[ad_1]

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 9,916,667 PFE shares, 2,994,167 PFE options. The Company has been engaged by PFE to share our commentary on the progress of our Investment in PFE over time.

Lithium stocks have been running over the last two weeks – some are up over 100% plus.

The reason?

The lithium price has actually just moved up for the first time in nearly a year.

… Bouncing off what might be the lows for lithium sentiment.

During the downturn, we have been building our position in Pantera Minerals (ASX:PFE).

Hopefully, timing our Investment with a positive turn in lithium sentiment.

While the lithium market waned, PFE has been quietly acquiring oil fields that are rich in lithium brines, in the Smackover Formation of Arkansas, USA…

It’s a strategy we have seen before…

Our previous big win in the lithium space was Vulcan Energy Resources which was picking up ground that had geothermal brines rich in lithium during the 2019 lithium market downturn.

VUL then went on to have a near 100x share price run over two years with tailwinds being in the right location (EU near all the carmakers) and in the right commodity (lithium).

It’s early days, but we think PFE is positioning itself similarly – in the US (near Tesla’s gigafactories) and also targeting lithium from brines….

(remember past performance is not a future indicator…not saying this will happen again, but we are taking the shot with the PFE position we built during this current lithium downturn).

14 reasons why we are Invested in PFE:

- PFE right next door to $643BN Exxon – Exxon reportedly spent >US$100M acquiring its project and just started drilling its first well 6 weeks ago with a view of getting to first production by 2027.

- Surrounded by (much) bigger players – PFE is also in the same neighborhood as $25BN Albermarle, $383M Standard Lithium, $790M Tetra Technologies.

- Nearby Standard Lithium almost producing – DFS for its phase 1A operation completed. Demo plant already produced lithium from ~15 million gallons of smackover brine. Construction to start in 2025, with first production target for 2026.

- Cheap re-entry into historical oil wells – PFE doesn’t have to drill new wells, instead, it can just re-enter old oil and gas wells and extract lithium brines. This is cheaper to do than drilling whole new wells.

- Direct Lithium Extraction (DLE) tech advancing – All over the world, DLE tech is progressing extremely quickly. PFE is in a unique position where it gets to benefit from the work and investment Exxon is doing next door – Exxon is working on DLE technology.

- Supportive local government and regulations – we attended the inaugural Lithium Innovation Summit in Little Rock, Arkansas and saw firsthand how much the state wants to make lithium a key pillar of its economic agenda.

- Federal government incentives – The US government is looking to incentivise critical minerals production inside the US. The $370BN IRA includes incentives that reward producers inside the US/friendly countries.

- Strong on the ground team – we visited the project site and got to know the people helping PFE lease ground in Arkansas – they know the area like the back of their hand. This will be very useful not only for building connections with the local community but also help PFE quickly grow its acreage (and hopefully its eventual lithium resource).

- Arkansas already has a brine processing industry – Arkansas is a globally significant brine processing hub. Arkansas produces ~40% of the world’s bromines by extracting it from brines.

- Small market cap of ~$11M – PFE’s market cap is well below its regional peers & has a lot of room for growth as it delivers catalysts at its project.

- Fast mover into the Smackover – PFE’s ground was picked up BEFORE Exxon Mobil entered the Smackover Formation & put the region on the map as a US lithium hot spot.

- Large JORC exploration target released – PFE’s exploration target is between 436,000 and 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE) – big enough to host a resource the size of its neighbour Standard Lithium’s project.

- We have had previous success with a DLE stock – We built our position in Vulcan Energy Resources in a down lithium market and then at its peak during the lithium bull market had a return from our Initial Entry Price of 5,420%.

- PFE Strategic Advisor previously sold a project to Rio Tinto for US$825M – PFE recently appointed Tim Goldsmith as its strategic advisor. Tim sold the Rincon lithium brine assets to Rio Tinto for US$825M in March 2022.

Our PFE site visit – we saw it first hand

Last week one of our analysts went on a site visit to see PFE’s project and attend the Lithium Innovation Summit in Arkansas in the US.

The key parts of the trip included:

- To visit PFE’s lithium project in the historical oil producing region – the Smackover Formation in Arkansas, USA.

- Attend Lithium summit in Arkansas with Exxon, Albemarle, Standard Lithium and the Governor of Arkansas.

- Visit a Direct Lithium Extraction (DLE) research center to learn more about the process from the experts.

Here’s what we learned from the DLE facility visit:

- DLE has been around longer than you think, +10 years – The Chinese have been using DLE at commercial scale for a decade.

- Modular approach most likely to work with clusters around wells – large processing facilities might not be the best way forward, especially for smaller operators.

- DLE at commercial scale in the West will happen sooner than you think, 1-3 years – Brett Rabe who runs the DLE facility that we visited was supremely confident that DLE in the West is on the verge of success given the amount of effort and capital being put into the projects.

- Power is the biggest component of operating expenditure (OPEX), jurisdictions with cheap power will work better – Arkansas’ energy prices are 25% below the average in the US, thanks to nuclear power.

The Lithium Summit provided key insights such as:

- Arkansas is making lithium a key part of its economic agenda – Arkansas governor Sarah Huckabee Sanders laid out her vision for lithium in the state. Politicians and business leaders are all pulling in the same direction.

- ExxonMobil is committing US$20BN to low carbon initiatives through to 2027 – Arkansas is going to be a key pillar of the strategy.

- Arkansas is very well positioned to deliver lithium for all the gigafactories being built in neighbouring states – Benchmark Minerals thinks Arkansas is in a great location, with US battery capacity growing at a rapid clip. Domestic sources of lithium will be crucial.

Read in full here: Arkansas Lithium Summit – lithium come back?

And the PFE site visit helped us get a good grip on why Arkansas is the right place for lithium:

- Lots of rail in the area – good for shipping products.

- Very flat – no topographical challenges when it comes to logistics.

- New, well sealed roads – even in remote areas.

- Plenty of oil rig sites scattered around – PFE will have a good set of existing drill holes to choose from to re-enter looking for lithium rich brines.

Read in full here: Lithium report filed by our international correspondent and roving reporter

Our Big Bet for PFE:

“PFE develops its Smackover Formation lithium brine assets to a point where it is taken over by a major company (Standard Lithium, Albemarle, Exxon Mobil etc) at 1,000% above its current share price. ”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved – just some of which we list in our PFE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

PFE plans to use Direct Lithium Extraction (DLE) technology to extract lithium from brines in old oil and gas wells in the Smackover formation, Arkansas USA.

PFE currently owns 13,457 acres in the Smackover Formation of Arkansas, USA.

Right next to the land recently acquired by Exxon Mobil.

Exxon Mobil paid over US$100M for 120,000 acres in the Smackover.

(Yes, Exxon, the $643BN oil supermajor, is now moving into lithium)

NYSE listed Standard Lithium has 63,000 acres in the Smackover and is capped at $383M.

NYSE listed Tetra Technologies has 5,100 acres and is capped at $790M.

Lithium giant Albemarle has ~140,000 acres in the Smackover and is capped at $25BN.

Right now, PFE is capped at just ~$11M.

PFE currently has a JORC exploration target for its project of 436,000 to 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE).

We are Invested in PFE to see it:

- Grow its acreage from 13,457 to as close to 50,000 as possible.

- Convert its exploration target into a maiden JORC resource.

- Take its project into the feasibility/development stage.

During that process we are hoping PFE’s share price re-rates to a level in line with its bigger neighbours.

As it sits right now, PFE’s exploration target could have the potential to host a lithium resource the size of Standard Lithium’s project (capped at $383M).

For context –

- Smackover neighbour Standard Lithium is capped at $383M and has a Measured and Indicated resource of 2.8 Mt LCE.

- Galvanic Lithium (which Exxon bought out for at least US$100m) had an inferred JORC resource with 4 Mt LCE,

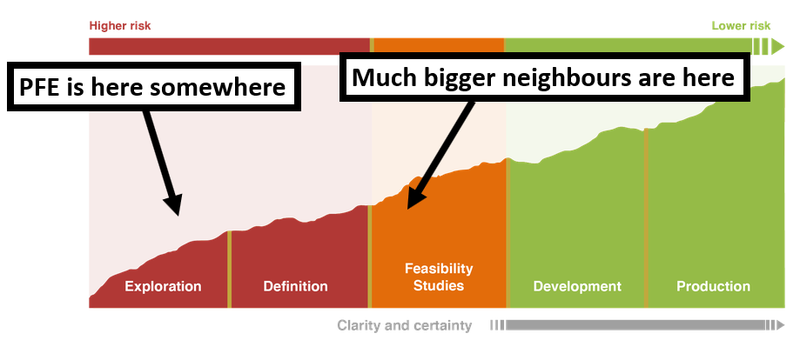

The main point of difference between PFE and its neighbours is that its project is at a far earlier stage in the mining company lifecycle.

While PFE is still at the exploration stage, its neighbours are at the resource definition/feasibility stages:

Last 10 days: Early signs of a lithium comeback?

We have been building our PFE position during the worst lithium market in over 3 years.

With the lithium price looking like it may have bottomed, we think PFE is in a strong position to benefit from any investors interest coming back into the sector.

In the last few days, the lithium price has FINALLY moved up a bit, since pretty much going down or sideways since May last year:

The price rises have also translated into share price moves in lithium stocks – share prices for some names are up over 100% from the recent lows…

Now of course there may still be more lithium pain, but we are happy to see some sentiment come back into the sector.

How serious is Exxon about lithium in the Smackover Formation?

Very serious, it seems.

Over the last few months, lithium in Arkansas (Smackover formation) is all over Exxon’s website…

(source)

(source)

(source)

Exxon’s move into lithium is also in the news:

(source)

(source)

(source)

(source)

(source)

It’s not just Exxon who thinks the Smackover will be the lithium hub in the USA.

The world’s most famous lithium analyst Joe Lowry thinks so too…

AND here is where Exxon’s project sits relative to our Investment PFE –

Standard Lithium’s project has a US$3.1BN NPV from a Pre Feasibility Study (PFS).

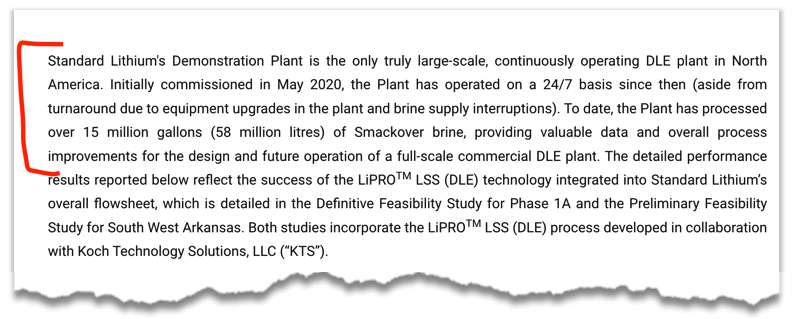

PFE’s other neighbour whose project is relatively well advanced has been putting out feasibility studies over the last ~12-18 months.

Standard’s PFS in August 2023 showed its project had a Net Present Value (NPV) of US$3.1BN.

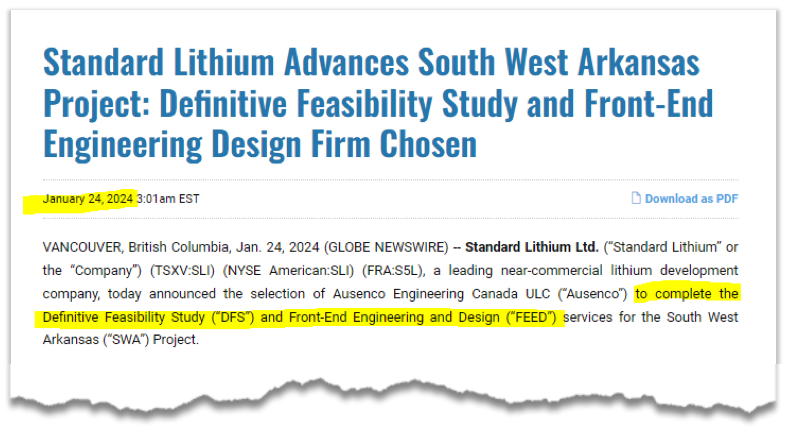

Then Standard commenced a Definitive Feasibility Study (DFS) for a Phase 1A development at the project.

(Source)

And then produced lithium brines from its demo plant late last year –

…

(source)

Early this year Standard picked its consulting team to finish a project wide DFS.

(source)

The Standard Lithium example is a good one when we compare to PFE because:

- PFE has a JORC exploration target of ~436,000 to 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE). Which as it sits right now, PFE’s exploration target has the potential to host a lithium resource the size of Standard Lithium’s project.

- Standard Lithium’s valuation shows where PFE’s valuation could be as its project moves from exploration into the feasibility stage

Here is where Standard Lithium’s project sits relative to PFE –

PFE has also been making the news lately –

(Source)

Some quotes from PFE Chairman Barnaby Egerton-Warburton:

“We’re surrounded by a lot of expertise. Smackover is interesting because of the great jurisdictional benefits of being in Arkansas”.

“We’re very nimble. We have two guys on the ground grinding it out leasing. At some stage we’re going to get a third person and then a fourth person and a fifth person and we’ll build”.

And here is our investment memo, where we share:

- Why we Invested in PFE

- Our long term bet for PFE

- The key objectives we want to see PFE achieve over the next 12 months

- The key risks to our Investment thesis

- Our Investment Plan

Investment Memo: Pantera Minerals (ASX:PFE)

Shares Held at Open: 9,916,667

Options at Open: 2,994,167

Date Opened: 4 March 2024

What does PFE do?

Pantera Minerals (ASX:PFE) is a micro cap lithium brine exploration and development company which is operating in the Smackover Formation in South West Arkansas, USA.

The Smackover Formation is home to large lithium companies such as Standard Lithium, Albemarle as well as oil giant, Exxon Mobil – which are all investing large amounts of money, seeking to produce lithium from this area.

At the time of writing, PFE controls over 10,000 leased acres directly next door to Exxon’s Arkansas lithium brine project, and is aiming to expand this land holding quickly.

What is the macro theme?

Lithium is a critical material used in Electric Vehicle (EV) battery cathodes.

We believe battery metals are the most compelling investment theme of this decade. A lithium supply deficit is anticipated between 2024-2030.

Lithium rich brines and the complementary technology, Direct Lithium Extraction, are an emerging option for addressing this anticipated supply deficit.

In addition, we think that domestically sourced lithium will be a top priority for the US, in the wake of the US$370BN Inflation Reduction Act which creates strong incentives for critical minerals production.

Our PFE Big Bet:

“PFE develops its Smackover Formation lithium brine assets to a point where it is taken over by a major company (Standard Lithium, Albemarle, Exxon Mobil etc) at a 1,000% premium to its current share price. ”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved – just some of which we list in our PFE Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true

Why do we continue to hold PFE?

- PFE right next door to $643BN Exxon – Exxon reportedly spent >US$100M acquiring its project and just started drilling its first well 6 weeks ago with a view of getting to first production by 2027.

- Surrounded by (much) bigger players – PFE is also in the same neighborhood as $25BN Albermarle, $383M Standard Lithium, $790M Tetra Technologies.

- Nearby Standard Lithium almost producing – DFS for its phase 1A operation completed. Demo plant already produced lithium from ~15 million gallons of smackover brine. Construction to start in 2025, with first production target for 2026.

- Cheap re-entry into historical oil wells – PFE doesn’t have to drill new wells, instead, it can just re-enter old oil and gas wells and extract lithium brines. This is cheaper to do than drilling whole new wells.

- Direct Lithium Extraction (DLE) tech advancing – All over the world, DLE tech is progressing extremely quickly. PFE is in a unique position where it gets to benefit from the work and investment Exxon is doing next door – Exxon is working on DLE technology.

- Supportive local government and regulations – we attended the inaugural Lithium Innovation Summit in Little Rock, Arkansas and saw firsthand how much the state wants to make lithium a key pillar of its economic agenda.

- Federal government incentives – The US government is looking to incentivise critical minerals production inside the US. The $370BN IRA includes incentives that reward producers inside the US/friendly countries.

- Strong on the ground team – we visited the project site and got to know the people helping PFE lease ground in Arkansas – they know the area like the back of their hand. This will be very useful not only for building connections with the local community but also help PFE quickly grow its acreage (and hopefully its eventual lithium resource).

- Arkansas already has a brine processing industry – Arkansas is a globally significant brine processing hub. Arkansas produces ~40% of the world’s bromines by extracting it from brines.

- Small market cap of ~$11M – PFE’s market cap is well below its regional peers & has a lot of room for growth as it delivers catalysts at its project.

- Fast mover into the Smackover – PFE’s ground was picked up BEFORE Exxon Mobil entered the Smackover Formation & put the region on the map as a US lithium hot spot.

- Large JORC exploration target released – PFE’s exploration target is between 436,000 and 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE) – big enough to host a resource the size of its neighbour Standard Lithium’s project.

- We have had previous success with a DLE stock – We built our position in Vulcan Energy Resources in a down lithium market and then at its peak during the lithium bull market had a return from our Initial Entry Price of 5,420%.

- PFE Strategic Advisor previously sold a project to Rio Tinto for US$825M – PFE recently appointed Tim Goldsmith as its strategic advisor. Tim sold the Rincon lithium brine assets to Rio Tinto for US$825M in March 2022.

What do we expect PFE to deliver?

Objective #1: Rapidly increase acreage in Smackover Formation

PFE, is aiming to rapidly grow its footprint in the Smackover Formation. This could make the company attractive to majors in the area or another company looking to gain exposure to the region. To do this PFE will need to continue leasing acreage quickly.

Milestones

✅ 10,000 acres leased

🔲 15,000 acres leased

🔲 20,000 acres leased

🔲 +25,000 acres leased

Objective #2: Convert exploration target into a maiden JORC resource

PFE has already defined a 436,000 to 2,966,000 tonnes of Lithium Carbonate Equivalent (LCE) exploration target. We want to see PFE convert that into a maiden JORC resource estimate.

Milestones

🔲 Release an exploration target

🔲 Acquire existing 2D seismic/geophysical data

🔲 Re-enter old oil and gas wells

🔲 Sample the wells for lithium brines

🔲 Maiden JORC resource estimate

Objective #3: Secure brine samples for further analysis and pilot plant DLE testing

We want to see PFE secure a brine sample to test in a DLE pilot plant to see if the brines on the company’s acreage are amenable to producing lithium (i.e they have a high concentration of lithium and/or low levels of contaminants).

Milestones

🔲 Secure brine sample

🔲 Analyse sample

🔲 DLE pilot plant testing

What could go wrong?

Leasing risk

There is a chance that PFE is not able to lease acreage quick enough or securing further mineral rights in the Smackover Formation proves to be more difficult than expected. This could be due to increased competition from other companies fighting to get a hold of acreage.

Alternatively, the exclusive agreement with the abstract provider expires before enough acreage is leased.

Exploration risk

PFE has said it intends to secure a lithium brine sample on the company’s acreage – there is no guarantee that lithium bearing brines are found or the brines are of economic concentrations.

Alternatively, if brines are found, they could contain contaminants that reduce or eliminate the value of PFE’s brines.

Funding risk

PFE held $1.8M in cash at the end of 2023. PFE is a micro cap stock and will need to raise more capital to continue expanding its foothold in the Smackover Formation. Capital raises can lead to dilution and may take place at a discount to market prices, reducing the value of PFE shares.

Technology risk

PFE is relying on Direct Lithium Extraction (DLE) technology to be proven viable and then being capable of producing lithium from PFE’s brines. There is no guarantee that a DLE tech will be advanced enough to effectively extract lithium from PFE’s brines.

Commodity price risk

Lithium prices have pulled back relatively strongly recently and that is impacting investor interest in small cap lithium companies. There is a chance the lithium price stays low for an extended period of time which would impact PFE’s share price negatively.

Market risk

There is always the possibility that broader market sentiment gets worse and shares as a whole trade lower, taking PFE’s share price with it. Alternatively, there could be further sector specific pain ahead where junior explorers suffer a lot more than the broader market.

Investment Plan

We will apply our standard plan for early stage exploration Investments.

We invest early, hold on to our position in anticipation of a major catalyst and Top Slice/Free Carry ~20% of our position.

For PFE, the major catalyst is likely to be more land acquired or the results of the brine sampling for DLE.

If you have been invested in PFE since its IPO like we have, here is our summary of how PFE performed on its original projects under the IM-1 tab on our PFE Investment Memo page.

[ad_2]

Source link