[ad_1]

Quilvest Capital Partners today announced an investment in Acuiti Labs, an SAP consultancy specializing in quote-to-cash process optimization. The amount of funding was not disclosed.

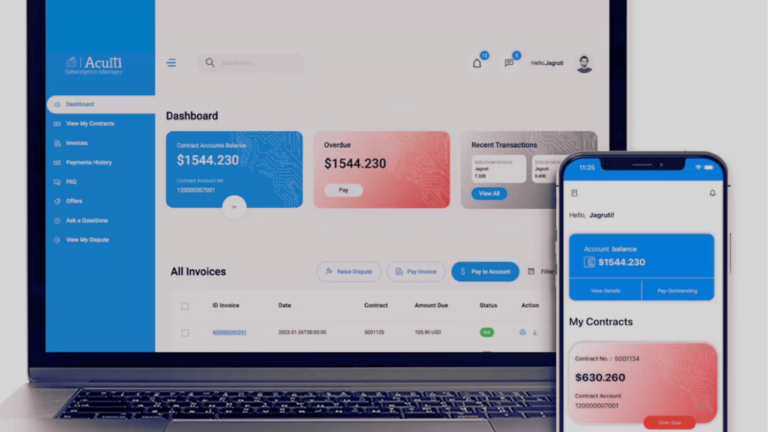

Founded in 2014 by CEO Manoj Harbhajanka and headquartered in London, Acuiti Labs advises large blue-chip companies looking to optimize revenue management and billing processes through SAP Billing and Revenue Innovation Management (BRIM) solutions. Masu.

Acuiti supports subscription and consumption-based target operating models. This is ‘everything as a service’ and covers industries such as public transport, automotive, travel and tourism, ports (airports and seaports), post, telecommunications, media and high-tech.

This helps customers monetize their services, minimize revenue leakage, and enhance financial reporting capabilities.

With a team of 200 people, the company derives 40 percent of its revenue from the US market and 55 percent from Europe and other international regions.

Quivest’s investment supports Acuiti Labs’ continued global expansion strategy, which includes further employee growth and technology investments.

said Manoj Harbhajanka, CEO of Acuiti Labs.

“We are thrilled to have Quivest as our strategic partner, ready to support our next phase of growth.

We look forward to further success by leveraging their expertise and extensive network, combined with Acuiti Labs’ strong positioning and talented management team. ”

said Benjamin Sass, Partner at Quivest Capital Partners.

“Acuiti Labs is at the forefront of a permanent technology shift as companies across industries look to transform and optimize their revenue models.

We are honored that Quilvest Capital Partners has been chosen to partner with Acuiti Labs for its next chapter of growth, and we are proud to have partnered with Acuiti Labs for its next chapter of growth, integrating our international expansion and partnership approach with Acuiti Labs’ unique expertise and proven track record in the SAP BRIM space. We look forward to combining it with success. ”

[ad_2]

Source link