[ad_1]

SoFi technology (NASDAQ:SOFI) has some good points, but it is by no means a perfect fintech (financial technology) choice. There are potential red flags for SoFi, and the company needs to shift its focus to business segments that are less sensitive to student loan policies and interest rates. Therefore, I’m neutral on SOFI stock in 2024.

SoFi Technologies is a company that offers an interesting alternative to traditional banks. The company generates revenue from lending businesses such as student loan refinancing assistance.

As we’ll go into more detail in a moment, there are specific reasons why SoFi should avoid over-reliance on its lending business and focus on other revenue streams. Failure to do so may result in a long-term loss of value in SOFI stock.

SoFi, student loan debt, and Fed policy

It’s no secret that the Biden administration supports federal student loan debt forgiveness. The administration has taken policy actions to cancel some or all of the debt for many student loan borrowers.

In a recent example, the Biden administration canceled $1.2 billion worth of collective debt for 153,000 student loan borrowers. The point here is not to debate the merits of student loan debt forgiveness policies, but simply to observe that the current administration will likely continue to pursue policies of this type.

This is why SoFi Technologies needs to get out of the lending business sooner or later. An additional factor is that the Federal Reserve may keep interest rates high for a longer period of time than the market expects.

Federal Reserve Chairman Jerome Powell has made it clear that a rate cut in March is “not the most likely or base case.” This could potentially be problematic for lenders like SoFi Technologies, as continued rises in interest rates could hamper lending and borrowing activity.

I 100% agree with Keefe, Bruyette & Woods analyst Michael Perito. He appears to be concerned about SoFi Technologies’ ability to generate revenue from its lending arm.according to BaronsPerito believes that SoFi “will likely find it increasingly difficult to increase market share” in the lending space and “will need to continue to diversify its asset base beyond personal lending.” ing.

With this in mind, Perito gave SOFI stock an “underperform” rating and a $6.50 price target, which suggests some downside from the current share price. Hopefully, SoFi Technologies’ management heeds Perito’s warning and focuses more on the company’s financial services and technology divisions.

New products may cause problems with SoFi technology

SoFi Technologies is down today, down 11% by 11 a.m. ET. Sure, the stock market was mostly in the red, but clearly something disturbing was going on with SoFi Technologies.

It wasn’t hard to figure out what was going on. SoFi Technologies announced in a press release that the company intends to issue convertible notes valued at $750 million due in 2029.

The easiest way to interpret this is to think of senior bonds as corporate bonds. SoFi Technologies is essentially selling his $750 million worth of bonds, but the company could ultimately sell “up to an additional $112.5 million” worth of senior notes, so It’s probably possible to exceed that.

I scoured the press releases multiple times and couldn’t find anything from SoFi Technologies specifying how much interest the company would have to pay on all of these senior bonds. This is a problem because markets hate uncertainty.

Not only will SoFi Technologies definitely have to repay these senior bonds with interest, but it’s troubling that the company feels it needs to borrow so much money. Although it is not immediately thought that SoFi Technologies is in serious financial trouble, it is understandable why the market would choose to sell his SOFI stock today.

At least SoFi Technologies didn’t print and sell large amounts of common stock. It would be even worse because it would dilute the value of existing shares. Still, investors should hope SoFi Technologies doesn’t have a habit of borrowing money through bond sales.

Is SOFI stock a buy?

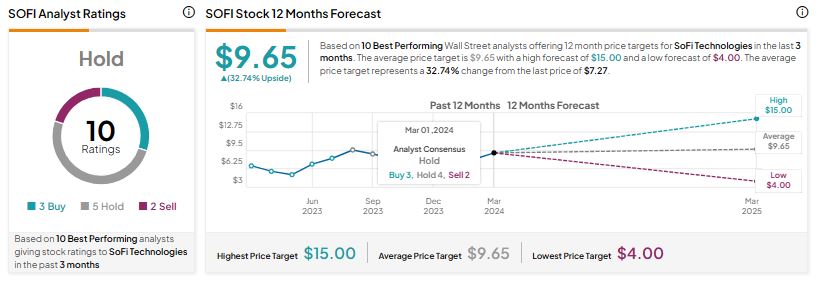

At TipRanks, SOFI is listed as a Hold based on 4 Buy, 8 Hold, and 4 Sell ratings assigned by analysts over the past 3 months. SoFi Technologies’ average price target of $9.65 suggests upside potential of about 33%.

Bottom line: Should you consider SOFI stock?

All in all, this is not a hopeless situation for SoFi Technologies. Going forward, investors will need to insist that SoFi Technologies shift away from the lending business and instead rely on other sources of revenue.

Nevertheless, shareholders may be concerned as SoFi Technologies plans to potentially borrow a very large amount of money through the sale of senior notes. With all this in mind, I remain neutral and am not currently considering SOFI stock.

disclosure

Disclaimer

[ad_2]

Source link