investment risk. Indeed, the billions of dollars in annual profits drew Buffett to Coca-Cola stock. The fundamental reason these profits continue to flow is the management’s skill in running the business effectively and the brand loyalty and stable spending habits of consumers.

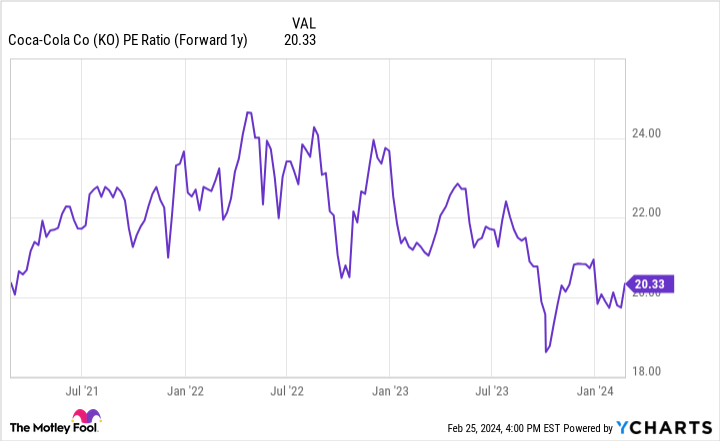

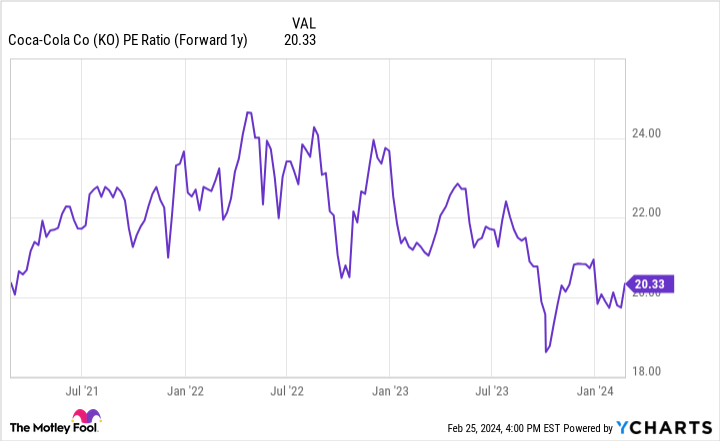

I’m usually willing to pay a higher price to invest in companies like Coca-Cola because they’re likely to last long. Fortunately, Coca-Cola’s valuation is not that high. Coca-Cola’s stock currently trades at a forward price/earnings ratio of 20 times, recently at the low end of the stock’s range over the past several years. An investor who buys Coca-Cola stock today has a reasonable expectation that his investment will be worth more 20 or 30 years from now.

Should you invest $1,000 in Amazon right now?

Before buying stocks on Amazon, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks For investors to buy now…and Amazon wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Keith Noonan has no position in any stocks mentioned. Parkev Tatevosyan, CFA, has no position in any stocks mentioned. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett’s 2 Great Stocks to Buy for 2024 (and Beyond) was originally published by The Motley Fool.

[ad_2]

Source link