[ad_1]

Stock picking has long been considered an art, but smart investors know there’s a lot of science to it. And for those willing to embrace the science, TipRanks has Smart Score, an AI-driven data sorting tool based on sophisticated natural language algorithms.

This tool collects a large amount of data spewed out by the stock market, including trades, stock movements, and trader movements. The results are distilled into a simple, easy-to-read score, a single number on a scale of 1 to 10, giving investors an at-a-glance view of any stock’s likely trajectory. And the “Perfect 10” stocks are clearly worthy of closer scrutiny.

Amazon (NASDAQ:AMZN) and Alibaba (NASDAQ:BABA) currently lead the pace, boasting the highest Smart Scores among large-cap stocks on the “Perfect 10” list. Let’s take a look at what makes these names stand out from the rest.

Amazon

First, let’s talk about Amazon. This is a company that needs little introduction. A survivor of the original dot-com bubble, the company has expanded from its beginnings as an online bookstore to become the world’s largest online retailer of everything, and the world’s fourth-largest publicly traded company in the process. . It has a market capitalization of $1.8 trillion and daily sales of approximately $1.4 billion.

Amazon has complemented its massive scale and near-limitless online retail services with a huge brick-and-mortar infrastructure and fast delivery guarantees. The Company has a worldwide network of warehouses and distribution centers, with some facilities totaling more than 1 million square feet of storage and work space. The company can deliver customer orders worldwide and can offer next-day delivery in many regions. Online retailer Amazon relies on its website, which is one of the most trafficked websites on the Internet, with over 2 billion site visits made each month.

That’s just Amazon’s e-commerce business. While e-commerce is at the company’s core, Amazon is working to expand its reach and diversify its product offerings to ensure it meets customer needs in an ever-changing world. The company offers a popular cloud computing service, AWS, available on a subscription basis, which is a significant source of revenue. Additionally, Amazon offers a wide range of services to its customers, including online games for both children and adults. Home automation; TV streaming; e-books via Kindle reader. The complete list of services includes these and many more, even grocery delivery. The common thread is making online retail and subscription models work in the real world and in people’s daily lives.

What this means for investors is simple. Last quarter, in the fourth quarter of 2023, he reported revenue of $170 billion. This is a nearly 14% increase over the same period last year and exceeded expectations by $3.74 billion. His $1 of EPS, the company’s revenue, came from $10.6 billion in net income. AWS proved to be a key driver of quarterly profits, generating $24.2 billion in revenue, up 13% year over year.

In all of 2023, Amazon brought in $574.8 billion in total revenue. Net income for the year was $30.4 billion, or $2.90 per diluted share. The company boasted free cash flow of $36.8 billion in 2023, compared with $11.6 billion in cash burn the previous year.

For Deutsche Bank analyst Lee Horowitz, the key takeaway here is Amazon’s proven ability to continue generating profit growth on top of its already fast pace. He writes about the company: “Despite outperforming the market by around 60 points last year, Amazon remains one of our top picks for coverage as the operating income growth the company is set to deliver over the next few years is increasingly attractive. …Given our positive outlook on the shape of advertising operating profits over the next few years, we are raising our FY24/25 OI estimates by 10/8% and raising our price target to $210. We continue to believe that his GAAP earnings valuation of Amazon is increasingly compelling…”

Of course, this all adds up to a Buy rating, and the $210 price target indicates nearly 20% one-year upside potential. (Click here to see Horowitz’s track record)

This tech and retail megacap stock has received 41 analyst reviews in recent weeks, all of them positive, with a unanimous consensus rating for the stock as a Strong Buy. It becomes. AMZN’s selling price is $175.35, and its average target price of $208.48 means an upside of almost 19% after one year. (look AMZN stock analysis)

alibaba holdings

Next up is Alibaba, another giant of the online retail world, a company some have dubbed the “Amazon of China.” Founded by Chinese technology entrepreneur and billionaire Jack Ma, the Hangzhou-based company has been in business since his 1999. Alibaba started as a major online retailer focused on China’s domestic market and remains a dominant e-commerce player in the country of 1.4 billion people. people. Although Alibaba has expanded into the global online market, China remains the core of its business.

The fundamentals of the business are solid. Alibaba prides itself on being able to deliver almost any product in China to almost any buyer, to almost any location, and guaranteeing next-day or two-day delivery. In the global e-commerce scene, Alibaba lists approximately 200 million+ products across 5,900 product categories, provided by his 200,000+ suppliers and shipped to more than 200 countries and regions.

In addition to online retailing in China and abroad, Alibaba, like Amazon, has expanded into other areas. The company has branched out into a variety of areas, including cloud services and digital media. However, retail remains the bulk of the company’s business. In fiscal year 2022, the company brought in 67% of its revenue from the Chinese retail segment and an additional 5% from international commerce.

In its last reported quarter, which ended Dec. 31, Alibaba’s total revenue was $36.67 billion, up 5% from a year earlier and beating expectations by $270 million. The e-commerce giant’s non-GAAP earnings came to $2.67 per share, 3 cents more than expected. The company generated free cash flow of $7.96 billion during the quarter. Despite this success, BABA’s stock price has fallen 5% since the beginning of the year, and trading has been somewhat volatile over the past two months.

Despite the share price decline, Trust five-star analyst Youssef Squali remains bullish on BABA stock. He believes Alibaba is well-positioned moving forward, citing four reasons why. “1) Compelling valuation (EV/revolutions 1x, EV/AEBITDA 4.4x), 2) Improved order volume growth on Taobao/Tianmall due to increased focus and investment, 3) Strong FCF generation (FCF yield of 11%) facilitates capital return strategy with larger share buybacks and dividends. 4) Management strengthens competitive offerings for TTG, international and cloud. Prospects for macro recovery. CY24 will be an investment year for BABA, requiring margin restraint in the short term, but we believe much of this is already reflected in current valuations.”

Going further from there, Squali gave BABA stock a Buy rating and set a $114 price target, implying a 55% upside in the stock this year. (Click here to see Squali’s track record)

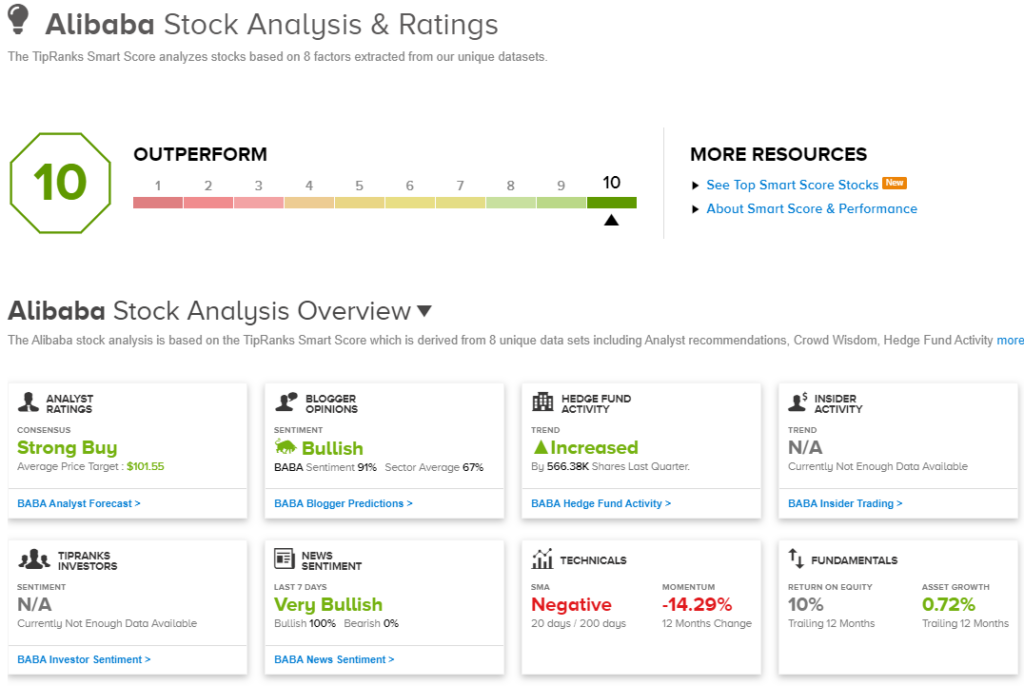

Alibaba stock receives a Strong Buy consensus rating from the Street, based on 18 recent reviews, including 15 Buys and 3 Holds. The current stock price is $73.55, and the average price target of $101.55 suggests a 38% upside potential over the next 12 months. (look Alibaba socks prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link