[ad_1]

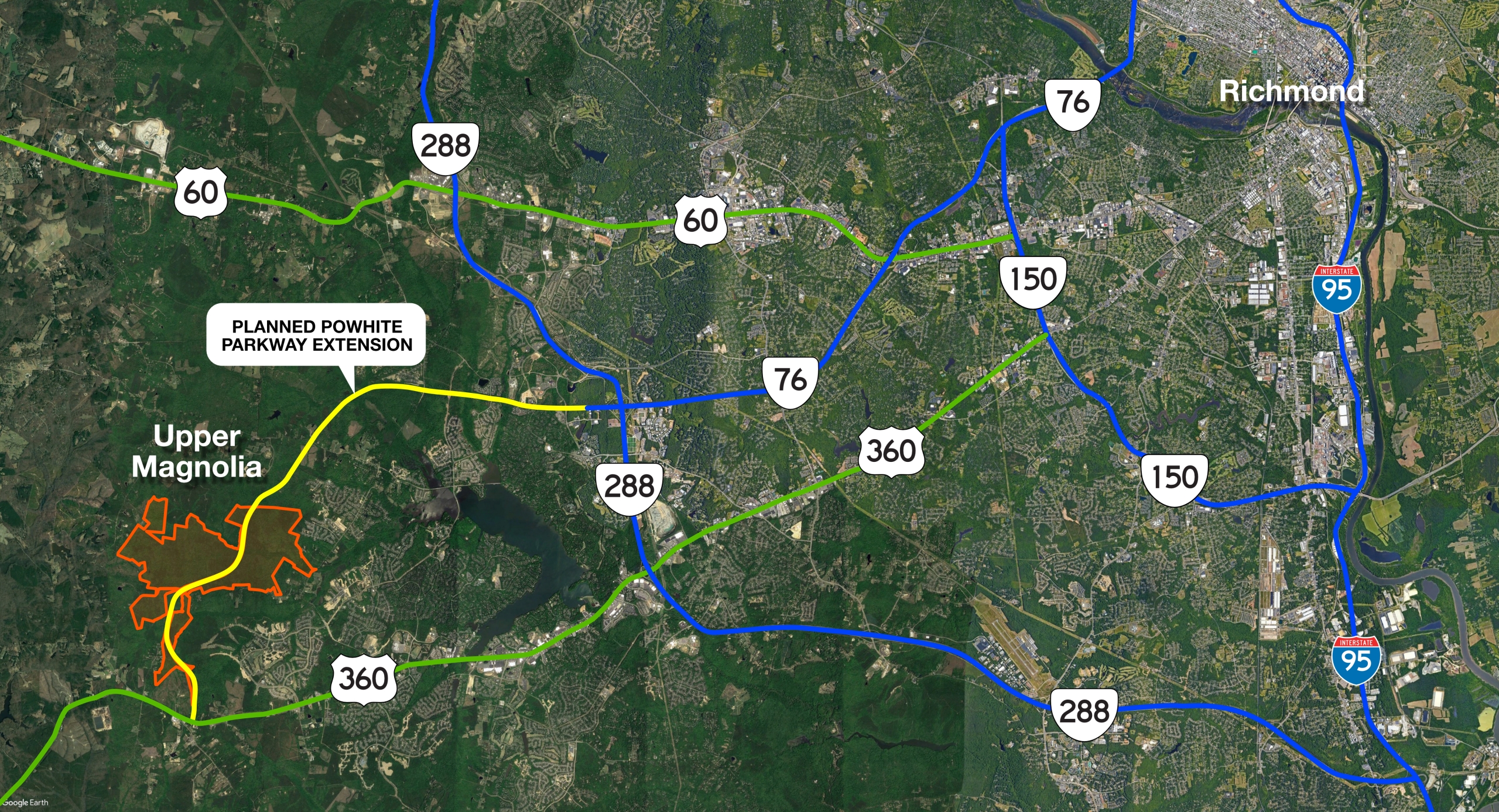

Chesterfield County’s proposed $2 billion budget includes a 1-cent reduction in real estate tax rates and funding for the planned Pawwhite Parkway expansion. (BizSense file)

Chesterfield County officials announced a proposed $2 billion 2025 budget that would allocate funding for the Powhite Parkway expansion and reduce the county’s real estate tax rate by 1 cent.

The pending budget includes a $300 million package of bond-driven road projects, about half of which will be spent on construction extending Powhite from its current terminus near the interchange with Route 288 to Woolridge Road. The money will be used for the first phase.

The city of Chesterfield intends to issue bonds to fund road projects and is considering repaying the bonds over time with county tax revenue from the Central Virginia Transportation Authority, a statement Wednesday morning said. officials said at a budget press conference.

CVTA was created in 2020 and uses sales and fuel tax revenue to fund transportation projects, half of which is donated to local governments in the region each year. The county expects to receive $30 million from CVTA in fiscal year 2025.

“In FY25, we will add a significant infusion of $250 million from the ability to utilize 50 percent of the local share of CVTA revenues to support the largest infrastructure bond ever issued in Chesterfield. CVTA was designed to accomplish great things locally and regionally,” said Chesterfield County Executive Joe Casey.

Eventually, Chesterfield officials hope the parkway will be extended to Hull Street Road.

The plan to fund the first phase of the Powhite Parkway expansion was added to the county’s five-year Capital Improvement Plan as part of the current budget. The current consideration is to put in the money that is actually needed, rather than waiting for it as part of a long-term capital plan.

Other projects that could be funded by the 2025 Transportation Initiative include improvements to the Route 150 and US 60 interchanges and the Center Point Parkway and Courthouse Road extension project.

The yellow line shows the general anticipated route of the proposed Powhite Parkway expansion.

A reduction in the county’s real estate tax rate is also proposed as part of the 2025 budget. The proposed budget would reduce the real estate tax rate by 1 cent per $100 of assessed value, to 90 cents.

Despite the decline, property tax revenues are projected to increase due to higher property valuations due to rising prices in the housing market. The county expects property tax revenue to be $560.2 million, an increase of nearly 9% compared to the $514.9 million in property tax revenue expected during fiscal year 2024, which is still underway. It is something to do.

Chesterfield’s Business Professional and Occupational License (BPOL) tax deduction is proposed to remain unchanged at $500,000 in gross income. Businesses with gross receipts below this threshold, which the county has increased in recent years, will be exempt from the tax.

Although the county feels it has found a “sweet spot” for BPOL at this point, officials may revisit BPOL rates as part of fiscal year 2026 budgeting, Deputy County Commissioner Matt Harris said.

The City of Chesterfield is planning to raise utility rates. Water rates will increase from $2.43 to $2.58 per 100 cubic feet, and sewer rates will increase from $2.56 to $2.71 per 100 cubic feet.

Unlike recent annual budgets, the proposed spending plan for next fiscal year does not include any major payroll compensation efforts for county employees. Rather, it primarily builds on efforts already underway.

The city of Chesterfield plans to fully fund a 10% pay increase for public safety employees that will take effect on January 1 of this year, as well as a 4% merit pay increase for county government employees.

Chesterfield’s proposed raise would bring the starting pay for county police officers and firefighters to $56,107.

A 4% pay raise is being proposed for county public school teachers. Under the proposal, starting salaries for teachers would be $53,978. Almost half of the proposed overall budget is allocated to the school sector.

The city of Chesterfield has budgeted for 85 new full-time jobs in its proposal. County government currently has approximately 4,100 full-time employees.

The $2 billion budget would represent a $100 million increase compared to the fiscal year 2024 budget.

The county’s general fund, the county’s primary operating fund, will be $998.4 million in the 2025 budget, an increase of $46.7 million compared to the current fiscal year.

The Board of Supervisors is scheduled to consider adopting a county budget in April. Fiscal year 2025 begins on July 1st.

[ad_2]

Source link