[ad_1]

For about 60 years, berkshire hathaway (NYSE: BRK.A)(NYSE: BRK.B) CEO Warren Buffett is the leading index on Wall Street. S&P500. Since taking over as CEO, the “Oracle of Omaha” has earned a total return of 4,927,141% on his company’s Class A stock as of the closing bell on March 8, 2024. This is compared to the total return including dividends. It paid out about 33,500% of his S&P 500 over the same period.

Riding on Warren Buffett’s backing has been a money-making strategy for decades, but thanks to Form 13F filings with the Securities and Exchange Commission, it’s even easier. The 13F provides a snapshot of what Wall Street’s smartest and most successful investors are buying and selling and is required to be filed quarterly by asset managers overseeing at least $100 million in assets under management. ing.

While most investors are intrigued by what the Oracle of Omaha and its investment aides, Ted Weschler and Todd Combs, are buying, it is unclear why Buffett and his team It can be equally insightful to understand which stocks are selling.

Based on Berkshire’s latest 13F, Warren Buffett and his team are selling 7 stocks.

1. Paramount Global: Sold 30,408,484 shares (63,322,491 shares remaining)

The first big stocks at stake in the quarter ended December were media companies. paramount global (NASDAQ:Para). Buffett’s company cut nearly a third of its position of more than 93 million shares.

The impetus for selling more than 30 million shares appears to be Paramount’s unfavorable balance sheet. Specifically, as of the end of 2023, the company had approximately $14.6 billion in long-term debt, compared to just $2.46 billion in cash and cash equivalents. As the cord-cutting continues and Paramount’s streaming division remains in the red, investors (including Buffett) are starting to lose patience.

The flip side of the coin is that Paramount’s streaming division is losing money because higher subscription prices are being passed on to users. Additionally, traditional media companies tend to enjoy a rebound in ad spending during major election years. Paramount Global clearly has concerns to address, but the situation may not be as dire as its weak stock price suggests.

2. HP: Sold 79,666,320 shares (remaining 22,852,715 shares)

Another well-known company that significantly reduced Berkshire Hathaway’s investment portfolio in the fourth quarter is a provider of personal computing and printing services. HP (NYSE: HPQ). Buffett and his aides have sold nearly 78% of their Berkshire stock compared to September 30, 2023.

This sales activity may be related to the slump in sales of personal computers (PCs). PC sales spiked during the early stages of the COVID-19 pandemic, but have recovered meaningfully as most employees returned to the office. With no sales growth expected this year, HP’s 3.6% dividend yield isn’t enough to attract the attention of Buffett and his team.

HP also seems like a good example of what Buffett would like to avoid: a fair company at a great price. You can buy HP stock at just 8 times forward earnings, but the company’s growth days are long gone. Currently, HP relies on relatively low-margin products and printing services, and lacks the breakthroughs Berkshire’s brightest minds desire.

3. Apple: Sold 10,000,382 shares (905,560,000 shares remaining)

Perhaps the most surprising selling activity during the fourth quarter was the roughly 10 million shares that Mr. Buffett and his investment “lieutenants” pulled out of tech stocks. apple (NASDAQ:AAPL). Keep in mind that selling 10 million shares only reduced the stake of Berkshire’s top holdings by 1.1%.

Maybe the Oracle of Omaha hasn’t changed his mind about what he once called a “better business than any we own.” Apple has led physical product innovation for more than a decade, and now the company is also focusing on high-margin subscription services. What’s more, Apple has repurchased $650.9 billion of its common stock since the beginning of 2013, the most of any publicly traded company.

The most logical reason for Buffett and his investment team to write down their stake in Apple is to offset realized investment losses from Paramount Global and HP. Buffett’s company has an estimated $119 billion in unrealized gains on Apple stock.

4. Markel Group: Sold 158,715 shares (sold all positions)

Insurance and investment companies were among the popular stocks that benefited greatly from Berkshire’s investment portfolio in the quarter ended December. markel group (New York Stock Exchange: MKL), has been called a kind of “mini-Berkshire” because of its investing habits. Buffett and his team have exited all Markel positions held continuously since the first quarter of 2022.

There are two guesses as to why Markel put herself on the chopping block. The most likely answer is ratings. Since 2015, Markel Group has traded at less than 120% of book value only a handful of times. One of those examples was in the first quarter of 2022. With Markel’s premium to book value approaching 50% just before the start of October 2023, the luster of getting a “deal” may have faded.

Another possibility is that Weschler or Combs, rather than Buffett, fire Markel. Mr. Buffett’s investment aides were far more active in trading than he was, and the position ultimately lasted less than two years.

5. StoneCo: Sold 10,695,448 shares (sold all positions)

Fintech company specializing in Brazil stone co (NASDAQ:STNE)It was held in Berkshire’s portfolio for five years, but was also shown the door during the fourth quarter.

Buffett and his team’s motivation for parting ways with StoneCo likely had to do with the company’s debt challenges. Brazil’s central bank has raised interest rates to a maximum of 13.75% in 2022 in a bid to curb domestic inflation. Unfortunately, StoneCo’s loan division was supported by debt, which led to high repair costs. Although management is addressing these issues, StoneCo remains something of a work in progress.

StoneCo, on the other hand, knows more than just payments in the Brazilian economy. We provide banking and credit solutions and software to small and medium-sized businesses. Although adoption of add-on services is increasing, StoneCo has only penetrated a small portion of the Brazilian fintech market.

6. Sold 831,014 shares of Globe Life (sold all positions)

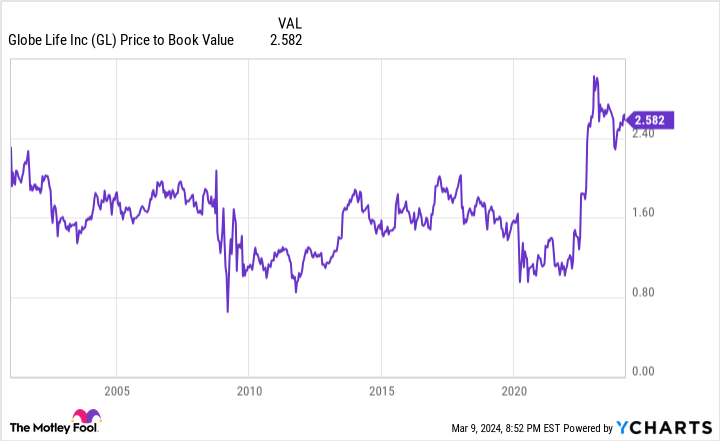

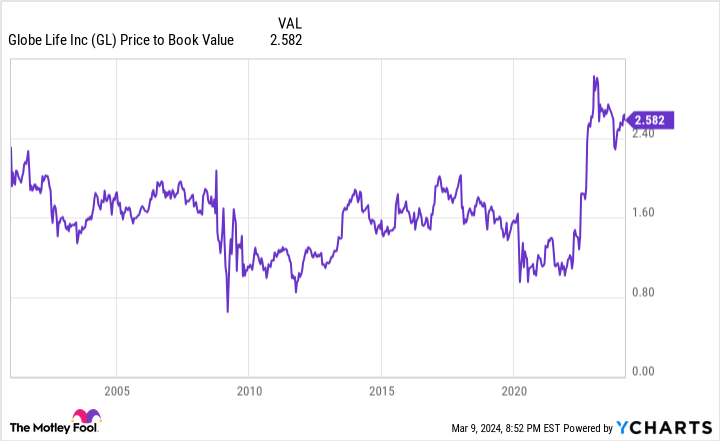

The sixth stock that Buffett and his team sold in the quarter that ended in December was a long-term holding. globe life (NYSE:GL). Globelife, a life and supplemental health insurance company, continued to hold Berkshire Hathaway’s investment portfolio for more than 20 years prior to its departure.

Valuation seems to be the most logical reason for Buffett & Company’s decision to sell. The company’s stock price more than doubled in the wake of the coronavirus pandemic (COVID-19) in March 2020, and the price-to-book ratio reached nearly 300% in the fourth quarter. In the 22 years that Berkshire has owned Globe Life stock, its book value has never been above 200%, much less near 300%.

Buffett and his team are also known for focusing their Berkshire investments on their best ideas. Globe Life never met the definition of core holdings, which ultimately determined its fate.

7. DR Horton: Sold 5,969,714 shares (sold all positions)

Last but not least, Oracle of Omaha and his team launch a home builder DR Horton (NYSE:DHI) From Berkshire’s investment portfolio during the quarter ending December.

This is one of the biggest problems given that DR Horton’s shares were only acquired during the quarter ending June. Warren Buffett is a big believer in holding onto great businesses for the long term, so the purchase and subsequent sale of DR Horton was the mastermind behind this relatively quick transaction, with Ted Weschler and Todd Combs. This suggests that

History may also have played a role in the fire sale of DR Horton stock. Home builders aren’t known for delivering huge investment returns. Depending on Berkshire’s entry and exit, DR Horton’s stock could have risen to more than 50% within nine months. This is an incredible gain for an industry that is traditionally slow-moving and highly cyclical. It may have been wise to lock in profits, as various monetary and predictive indicators hint at a possible recession in 2024.

Should you invest $1,000 in Paramount Global right now?

Before buying Paramount Global stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors should buy right now…and Paramount Global wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Sean Williams has no position in any stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, HP, Markel Group, and StoneCo. The Motley Fool has a disclosure policy.

All 7 stocks sold by Warren Buffett are published by The Motley Fool.

[ad_2]

Source link