[ad_1]

top line

The US appears almost certain to avoid a recession, US stock indexes are trading at record levels, and even risky investments like Bitcoin are at all-time highs, but perhaps Gold, the world’s oldest investment, is often seen as a hedge against market losses elsewhere. —Continue to increase value.

important facts

On Friday, gold traded at an all-time high of $2,195 an ounce, up 5% year-to-date and 19% for the 12-month period, and behind the US benchmark S&P 500. It moved in the same direction. The year-to-date and 12-month return is 31%.

Given that the “safe haven” precious metal’s record rally is not consistent with past events that have driven gold’s all-time highs, such as the financial crisis of the late 2000s or COVID-19, gold The rush may come as a surprise to U.S. investors. 19 pandemic.

The main reason for the rise in gold prices is that conditions are not so bright for many markets outside the US. The U.S.’s projected economic growth rate of 2.1% this year is higher than expected growth rates of less than 1% in other developed countries, including Germany, Japan and the United Kingdom. -Meanwhile, stocks listed on major foreign exchanges have significantly underperformed U.S. stocks, with Hong Kong’s Hang Seng index down 18% last year and Britain’s FTSE 100 index down 3%.

Metals Daily CEO Ross Norman said “Western investors are not far behind” on gold’s rise, adding that the potential of the world’s second-largest economy amid a strong commercial real. It attributed this to “tremendous” demand from Chinese investors looking to avoid economic uncertainty. China’s real estate crisis.

Within the United States, there are several other explanations for the rise in gold prices. That’s because some investors are betting on the possibility of worse-than-expected inflation, repositioning their portfolios in the wake of stock market spikes, and looking for ways to protect against geopolitical instability, which can pose problems such as: . In addition to wars between Israel and Hamas and Russia and Ukraine, the November presidential election is looming on investors’ minds.

What to watch out for

Future interest rate cuts will lower yields on U.S. Treasury bonds, making the returns of another typically safer asset class less attractive. Solita Marcelli, chief investment officer at UBS Global Wealth Management, said the past 50 years of big gold purchases by central banks around the world and Republican presidential candidate Donald Trump are increasing tensions between the U.S. and China. He said potential is also a reason to remain bullish on gold. Americas said in a note to clients on Friday.

big number

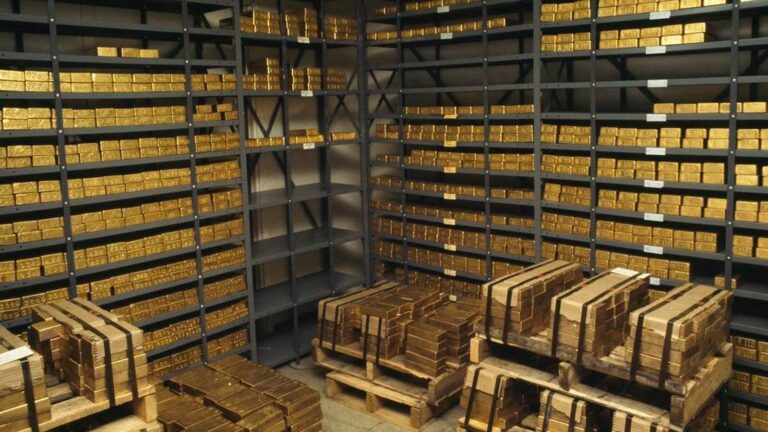

3.3 trillion dollars. According to JPMorgan Chase strategist Nikolaos Panigirtzoglou, this is the amount of gold held by investors. This equates to approximately 1.4% of global investment.

amazing facts

About half of January’s gold shipments went to Hong Kong and mainland China, UBS said.

Main background

Gold’s popularity as an investment traces its centuries-long history of maintaining its value through periods of inflation and conflict around the world. U.S. investors’ confidence in precious metals reached its highest level last year since 2012, with a Gallup poll showing respondents are more confident investing in gold than stocks. Gold’s rise has coincided with a roughly flat US dollar, and the value of the US dollar typically rises when markets are in distress. The DXY, which tracks the dollar’s movement against a basket of major world currencies, is up 1% since the beginning of the year and down 2% from last year. According to FactSet data, gold’s value has increased 394% over the past 20 years, lagging the S&P 500’s 20-year return of 522%, but it still has no chance of returning profits in inorganic materials. Considering this, this is an amazing feat. As with stocks, so do shareholders.

References

follow me twitter Or LinkedIn. Send us a safe tip.

[ad_2]

Source link