[ad_1]

Important points

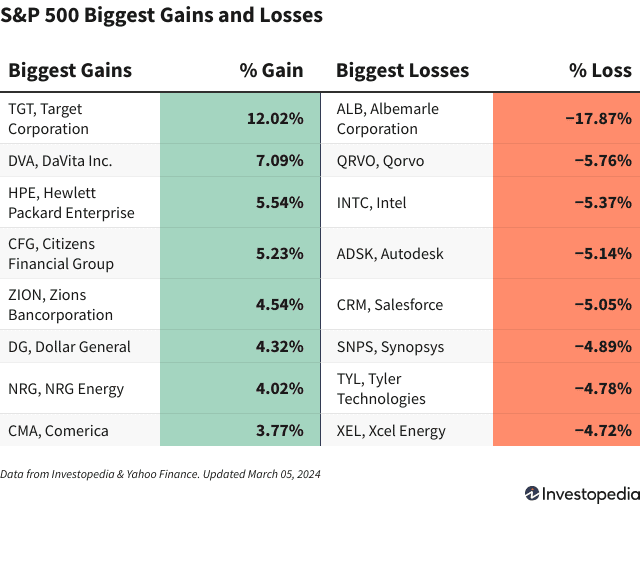

- The S&P 500 index fell 1.0% on Tuesday, March 5, 2024, as uncertainty surrounding interest rate cuts and a downturn in tech stocks weighed on the market.

- Albemarle stock fell after the world’s largest lithium producer announced it would raise capital through an initial public offering.

- Target reported strong results in the important holiday quarter, sending the retailer’s stock soaring.

Major U.S. stock indexes fell on Tuesday as tech stocks slumped.

Apple (AAPL) shares closed 2.8% lower after reports of weak iPhone sales in China, while Telsa (TSLA) shares fell after the company suspended production at a factory near Berlin due to suspicions of arson. As a result, the stock fell by 3.9%.

On this day, the S&P 500 and the Dow Jones Industrial Average fell 1.0%. The Nasdaq fell 1.7% as Apple news and uncertainty over interest rate cuts weighed on the tech sector.

Albemarle (ALB) stock posted the biggest daily loss in the S&P 500 after the world’s largest lithium producer announced it would raise capital through a public offering of $1.75 billion worth of depository shares. It plummeted by 17.9%. Albemarle plans to use the proceeds for capital expenditures, including investments in its Australian and China operations.

Shares of semiconductor company Qorvo (QRVO) fell 5.8% on Tuesday after soaring to a 52-week high earlier in the day. Qorvo expects strong demand in the defense, aerospace, power management, WIFI, smartphone and automotive markets, but weakness in its mobile base station business is constraining revenue growth.

The tech industry’s dark days extended to semiconductor stocks, which have recently soared amid enthusiasm for the impending artificial intelligence (AI) boom. The Philadelphia Semiconductor Index (SOX) fell more than 2%, and industry giant Intel (INTC) stock fell 5.4% on the Dow Jones Industrial Average, the weakest performance of the day.

Target (TGT) stock rose 12.0% after strong results in the important holiday quarter, the strongest daily performance in the S&P 500. In addition to beating revenue estimates, the retailer predicted stronger-than-expected same-store sales growth for the year. The company also plans to open 300 new stores in the U.S. and will launch its Target Circle 360 membership program in April.

Shares of kidney care company DaVita (DVA) rose 7.1 after Novo Nordisk (NVO) revealed that its blockbuster weight loss drug Ozempic had limited effectiveness in reducing the risk of death in patients with chronic kidney disease. %Rose. This news suggests that demand for dialysis machines made by DaVita to treat this condition is likely to continue.

Local bank stocks rose on Tuesday, recovering from losses posted last week after New York Community Bancorp (NYCB) disclosed problems related to its risk assessment protocols. NYCB’s struggles led Fitch and Moody’s to downgrade its credit ratings, but the bank emphasized that deposits remained stable in recent quarters. NYCB stock rose 17.4% on Tuesday, while shares of fellow regional financial companies Citizens Financial (CFG) and Zion (ZION) rose 5.2% and 4.5%, respectively.

[ad_2]

Source link