[ad_1]

Many income investors primarily focus on a company’s dividend payments, track record of increases, and dividend yield. But if you’re wondering which companies pay the most dividends, you’ve come to the right place.

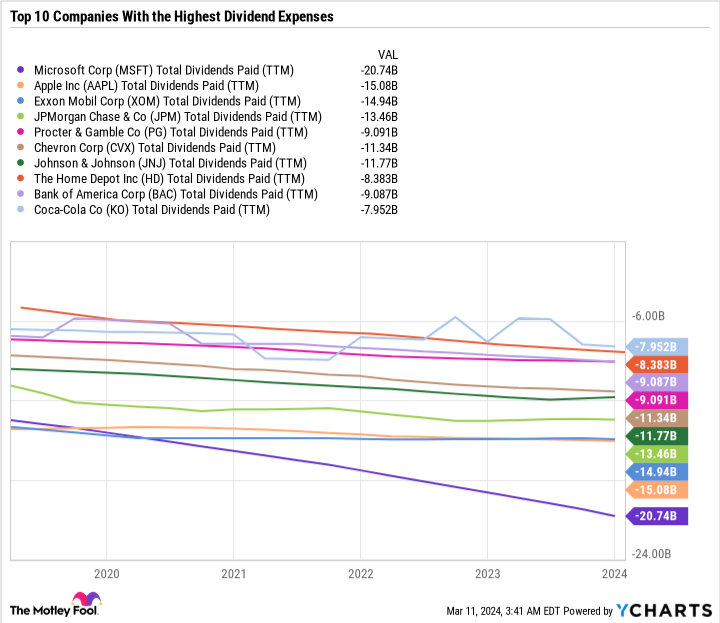

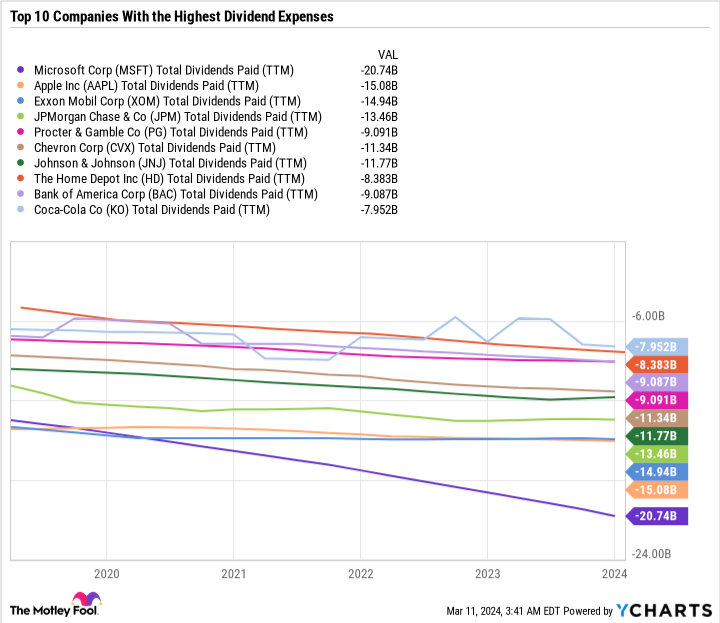

The most likely candidates are large companies with high yields, but the two companies with the highest dividend costs are actually microsoft (NASDAQ: MSFT) and apple (NASDAQ:AAPL) –Both “Magnificent Seven” stocks.

Here’s a look at the 10 US-based companies with the highest dividend spending, why Microsoft leads the group, and why it’s worth buying now.

Microsoft’s multibillion-dollar annual dividend hike

other than exxon mobil and american bankthe 10 U.S. companies with the highest dividend costs were all Dow Jones Industrial Averageis known for having industry-leading companies as its components.

If you follow the purple line on the chart, you’ll see that Microsoft’s dividend payments have increased significantly, especially recently. In fact, it has almost doubled in the past six years. For fiscal year 2024, Microsoft has increased its dividend by more than 10%. Because the company is such a large company, every 5% increase in his dividend will increase his dividend expense by about $1 billion.

Apple, on the other hand, has been increasing its dividend at a bare minimum of 1 cent per share for the past few years. Apple prefers to return money to shareholders through stock buybacks rather than dividends.

Don’t underestimate Microsoft’s dividend

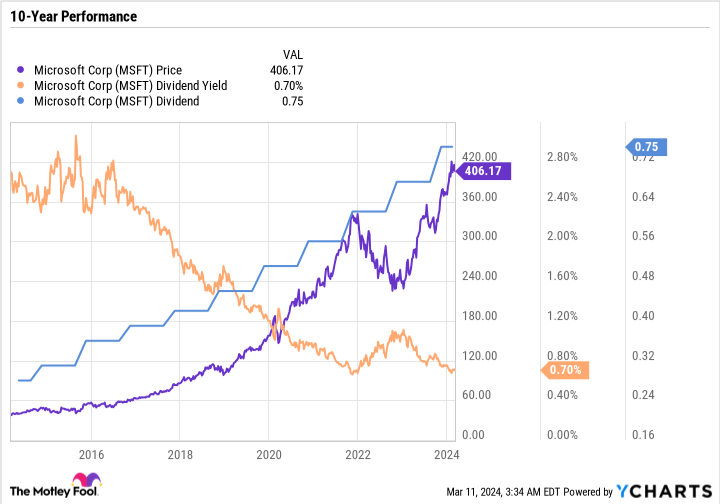

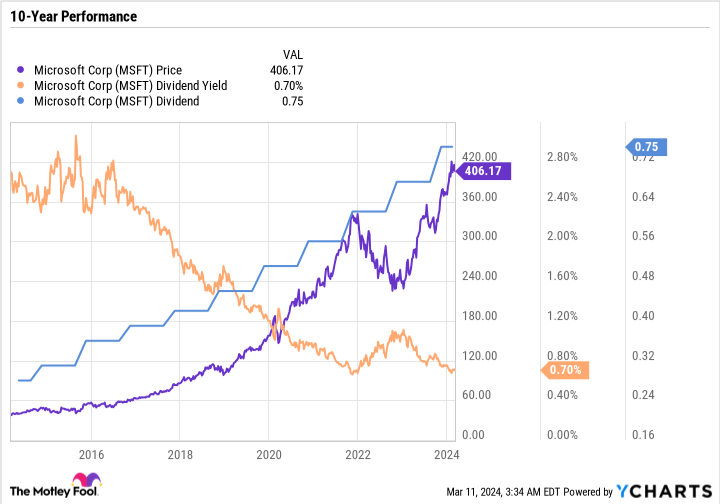

Microsoft’s yield is below average at just 0.7%, but even with that in mind, it’s still the best of the Magnificent Seven stocks. meta platform‘New dividend.

Although Microsoft has been increasing its dividend significantly, the growth in its stock price has far outpaced the growth in dividends, resulting in its yield decreasing over time. Over the past 10 years, management has raised the dividend nearly three times as much as it has, but as the stock price has risen an astounding 900% during that period, the yield has gone from more than 2.5% to less than 2.5%. It dropped to 0.7%.

If you’re looking to build a passive income stream over the long term, you’ll find that a company’s ability and willingness to increase its dividend are more important than its current dividend yield. Microsoft stands out because it can afford to regularly increase dividends, buy back stock, finance its operations, invest in research and development, and still maintain a balance sheet with more cash than debt. is.

Basically, Microsoft can do it all. Rather than looking at the company’s dividend in isolation, it’s better to look at it as an addition to your investment thesis.

Building an investment theory

There are three basic ways companies reward shareholders: capital gains, dividends, and stock buybacks. When considering whether to invest in stocks, it’s important to understand which levers a company is most focused on pulling.

For many companies, it’s all about capital gains. Amazon and teslaFor example, the company fits into that category. They don’t pay dividends and have large stock-based compensation programs that increase the number of shares outstanding and dilute value for existing shareholders.

For those who do not pay much in dividends, procter and gamble, dividends and share buybacks are definitely a bigger part of the investment thesis than potential stock price appreciation. P&G still has the potential for an incredible rally, but the stock is up more than 9% year-to-date, outperforming the stock. S&P500.

Additionally, there are rare companies that have plenty of room to grow and offer stock buybacks and dividends to their shareholders. Microsoft belongs to this elite category. Over the past five years, the company has reduced its share count by 3%, raised its dividend by 63%, and its stock price has increased by more than 255%. Shareholders were all set.

Leverage AI across business channels

Microsoft stands out as one of the most comprehensive buys on the stock market right now, as it’s a company with relatively low risk but high potential reward. With such high cash flow and a strong balance sheet, Microsoft has the ability to make mistakes, spend money on acquisitions, and develop new products when many other companies lack the capital or market position. You can afford to try things and take risks. Microsoft also has a clear path to monetizing artificial intelligence (AI). The company has multiple high-margin business units that are related but diversified.

Microsoft Copilot is an AI assistant that works across multiple applications, including Microsoft 365 programs and GitHub. During Microsoft’s fiscal 2024 second quarter earnings call, management detailed the many ways Copilot helps customers save time and improve efficiency, contributing to revenue.

Even if Copilot stalls and its impact on the growth of all these products proves to be limited, the company’s AI strategy doesn’t stop there. There’s also Azure AI for Microsoft’s intelligent cloud segment, which serves an entirely different industry than his Copilot target.

In summary, Microsoft’s AI aspirations are not dependent on a single product or idea. AI is already driving the company’s profitability and contributing to its growth, and there’s no reason to believe that trend will slow down anytime soon.

You can expect a snowball effect. Microsoft could choose to accelerate stock price growth, return capital to shareholders through larger share buybacks, or raise its dividend at a faster pace. No matter which levers Microsoft pulls, investors stand to benefit.

There’s a good reason why Microsoft has a high valuation.

The only problem with Microsoft is its reputation. The company’s price-to-earnings (P/E) ratio of 36.8x is well above the historical average and the S&P 500’s average P/E ratio of 27.8x. The stock is not cheap, but it shows that investors already have high expectations for Microsoft.

Don’t expect Microsoft’s valuation expansion to continue. Profit has to come from revenue, and that’s not a bad thing. It simply means that some of the “exploit money” has already been earned.

The good news is that Microsoft has a decades-long plan to grow revenue and reward shareholders. Even with its expensive stock price, Microsoft stands out as one of the safer ways to invest in AI and earn passive income in the process.

Where to invest $1,000 right now

When our analyst team has a stock tip, it’s worth listening. After all, the newsletter they’ve been running for 20 years is Motley Fool Stock Advisorhas more than tripled its market. *

they just made it clear what they believe Best 10 stocks Microsoft made the list of stocks that investors should buy right now, but there are nine others you may have overlooked.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

JPMorgan Chase is an advertising partner of The Motley Fool’s Ascent. Bank of America is an advertising partner of The Motley Fool’s Ascent. John Mackey, former CEO of Amazon subsidiary Whole Foods Market, is a member of the Motley Fool’s board of directors. Daniel Felber has no position in any stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Bank of America, Chevron, Home Depot, JPMorgan Chase, Microsoft, and Tesla. The Motley Fool recommends Johnson & Johnson and recommends the following options: A long January 2026 $395 call on Microsoft and a short January 2026 $405 call on Microsoft. The Motley Fool has a disclosure policy.

A look at the ‘Magnificent Seven’ stocks that pay more dividends than any other US-based company was originally published by The Motley Fool.

[ad_2]

Source link