[ad_1]

In early February, PayPal (NASDAQ:PYPL) Chief Financial Officer Jamie Miller said the company plans to buy back about $5 billion in stock in 2024. With a market capitalization of just $65 billion, the buyback represents nearly 8% of the company’s stock value.

This is a big gamble for PayPal. At present, valuations are depressed, but stock buybacks could be a genius move. But if history is any indication, PayPal could quickly destroy shareholder value.

The company has already spent $15 billion on stock buybacks since going public in 2015. Most share buybacks ended up destroying shareholder value, given that the buyback price was much higher than current valuations.

Will it be different this time? The company is optimistic for three reasons:

1. PayPal stock is clearly cheap

PayPal may have spent billions of dollars on stock buybacks in the past, but 100% of those stock buyback programs were done at higher valuations than today.

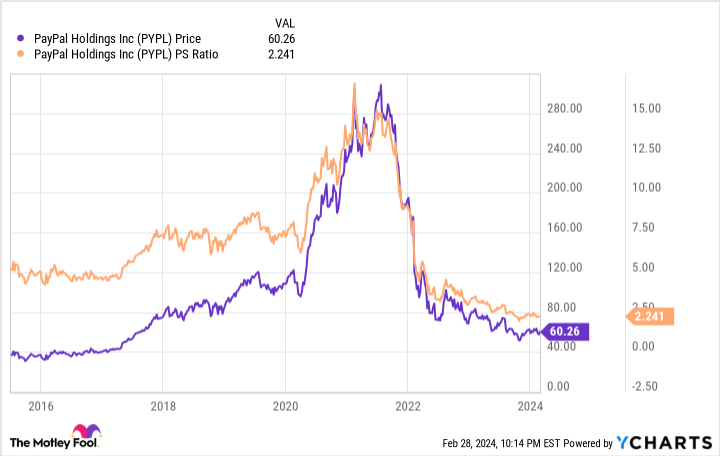

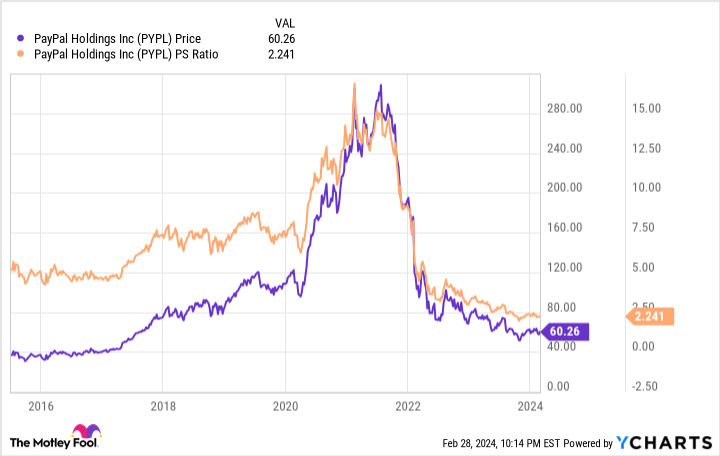

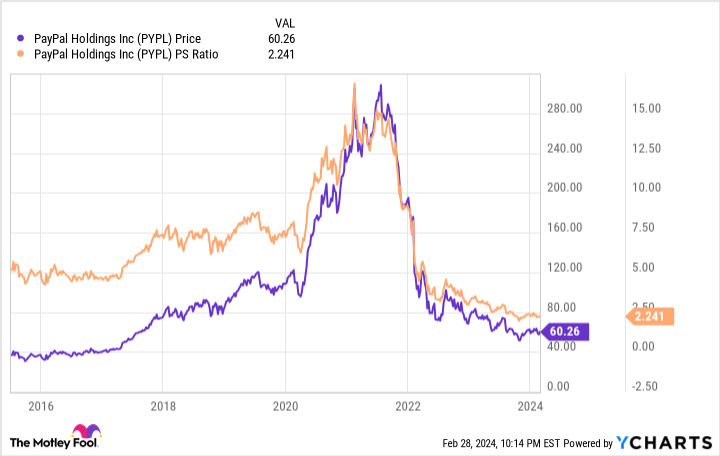

When the company went public in 2015, PayPal stock traded at about five times sales. During the pandemic bull market that drove up the stock prices of nearly every tech company, PayPal stock was worth 15 times sales.

PayPal stock currently trades at an all-time low valuation of just 2.2 times sales. There are many reasons for this drop in ratings. From 2015 to 2020, PayPal’s quarterly revenue growth averaged 15% to 20%. In recent quarters, that growth rate has slowed to about 8%.

There are also concerns that the company is not investing enough in its future. In 2020, the company spent approximately 12% of its sales on research and development. Currently, that number is around 10%. This isn’t a huge drop, but when growth starts to slow, the last thing a company can do is ignore research and development efforts that can help reverse the trend.

There are more positive reasons why management thinks now is the time for a $5 billion stock buyback. But there’s no question that the negative events and trends of the past year or two have created perhaps the best conditions for share buybacks in the company’s history.

2. PayPal is a free cash flow machine

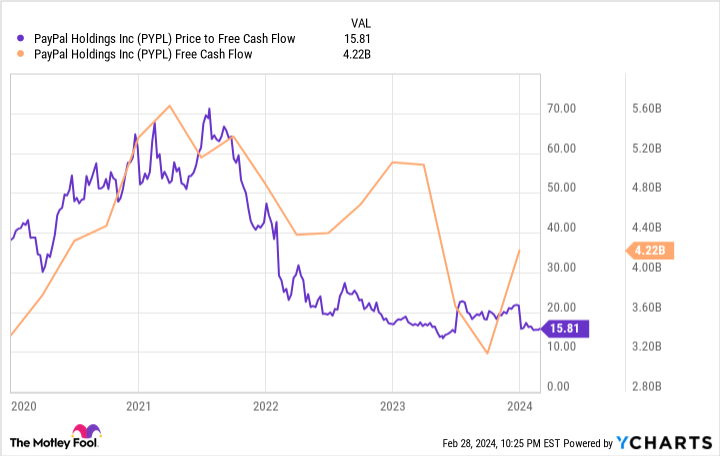

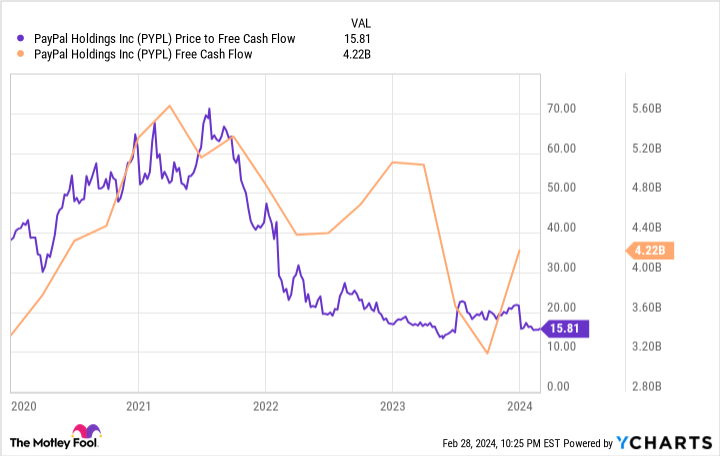

Despite slowing revenue growth, PayPal continues to generate large and reliable cash flows. The company’s stock currently trades at a free cash flow yield of 6.3%, the highest yield in the company’s history thanks to more than $4 billion in free cash flow generated over the past 12 months.

Historically, the company has spent a significant portion of this funding on stock buybacks. Meanwhile, more than $11 billion went toward acquisitions.

The recent slowdown in growth suggests that perhaps PayPal should have allocated more funds to research and development. Still, management has to figure out what to do with the extra cash. The company currently has a record $9.1 billion in cash, and that number will continue to grow unless management is able to spend inbound cash flow.

It’s not the best rationale in the world, but a big reason PayPal continues to buy back its own stock is because it has cash burning a hole in its pockets. If acquisitions or dividends are not on the table, investing itself is the only option.

Strategically, PayPal executives appear to want additional stock buybacks rather than fostering internal innovation.

3. New technologies can drive growth

PayPal has invested less in research and development than in the past, but that doesn’t mean the company doesn’t have the ability to innovate.

Last fall, the company announced a series of new services and features, all aimed at reversing the trend. One innovation in particular illustrates not only the company’s established market dominance, but also where it can find new growth engines.

PayPal calls this innovation “Fast Lane.” The sales pitch is simple. PayPal has 400 million active users. This means that PayPal can recognize a huge percentage of the visitors to your retail site. Fastlane allows potential buyers to checkout without entering any additional information. The company says this technology can reduce checkout time by up to 40%.

There is no feature that will return PayPal to its previous growth rate, but features like Fastlane seem promising.Currently, the entire EC market is growing Faster than paypal. If the company can find a way to integrate more deeply into the global e-commerce market, the rising tide could give it a much-needed lift.

PayPal executives know the stock is historically cheap. They also have a good idea of how much free cash flow the company generates. By pledging to buy back so many of their own shares this year, they are betting on new innovations like FastLane that will almost certainly reverse their growth trajectory, a scenario in which PayPal’s stock is valued at likely to rise significantly.

Where you can invest $1,000 now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks PayPal made the list of stocks that investors should buy right now. But there are nine other stocks he has that you may have overlooked.

See 10 stocks

*Stock Advisor will return as of February 26, 2024

Ryan Vanzo has no position in any stocks mentioned. The Motley Fool has a position in and recommends PayPal. The Motley Fool recommends this option: His March 2024 $67.50 Short Calls on PayPal. The Motley Fool has a disclosure policy.

3 reasons why PayPal is betting $5 billion on its stock was originally published by The Motley Fool.

[ad_2]

Source link