[ad_1]

-

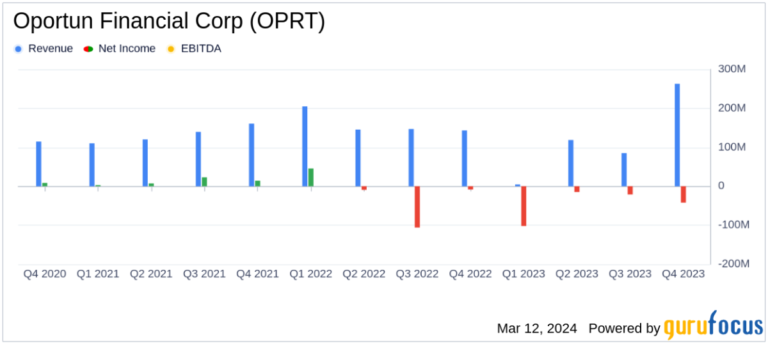

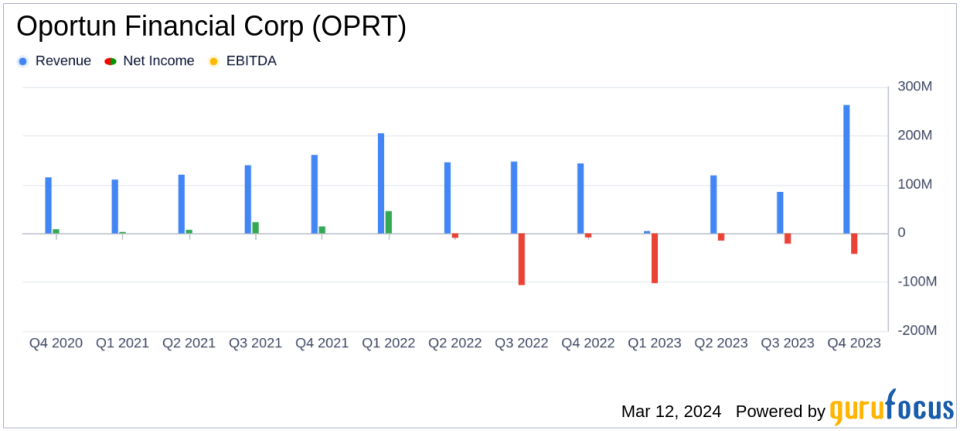

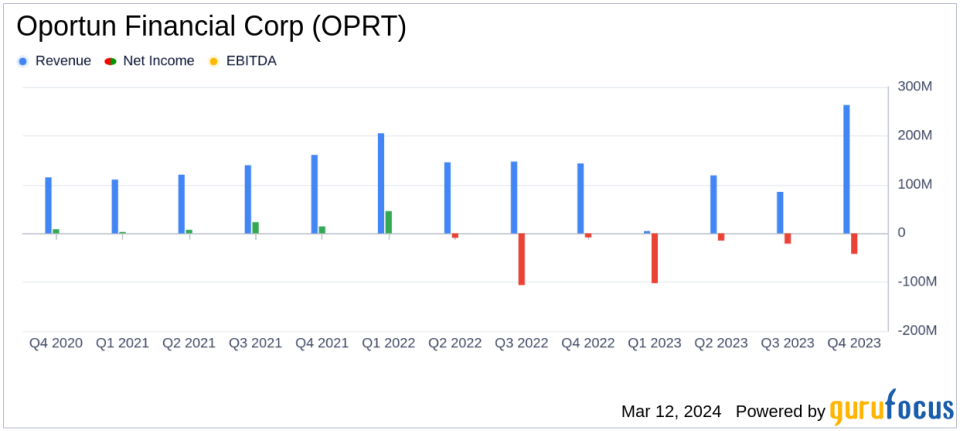

revenue: OPRT reported total revenue of $1.1 billion for fiscal year 2023, an 11% increase year-over-year.

-

Net income (loss): The company posted a net loss of $180 million in FY23, compared to a net loss of $78 million in FY22.

-

Adjusted EBITDA: Adjusted EBITDA for FY23 was $1.7 million, an improvement from -$10 million in FY22.

-

Operating expenses: Operating expenses were reduced by 15% year-over-year in the quarter, with an additional $30 million in operating expense reductions announced for FY24.

-

debt indicators: OPRT’s debt-to-equity ratio increased to 7.2 times as of December 31, 2023 from 5.3 times the previous year.

-

Portfolio performance: The company’s portfolio yield increased, but annualized net charge-off rates and 30+ day delinquency rates showed mixed results.

-

guidance: OPRT’s FY24 guidance reflects expectations for significant improvement in profitability on an adjusted basis.

On March 12, 2024, Oportun Financial Corp (NASDAQ:OPRT) released its 8-K report detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company specializes in providing financial services to underserved populations. Consumer reported that its total revenue for the year was $1.1 billion, an 11% increase over the previous year. Despite this growth, OPRT faced a net loss of $180 million for the year, a significant decrease from his $78 million net loss the previous year.

Company Profile

Oportun Financial Corp is a mission-driven fintech company that offers a wide range of financial products, including personal and auto loans, to consumers who may lack a substantial credit history. OPRT is focused on responsible lending and has provided more than $17.8 billion in credit since its founding, helping members save on interest and fees.

Financial performance and challenges

While OPRT’s revenue growth is a positive indicator, its net loss highlights ongoing challenges. Net loss increased significantly in 2023 primarily due to non-cash fair value mark-to-market adjustments, higher amortization and higher interest expense. These challenges highlight the importance of credit quality and cost management strategies, which are critical to OPRT’s long-term financial stability.

Financial performance and industry importance

The company’s ability to grow revenue even in a challenging economic environment is noteworthy, especially in the highly competitive credit services industry. OPRT’s focus on operating efficiency is evidenced by quarterly operating expense reductions and the completion of his $200 million asset-backed securitization transaction at favorable pricing, improving financial condition and the market. It shows the company’s efforts to improve its competitiveness.

Key financial indicators

OPRT’s income statement and balance sheet reflect a company in transition as it seeks to optimize its cost structure and improve its lending practices. Key metrics such as portfolio yield, which increased to 32.7% in the fourth quarter, and principal balance under management, which decreased 7% year-over-year to $3.2 billion, demonstrate the company’s strategic focus on quality over quantity. It shows that. The origin of the loan. In addition, adjusted operating efficiency also improved, reflecting the company’s revenue growth outpacing operating expenses.

Management commentary

“We performed well in the fourth quarter and achieved our respective guidance,” said Oportun CEO Raul Vázquez. “Our sales remain strong and we expect to achieve 11% year-over-year growth in full-year 2023 with record total revenues of $1.1 billion, while continuing to focus on quality, not quantity, of originality amid tight credit conditions. I did. Attitude.”

Analyzing OPRT performance

OPRT’s performance has been mixed, reflecting a company with good revenue growth but still struggling with costs related to lending operations and market conditions. The company’s strategic decision to tighten credit and reduce operating expenses is a step toward addressing these challenges and improving profitability. The 2024 guidance anticipates a significant improvement in profitability, suggesting management is confident in the effectiveness of these strategies.

For a more detailed analysis of Oportun Financial Corp.’s financial results and future prospects, investors and interested parties should refer to the complete earnings presentation and reconciliation of non-GAAP financial measures available on the Investor Relations page of Oportun’s website. We recommend that you check.

For more information, see Oportun Financial Corp’s full 8-K earnings release here.

This article first appeared on GuruFocus.

[ad_2]

Source link