[ad_1]

I haven’t written about index funds in a long time because, to be honest, I don’t have anything else to say about them. Not only is this topic thoroughly analyzed, but I believe there are far more important items when it comes to investing that will determine whether you can achieve your financial goals. It’s like checking your spending and saving. They are where they are supposed to be. It’s like staying invested for the long term when things are really scary. It’s like choosing the right asset allocation. And instead of chasing the latest shiny object, it’s like chasing a herd that ends up over a cliff.

S&P just released its 2023 SPIVA report last week, which shows how stock and bond funds have performed compared to their benchmarks, so I’m adding to the already large pile of index fund articles. Masu. In both the short and long term, the numbers speak for themselves. The lesson this year is the same almost every year. This means that index funds should remain the preferred investment choice for most investors.

Before I get into it, I want to say that while I’m a big supporter of index funds, I’m not a huge believer. While I recognize their benefits and leverage them for my clients and myself, I also believe there are other strategies you can implement to achieve your financial goals, some of which are: we are hiring.

Twenty years ago, there were 2,337 domestic stock investment trusts in the database. Only 34% of his works still exist today. In other words, 66% don’t.

We all know that it is very difficult to outperform the stock market by picking individual stocks over the long term. We all know it’s very difficult to find managers who can do that. And we all know that continuing to work with such a manager in the long term can be the most difficult thing.

Index funds aren’t perfect, but you know exactly what you’re getting. Index return net of fees.

I have to point out that last year was a very difficult time for stock pickers, especially those benchmarked to the S&P 500. Over the past 12 months, he has outperformed the S&P 500 with fewer stocks than at almost any point since 1990. If they aren’t the same weight, they won’t be able to outperform this amazing seven of him.

Index funds are one of the greatest innovations in finance and have created trillions of dollars of wealth for consumers, but it’s natural to think that index funds create strange dynamics in the market. This is an incredibly sensitive topic and is not very black and white. He points out one point that contradicts the previous point, so you can see it right away. I should also note that others have been working on this issue for a while, most notably Mike Green.

This week I shared a shocking data point on The Compound and Friends. Over the past six sessions, Nvidia has increased its market cap by an average of $61 billion, for a total of $366 billion. Josh asked, “Who just bought NVIDIA for cash?” The stupidest son of a bitch on Wall Street? ”

My answer was, “You’re kidding, it’s an index fund. It’s us.” I was kind of joking, but I was also kind of serious.

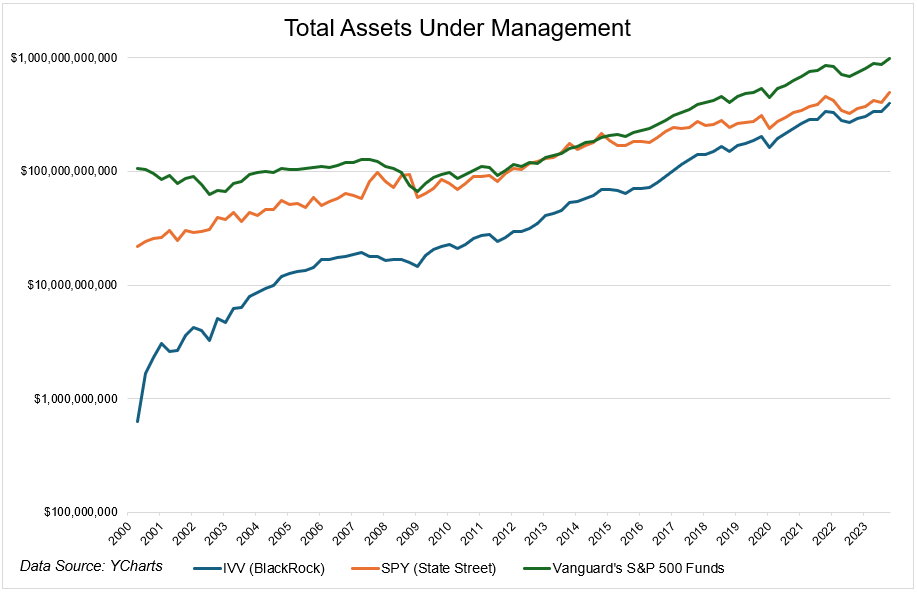

Nvidia makes up 5.3% of the S&P 500. His S&P 500 fund from Vanguard*, an S&P 500 tracking ETF from BlackRock and State Street, has total assets of $2 trillion*. That’s the large weighting of the Nasdaq 100, not to mention the trillions of dollars in other funds that track the index, as well as every dollar allocated to target-date funds that hold trillions of dollars in assets as well. And money is flowing into these things relentlessly.

So are index funds the only reason Nvidia is going vertical? Unlikely. I remember watching a speech by Charlie Ellis talking about who sets prices. While it’s true that index funds capture a large portion of the money, they only make a fraction of the total trades on any given day. The active manager sets the price and the index fund receives it. generally. I say primarily as a hedge for Grand Rapids because I think it probably has a bigger impact on the price of certain stocks than others.

One area that is absolutely impacted by index funds is which stocks are added to the basket. Let’s take super microcomputers as a typical example. This stock price, along with all the semiconductor names, had been rising wildly throughout the year. The stock has risen 300% in the past six months, topping the Russell 2000’s largest holdings by a mile. Last week, the company announced it would be added to the S&P 500 index, comically leapfrogging the mid-cap index into the big leagues.

The stock price rose 19% that day, and it now owns $64 billion worth of shares. I don’t know how much of this is due to index inclusion, but a sophisticated trader probably would have suspected this announcement was coming, so it’s probably more than 19%.

The following graph shows that technology is dominating the sector’s capital flows in interesting ways, and for good reason. These are the most dominant businesses on the planet. They invent billion dollar items, hundred billion dollar categories, and trillion dollar industries. And it does so with higher, more stable and more protected profit margins than any other sector in the world. And naturally, their stocks are rewarded for all this. And, of course, investors will flock in to drive up prices, perhaps someday sewing the seeds of their own demise. Let’s take a look.

Many of these flows are from indexes that track sectors, but I don’t think they fall into the category of “index funds distorting the market.” Reasonable people can argue with that statement.

Do index funds move mega-cap stocks? I don’t know, maybe? But if they are the only thing driving the epic 7, and I know no one would go that far, how do you explain the recent price movement of Apple, your second largest holding? Is it okay? It’s trading like crap because the news flow isn’t good. It’s not a coming-of-age story either. Tesla is another one. Stocks are down 29% since the beginning of the year, but the index is at a new all-time high.

Now, here’s the problem. so what? I don’t mean to trivialize a legitimately important topic, but what is the “and” here? Index funds are doing strange things to the market, so should people buy active mutual funds? mosquito? Should the government ban index funds because they are doing strange things to the market?

I think it’s pretty hard to argue that index funds don’t impact certain parts of the market. I also think it’s pretty hard to argue that the negatives outweigh the positives.

Index funds are surprisingly simple. This topic is anything but.

*Vanguard numbers include multiple stock classes including mutual funds, ETFs, and VOO

[ad_2]

Source link