[ad_1]

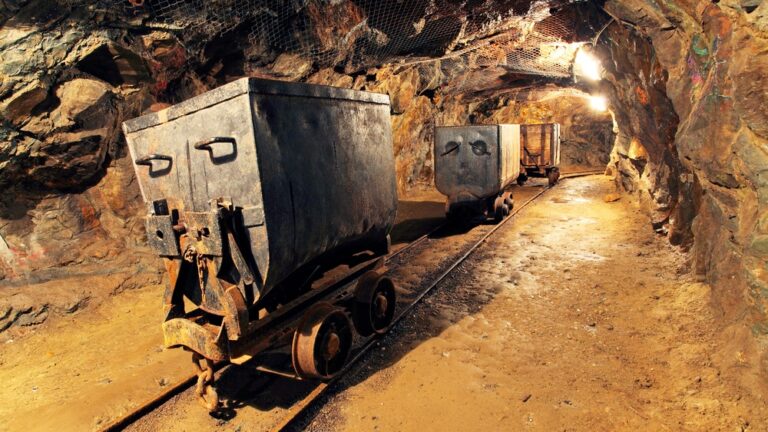

Newmont was already the largest gold producer by a wide margin in 2022. Since then, the company has acquired Australian rival Newcrest in a $15 billion deal to solidify its leadership position in “robust copper options.”

Newmont is so large that its production volume is about twice that of its next closest competitor. barrick gold company (NYSE:Gold).

But recently, shareholders have not been rewarded for the company’s rapid growth, showing a lack of confidence from investors as the company’s stock price hovers near five-year lows.

Do not miss it:

The company’s stock price soared from the pandemic until mid-2022, but has since fallen more than 63% from peak to low.

Some analysts believe that Newcrest’s recent acquisition and integration contributed to its recent disappointing financial performance.

For example, Morningstar points out that “bigger is not necessarily better when it comes to gold mining,” and that Newmont’s large-scale operations across five continents necessarily make it difficult to control costs. He points out that it will be complicated.

Veteran gold watcher John Ng shared a similar sentiment, telling Bloomberg in October that “sometimes with these acquisitions, you’re buying someone else’s problem.”

But Newmont CEO Tom Palmer remains optimistic, saying in a recent interview with Bloomberg that Newmont’s stock is “a good choice for anyone looking to invest a few dollars in gold stocks.” , it’s a once-in-a-generation purchase.”

Trending: The breakthrough startup that coined the term “eBay for gamers” is now open Become a window for investing in future growth.

It’s worth noting that there have been no insider purchases in the last five years, according to insider trading data aggregation provider SecForm4.com. However, Newmont has a $1 billion stock repurchase program as part of its capital allocation strategy and has an annualized base dividend of $1 per share.

Investment bank Jefferies believes in stocks. The company initiated a Buy rating with a price target of $38 per share, a significant premium to the stock’s current trading price of approximately $31 per share.

Jeffries blames Newmont’s stock price decline on hopefully one-off challenges such as mining strikes, project delays and mechanical problems.

Investors seeking exposure to gold without owning mining stocks can purchase gold exchange traded funds (ETFs) such as: SPDR Gold Trust (NYSE:GLD).

In the past year SPDR Gold Trust rose about 11%, significantly outperforming Newmont. Given that Newmont is a price taker in a commodity that appreciates in value, investors are hoping that Jefferies can resolve operational issues to deliver the expected upside.

Read next:

“The Active Investor’s Secret Weapon” Step up your stock market game with the #1 News & Everything else trading tool: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

In this article, a gold miner’s CEO says his company’s stock is a “once-in-a-generation buy” and aims to rebound from a five-year low.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

[ad_2]

Source link