[ad_1]

Time flies in the stock market. It now seems like a long time ago when people rushed to invest in cannabis stocks, especially in the wake of positive regulatory developments in Canada. Unfortunately, the industry hasn’t lived up to the hype. Even those who are perceived as market leaders canopy growth (NASDAQ:CGC) It fails to provide anything resembling a positive return.

Canopy remains one of the leaders in the Canadian cannabis market, so if things improve, this pot grower could be one of the big winners. Find out how poorly Canopy Growth has performed over the past five years by calculating how much a $5,000 investment in the stock in 2019 would be worth today. Then determine whether future performance will improve.

I can’t express it with the word “regrettable”

Let’s start with a (very) quick summary of what’s happened to Canopy Growth over the past five years. The company has quickly emerged as a leader in the Canadian cannabis market for several reasons. One of the reasons was the investment from. constellation branda company that manufactures alcoholic beverages.

The argument was that partnering with Constellation Brands would give Canopy Growth access to significant capital to expand without diluting shareholders. Constellation Brands’ expertise in navigating highly regulated industries will also help. And the possibility of the two creating a cannabis-infused beverage seemed exciting.

Canopy Growth will benefit from Constellation Brands’ existing distribution channels. Despite these benefits, Canopy Growth failed. The company fell prey to the same problems that plagued other pot growers in Canada. The country’s complex process for issuing cannabis retail licenses has caused significant delays. Former CEO Mark Zechlin once said:

Today’s market opportunity has not quite lived up to expectations, and the oversimplified risk of the Ontario government’s inability to license retailers quickly will result in half of Canada’s expected market not existing. I am.

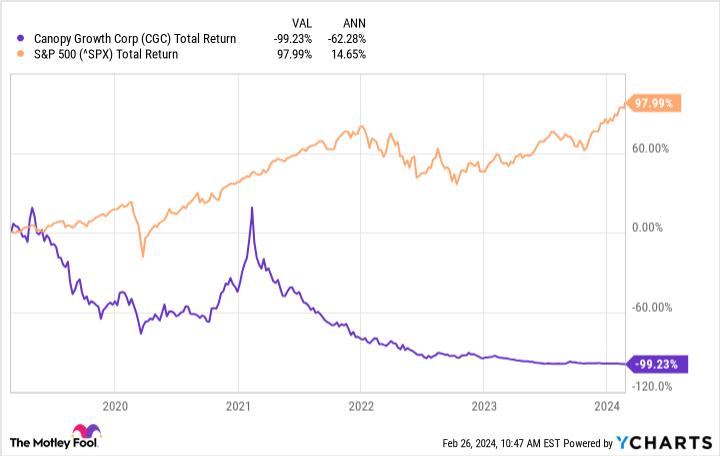

Zeklin said in late 2019 that the issue had a long-lasting impact on markets north of the border. That’s not to mention competing illegal markets, US legal issues, and the fact that the opportunity seemed so attractive that too many companies jumped on it, creating an oversupply problem. there is no. Canopy Growth stock has registered a negative compound annual growth rate (CAGR) of 62.28% over the past five years.

That way, your initial capital of $5,000 becomes $38.18, which is enough for a few cups of coffee. Investors would have been better off investing in exchange-traded funds that track fluctuations. S&P500. If the CAGR of the index for this period is 14.65%, $5,000 becomes $9,904.68.

A bumpy road ahead for Canopy Growth

Canopy Growth’s plan to turn things around includes at least two parts. First, the company decided to improve its management by aggressively reducing expenses and moving it closer to profitability. Second, cannabis leaders have devised an elaborate plan to dominate the US market once cannabis is legalized at the federal level. To be fair, the first part of this strategy is underway.

In the most recent reporting period (third quarter of fiscal 2024 ended December 31), Canopy Growth’s gross margin and adjusted gross margin increased 30% and 27%, respectively, year over year, with both The index was 36. %. Canopy’s net loss worsened slightly to C$230.3 million ($170 million), up 2% year-on-year. However, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) were negative by C$9 million, an 82% increase year-on-year.

Canopy’s free cash flow was negative C$33.9 million, an improvement of 57% from the prior-year period. This was all achieved despite net revenue down 7% year over year to C$78.5 million. There are some improvements, but they are not enough to make the company attractive. And that’s before considering Canopy’s hopeful strategy to enter the U.S. market if legalization happens at the federal level.Canopy has signed an acquisition agreement. AcreAge Holdingsthe New York-based pot company provided such a swing in the regulatory pendulum.

Canopy has made several other moves to capitalize on opportunities in the US But when will the country legalize adult use of cannabis at the federal level? That’s anyone’s guess. It could be in a year or 10 years. Until then, it will be a waiting game until this strategy is fully successful.

As we learned from Canada’s experience, even if the United States legalizes marijuana, there is no guarantee that Canopy Growth will be successful. Don’t expect this cannabis stock to give much better returns over the next five years than it has since 2019. It’s best to stay away from canopy growth for now.

Should you invest $1,000 in Canopy Growth right now?

Before buying Canopy Growth stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Things investors can buy right now…and Canopy Growth wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Prosper Junior Bakinny has no position in any stocks mentioned. The Motley Fool has a position in and recommends Constellation Brands. The Motley Fool has a disclosure policy.

“If You Invested $5,000 in Canopy Growth in 2019, How Much Would You Get Today?” was originally published by The Motley Fool

[ad_2]

Source link