[ad_1]

The stock market has seen significant fluctuations in recent years, with many peaks and troughs caused by external factors such as the coronavirus pandemic, the resulting economic downturn, and the artificial intelligence (AI) boom. actual, Nasdaq Composite The index plunged 33% in 2022, but rose 43% the following year.

However, recent volatility appears to be subsiding as inflation eases and excitement about technology fuels a market recovery. As a result, now is the perfect time to put a large portion of your portfolio into the expanding technology market and reap the benefits for years to come.

Here, I would like to introduce three stocks that I would buy right away without hesitation.

1. Nvidia

Nvidia (NASDAQ:NVDA) AI has become the gold standard over the past year, and it looks like there’s no stopping it. The company’s stock price has risen 260% since last March, drawing back investors and giving it an estimated 90% share of the AI chip market.

Increased demand for AI services has led to an increase in sales of graphics processing units (GPUs), chips that are essential for training AI models. As a major chip manufacturer, Nvidia has profited hugely from the growing demand for its GPUs.

In its most recent quarter (Q4 2024 ended in January), the company’s revenue increased 265% year-over-year to $22 billion. Meanwhile, operating profit rose 983% to nearly $14 billion. This impressive growth was primarily due to a 409% increase in data center revenue, reflecting a surge in AI GPU sales.

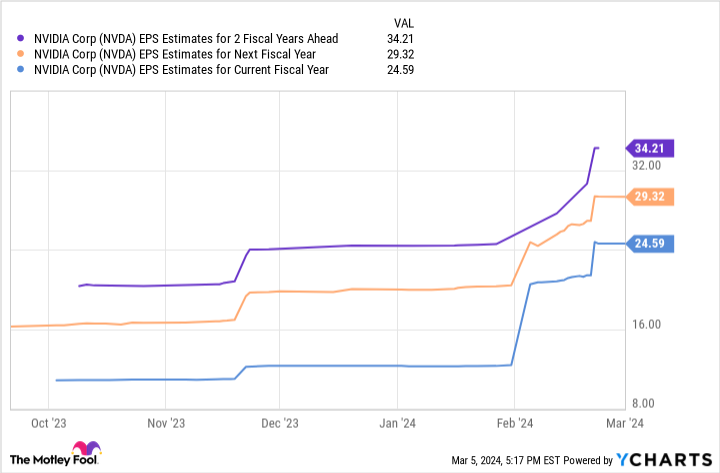

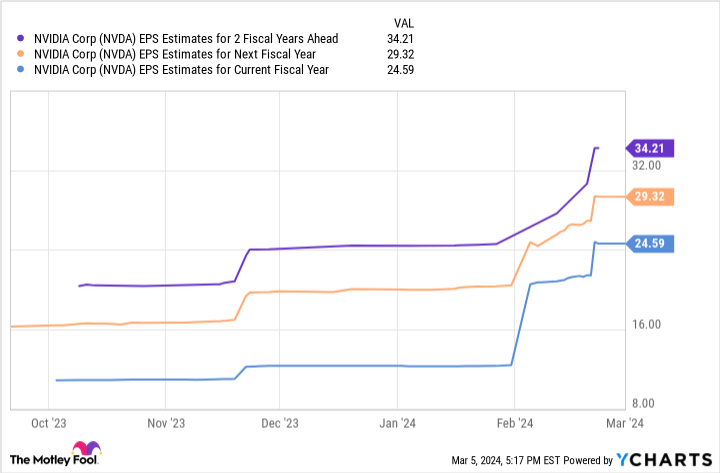

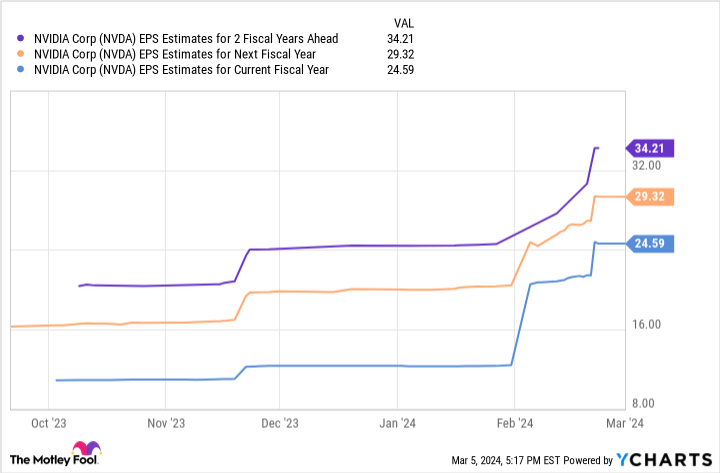

As the AI market evolves, Nvidia has significant potential, and its earnings per share (EPS) estimates reflect this. The graph above shows that Nvidia’s earnings could reach just over $34 per share over the next two fiscal years. Multiply that number by the tech giant’s forward price-to-earnings ratio of 35, and you get a stock price of $1,197.

Looking at the current situation, these forecasts would see Nvidia stock increase 39% by fiscal year 2027, making it a very good buy at the moment.

2. Advanced microdevices

Like Nvidia, Advanced Micro Devices (NASDAQ: AMD) There is much to be gained from the rise of AI.

According to Grand View Research, the AI market is expected to expand at a compound annual growth rate (CAGR) of 37% through at least 2030. Its strong growth potential suggests that Nvidia can maintain its dominance despite new entrants like AMD.

AMD fell a little behind the AI party. But the company is making moves to acquire a slice of the $200 billion industry, which could lead to big gains in the long run.

Last December, the company announced its new MI300X AI GPU. The chip is designed to compete directly with his Nvidia products and has already attracted the attention and contracts of some of the most prominent players in the tech world. microsoft and meta platform as a client.

Additionally, AMD is looking to lead its own space in the AI space by focusing on developing AI-powered PCs. The sector is expected to see significant growth this year, with AI integration acting as a key catalyst.

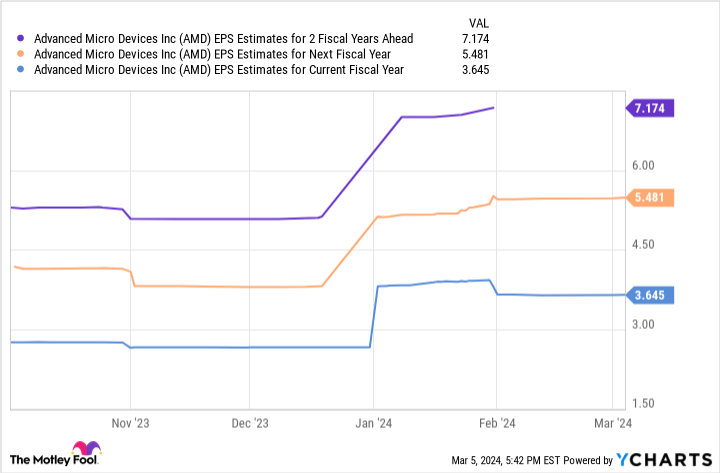

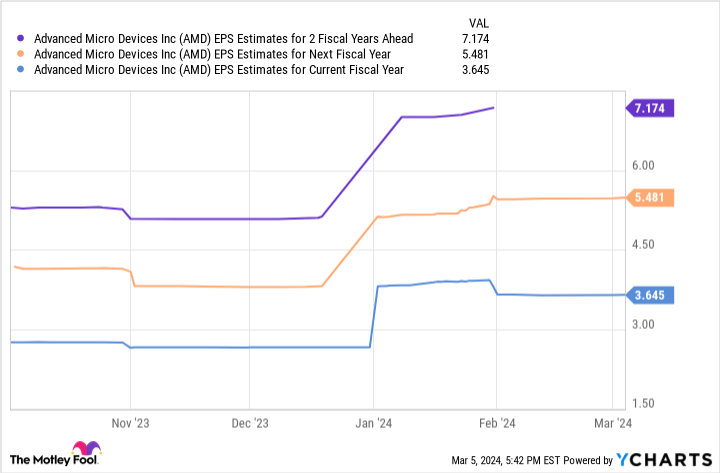

The table above shows that AMD’s earnings could reach up to $7 per share over the next two fiscal years. Using similar calculations for Nvidia, multiplying this number by AMD’s expected P/E of 58 results in a stock price of $403, and the company’s stock is projected to nearly double within his two years.

3. Amazon

Amazon (NASDAQ:AMZN) has come a long way since its beginnings as an online book retailer nearly 30 years ago. The company has expanded into multiple industries, from becoming an e-commerce giant to leading the cloud market, developing space satellites, and expanding into groceries, gaming, consumer technology, and more.

Amazon dominates e-commerce in dozens of countries, and the market is expected to reach $3.6 trillion in 2024 and grow at a CAGR of 10% until 2028. The company will continue to benefit from tailwinds in this sector.

But Amazon’s biggest growth driver is undoubtedly its cloud platform, Amazon Web Services (AWS). In the fourth quarter of 2023, revenue from the platform increased by 13% year-on-year to his $24 billion. Meanwhile, AWS accounted for his 54% of the company’s operating profit, despite having the lowest revenue of his three segments.

Additionally, AWS gives Amazon a favorable role in the AI space. As the world’s largest cloud service, AWS has the potential to leverage its massive cloud data centers and lead the generative AI market.

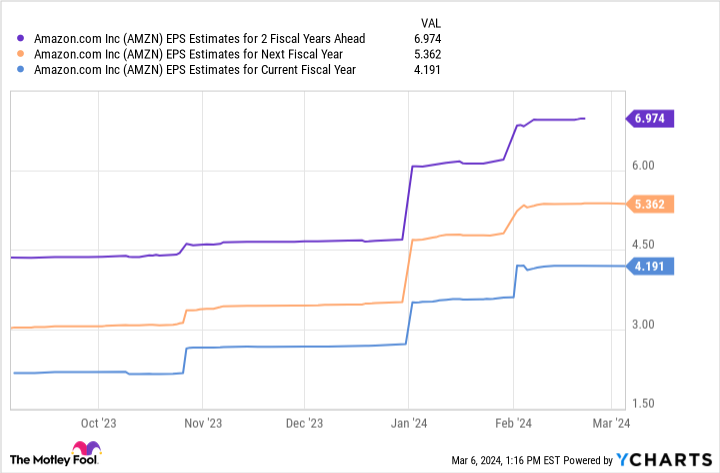

Similar to Nvidia and AMD, EPS estimates show great potential for Amazon stock. This table shows that this e-commerce giant’s earnings will reach nearly $7 per share by his 2026 fiscal year. Multiplying this by Amazon’s forward P/E ratio of 42 yields a stock price of $294.

From its current position, Amazon’s stock price would rise 68% over the next two fiscal years. With its dominant position in e-commerce and cloud computing, Amazon is a natural buy this March.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 8, 2024

Randi Zuckerberg is a former head of market development and spokesperson at Facebook, sister of Meta Platforms CEO Mark Zuckerberg, and a member of the Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Dani Cook has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, and his Nvidia. The Motley Fool recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

“3 Easy Stocks to Buy Now, Don’t Hesitate” was originally published by The Motley Fool.

[ad_2]

Source link