[ad_1]

For most investors, finding good stocks to buy isn’t that difficult. But there are also challenges in finding stocks that can turn virtually nothing into $500,000 in a lifetime.

Potential candidates are likely to be found in the technology field, as technology is ultimately at the heart of most major sociocultural advances. But these companies must also be able to adapt their products and services as they continue to be in demand. This criterion narrows down the list of possibilities considerably.

With that as background, let’s take a closer look at three technology stocks that, given enough time, have a huge chance of turning near-zero value into $500,000, if not more.

1. Nvidia

you probably know Nvidia (NASDAQ:NVDA) As a manufacturer of computer graphics technology. The company’s standalone GPUs (graphics processing units) are popular among video game enthusiasts, but it also offers display solutions for PCs without graphics cards.

But computer displays are no longer the company’s biggest business, or even close to it. Last year, data center processing solutions accounted for more than three-quarters of the company’s revenue. By and large, these data centers use his Nvidia hardware for artificial intelligence applications. After all, the same computer architectures that create high-performance graphics cards are also ideal for handling the heavy data loads inherent in AI. That’s why Nvidia has been developing dedicated artificial intelligence hardware for some time. And that’s why Nvidia is currently believed to control the majority of the AI hardware market.

problem? Investors who follow Nvidia closely probably already know that. With a market capitalization well above his $2 trillion mark, this company is now a regular contender for the honor of being the world’s largest. But its sheer size also seems to limit its upside potential. How big can a company realistically get?

The problem is that there’s no real limit to Nvidia’s potential scale. They are purely mental constructs. This is especially true given the fact that we have only scratched the surface of the world’s use of AI. Precedence Research’s outlook suggests that the global AI market will grow at an average annual rate of 19% through 2032, while Mordor Intelligence estimates that the AI computing hardware market alone will grow at an average annual rate of 26% through 2029. He says there is a high potential for growth. Both predictions, of course, bode well for NVIDIA.

2. Trade Desk

trade desk (NASDAQ:TTD) It’s not a name that everyone knows. However, there is a good chance that you or someone in your family is affected by the service on a regular basis.

In the simplest terms, The Trade Desk helps businesses advertise more effectively, especially when it comes to digital advertising. From ad-supported streaming to billboards to traditional web advertising, The Trade Desk is your one-stop shop to get your message in front of consumers. Equally important, the company helps advertisers better target specific audiences and monitor the success of their advertising campaigns. Additionally, it integrates its platform with other comparable ad-supported and data monitoring services.

It’s not an entirely new idea. Companies have been trying to fine-tune their advertising for decades. Shortly after the Internet itself was recognized as an effective advertising medium, it didn’t take long for advertisers to do the same.

Trade Desk is probably better than most, if not all, of its competitors in this space. Quadrant Knowledge Solutions recognized The Trade Desk as his top advertising technology provider of 2023, beating out competitors such as: alphabetGoogle, Amazonand adobe. IT research and consulting gartner The Trade Desk is also regularly ranked as a leader in ad tech, again on a par with Adobe, Google, and Amazon.

This powerful platform is the main reason the company’s revenue is expected to grow by nearly 23% this year and another nearly 20% next year. Earnings are expected to grow further, from $1.26 per share last year to $1.47 per share this year and $1.76 next year.

This may help seal the deal. Despite Trade Desk’s strong performance, the stock remains well below analysts’ value estimates. Most analysts currently rate the stock a Strong Buy, with the consensus price target of $97.85 currently over 20% above the stock.

3.Ion Q

Last but not least, please add ion Q (NYSE:IONQ) Add it to our list of unstoppable technology stocks that can go from zero to $500,000 in a relatively short period of time.

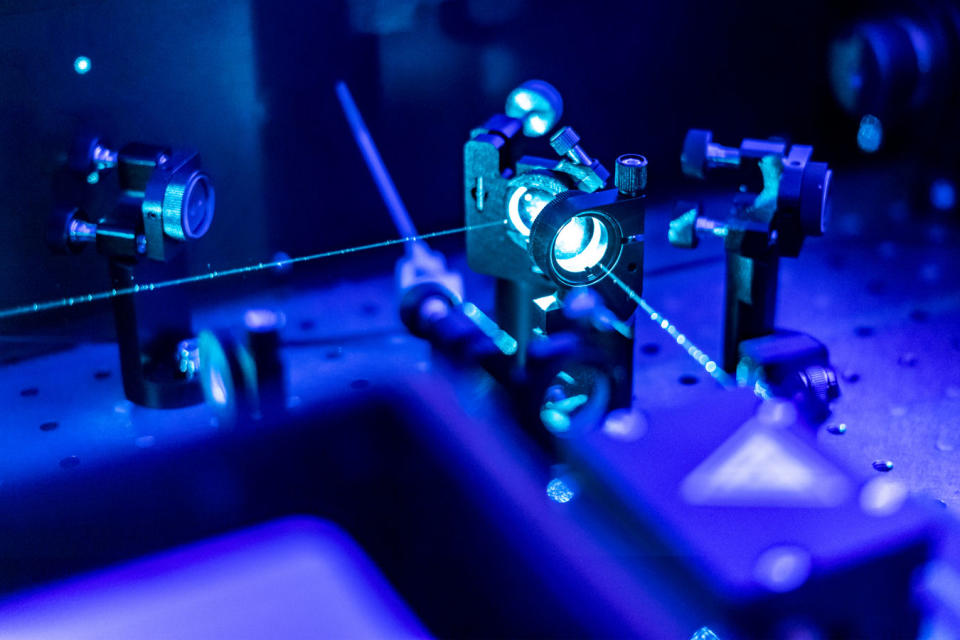

Most investors have heard of the term “quantum computing.” But most investors would be hard-pressed to name a single publicly traded company working on this revolutionary computing technology. IonQ is one of those few. By using ionized ytterbium atoms as the foundation of its computing platform, the company is able to provide computational solutions not possible using traditional silicon-based hardware. For reference, quantum computing is about 100 million times faster than the types of computers used at home and at work.

It’s not necessarily better for all purposes. Quantum computers are not practical for most ordinary uses, such as browsing the Internet or playing video games, for example. They are only suitable for handling complex calculations such as those that need to be performed by AI or drug development platforms. They may also be able to handle jobs such as financial modeling and cybersecurity. Although these jobs are not necessarily data-intensive, they are still complex and multifaceted tasks.

Investors need to understand that these solutions are not just theoretical or even in beta testing. they are real. IonQ’s quantum computer is now commercially available. The company posted $22 million worth of revenue last year, reported $39 million worth of sales this year, and is expected to achieve nearly $81 million worth of sales in 2025.

For the record, the company is not yet profitable and likely never will be. This is a risk to consider, as unprofitable companies often have volatile and unpredictable share prices.

That doesn’t necessarily mean IonQ stock won’t do well in the future, especially as more investors start to see the company’s opportunities in the quantum computing space. According to Precedence Research, this market is expected to grow an average of 37% through 2030 and be worth $125 billion annually.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Alphabet executive Suzanne Frye is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. James Brumley holds a position at his Alphabet. The Motley Fool has positions in and recommends Adobe, Alphabet, Amazon, Nvidia, and The Trade Desk. The Motley Fool recommends his Gartner. The Motley Fool has a disclosure policy.

“3 Unstoppable Technology Stocks That Will Make You Over $500,000 One After Another” was originally published by The Motley Fool.

[ad_2]

Source link