[ad_1]

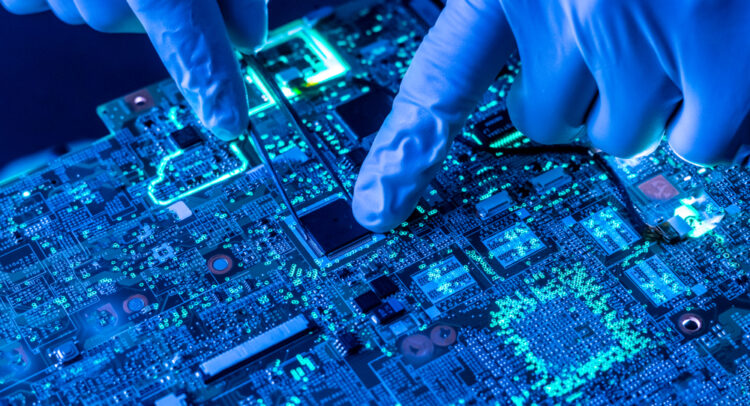

China has set up a megachip fund worth $27 billion. The move is aimed at boosting technological capabilities in the face of increasing U.S. technology regulation.

according to bloomberg, China’s National Integrated Circuit Industry Investment Fund pools resources from the country’s local governments and state-owned enterprises. Notably, this is the third such investment vehicle in the country.

China is the world’s largest semiconductor market. The country is increasingly promoting independence and the use of domestically developed technologies, both in hardware and software. This means government officials are being asked to ditch their iPhones and switch to Chinese-made phones, source hardware from Chinese manufacturers, and even develop Chinese-made operating systems. This has led to top US tech companies losing sales and market share in China year after year. Micron (NASDAQ:MU) Domestic struggles are a good example.

Companies that receive funding from large Chinese funds are seen as having the support of Chinese authorities.Street bloomberg, the first fund holds shares in 74 companies and the second fund holds shares in 48 chip names. Meanwhile, the United States is urging its allies to tighten technology regulations against China.

What are the best Chinese stocks to buy now?

This large investment could boost the fortunes of companies like Huawei. Moreover, China aims to grow GDP by about 5% this year. This ambitious goal, coupled with China’s recent steps to stem the decline in financial markets, could lead to a big rally in Chinese stocks. TipRanks Stock Comparison Tool shows Baidu the highest upside potential of 68.2% among top Chinese companies (Nasdaq: Bidu) over the next 12 months.

Read the full disclosure

[ad_2]

Source link