[ad_1]

This is a famous Wall Street adage and will always be relevant. “Buy fear and sell greed.” Considering recent price trends, SoFi Technologies (NASDAQ:SOFI) There seems to be a lot of anxiety as the stock price (down 26% since the beginning of the year) has fallen.

But looking at SOFI’s current situation, Trust’s Andrew Jeffrey, a 5-star analyst ranked in the top 2% of Street stock professionals, isn’t worried. He recommends the old games mentioned above.

“We see opportunity in the fear of others,” Jeffrey says. “In our view, the discussion around SOFI is centered around the potential for credit and capitalization readings. We believe that SoFi remains well capitalized and that recent convert tx It claims to provide a 200 bp buffer.”

Mr. Jeffrey’s discussions with investors have revolved around evaluating the validity of SoFi’s lifetime loan loss estimates. Analysts believe this is a “point of high leverage,” particularly due to the company’s held-for-sale accounting method, which marks loan portfolios quarterly. As of Q4 2023, SoFi’s assumptions include an annual amortization rate of 4.8%, which translates to an interest rate of approximately 7.2% over the life of the loan. This represents a 20 basis point increase over the previous year and indicates a “credit normalization” trend.

Jeffrey believes the bears are skeptical that SOFI will remain in the 7% to 8% life-of-loan loss range. “Until or unless management has visibility into the performance of static pools, it is nearly impossible to prove either side of this argument, but our conversations with SoFi indicate that loans are performing as expected. It gives us confidence that it’s moving forward,” Jeffrey said of the issue.

Jeffrey also claims that SOFI’s data-driven underwriting approach and advanced algorithms set it apart from other personal loan (PL) providers. In contrast to its competitors, SOFI benefits from extensive banking partnerships and access to vast amounts of data from its Relay aggregation product. Additionally, Jeffrey emphasizes that lower interest rates are likely to provide a buffer against a slight increase in amortization rates, given that interest rates are a key factor in loan valuation.

“Regardless,” the five-star analyst continued, “investors will gain insight on credit in the coming months as loan growth slows and the recent vintage season arrives.” said.

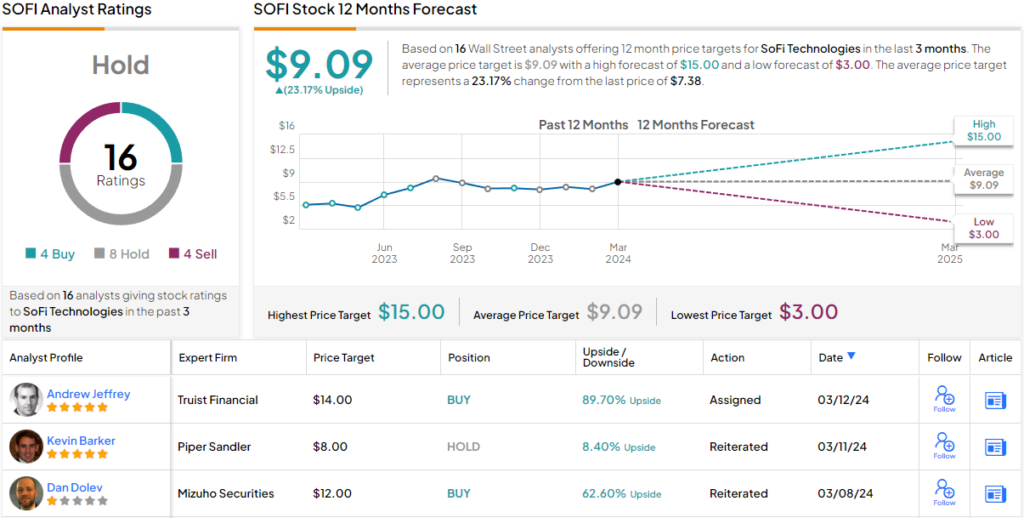

Overall, Jeffrey rates SoFi stock a Buy, but his $14 price target suggests the stock is on track for ~90% return over the next year. Masu. (Click here to see Jeffrey’s track record)

Three other analysts among Jeffrey’s colleagues are also positive, but with 8 Holds and 4 Sells, the stock asserts a Hold (i.e. Neutral) consensus rating. The average price target is $9.09, implying a 23% upside over 12 months. (look SoFi stock price prediction)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, the tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. Content is for informational purposes only. It is very important to perform your own analysis before making any investment.

[ad_2]

Source link