[ad_1]

Stock markets got off to a solid start in 2024. S&P500 The index is already up nearly 8% and hitting new highs, but the good news is that the market could continue to rise thanks to a strong U.S. economy and falling inflation.

Technology stocks, in particular, could have another strong year thanks to catalysts such as artificial intelligence (AI). It is worth noting that Nasdaq 100 Technology Sector Bargains may be hard to find in this sector, as the index has soared more than 62% over the past year. But if you have $1,000 to spare after paying your bills, saving enough for a rainy day, and paying off high-interest debt, you can use that investable cash to invest in these seemingly solid You might want to buy one share of each of the two tech companies. Buy now based on long-term prospects.

1. Twilio

cloud communication specialist Twilio (NYSE:TWLO) It might seem like a surprising buy, considering the stock has underperformed, losing 18% of its value over the past year. There was more bad news for Twilio investors when the company announced its fourth quarter results last month.

Although the company beat expectations for the quarter, with annual revenue up 9% to $4.15 billion, management did not provide full-year guidance for 2024. The company is conducting a review of its customer data platform business, known as a segment. The company plans to issue guidance for 2024 by the end of this month once the review is complete.

But a closer look at Twilio’s guidance for the current quarter shows it’s going to be a difficult year for the company. The company expects sales to rise only 2% to 3% to $1.03 billion for the quarter. Twilio also expects adjusted earnings of $0.58 per share at the interim, which would represent a 23% increase from the year-ago period. For comparison, Twilio’s full-year earnings increased from just $0.15 per share in 2022 to $2.45 per share in 2023, largely due to cost-cutting efforts.

The outlook for relatively slow growth in 2024 explains why some investors are selling Twilio stock. As a result, it is now available for purchase at just 2.7x sales, well below the average sales multiple of 6.5x over the past five years.Additionally, Twilio currently trades at his 24x forward earnings, with the stock priced at Nasdaq-10030 times expected earnings (using the index as a proxy for the tech sector).

Buying Twilio at these multiples could be a smart move in the long run. This is because the company’s slowdown is likely to be temporary, considering the CPaaS (Communications-Platform-as-a-Service) industry in which it operates. Twilio’s application programming interfaces (APIs) enable businesses to build voice, messaging, and video applications and continue to do so. Connected with customers. This allows organizations to avoid traditional physical call centers that require large initial investments.

As of October 2023, Synergy Research Group describes Twilio as the leading player in CPaaS with a 37% market share. Meanwhile, as of June 2023, market research firm IDC estimates that Twilio controls nearly a quarter of this market. IDC further states, “Despite setbacks such as sales cycle slowdowns, restructuring, and downsizing, the industry remains one of the strongest IT sectors, with many companies achieving double-digit growth while remaining profitable.” It is achievable,” he added.

This explains why the CPaaS market is expected to generate nearly $30 billion in revenue in 2026, compared to $14 billion in 2022 revenue. So it’s no surprise that Twilio’s growth will accelerate again over the next few years. Moreover, if the company continues to control a quarter of the CPaaS market in his 2026, its revenue could increase to $7.5 billion, based on IDC’s forecasts.

This translates into a three-year compound annual revenue growth rate of nearly 22% based on Twilio’s 2023 revenue. If Twilio maintains its current price-to-sales ratio of 2.7, its market cap could increase to his $20 billion over the next three years. This would be a significant increase from the current level of about $11 billion.

2. Nvidia

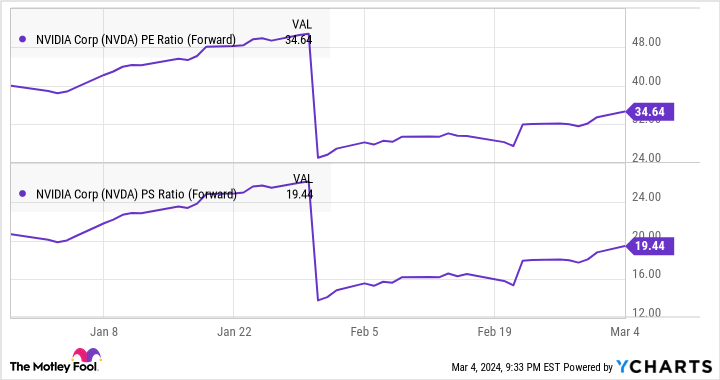

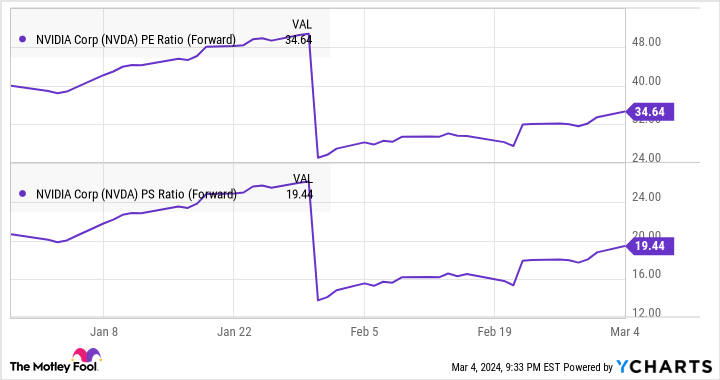

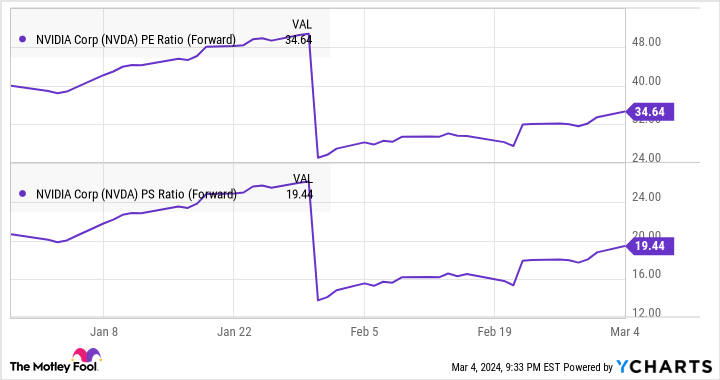

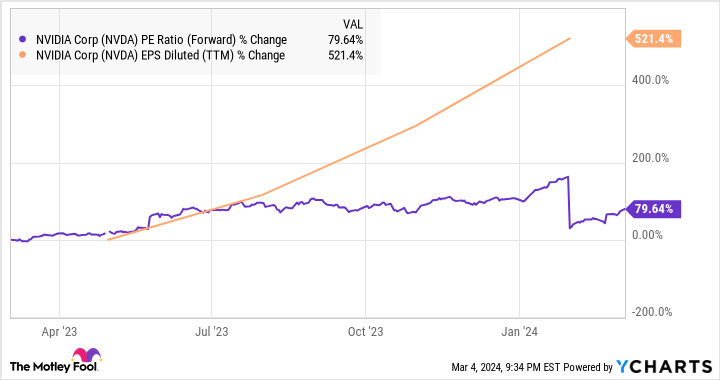

Nvidia (NASDAQ:NVDA) For investors looking for undervalued stocks, this may seem like another surprising stock. The company trades at 33 times sales and 69 times earnings, with the stock up 244% over the past year. By these standards, it looks expensive. However, Nvidia’s forward multiples tell a different story.

As the graph above shows, NVIDIA’s future earnings and sales multiples have been declining rapidly recently. This isn’t surprising, as the company’s sales and bottom line are expected to rise significantly this year. Analysts expect Nvidia’s earnings to jump to $24.43 per share in fiscal 2025 from $12.96 per share in the 2024 fiscal year, which ended Jan. 28. Sales are expected to increase nearly 80% to $109.5 billion.

More importantly, it looks like NVIDIA will be able to maintain this impressive growth rate beyond 2024. Japanese investment bank Mizuho analyst Vijay Rakesh estimates that NVIDIA could generate $300 billion in revenue from AI chips by 2027. This is a significant increase over his previous earnings of $47.5 billion. The company generated revenue from its data center business last year through the sale of AI chips, a huge 217% year-on-year increase.

There are several reasons why it’s not absurd for Nvidia’s revenue to grow at such an incredible pace over the next three years.First, Nvidia’s peer AMD predicts that the global AI chip market will generate annual revenue of $400 billion by 2027. Second, NVIDIA reportedly controls a whopping 90% of this market and is well-positioned to make the most of this opportunity.

Also, NVIDIA’s efforts to expand into further niches in the AI chip market could ultimately help Mizuho move closer to the ambitious revenue goals it has set. All of this indicates that NVIDIA could be his top growth stock in 2024 and beyond, and its low forward multiple means investors are getting a good deal on his Nvidia at the moment. It means that.

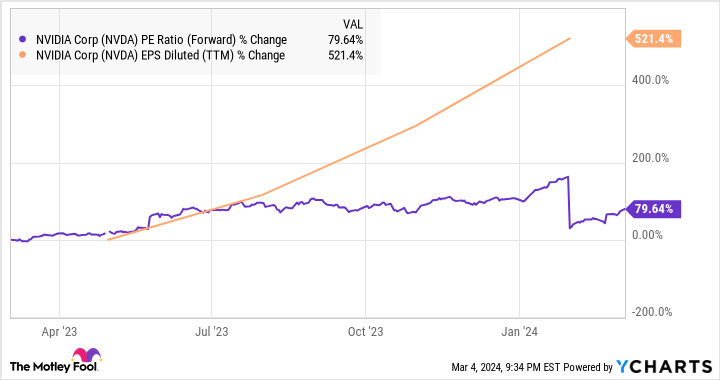

Another thing to note here is that NVIDIA has justified its valuation over the past year by posting impressive earnings growth that has outpaced its price-to-earnings ratio growth.

As such, NVIDIA stock looks cheap considering its growth potential, and smart investors should consider buying before the stock price rises.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Nvidia wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Harsh Chauhan has no position in any stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Nvidia, and Twilio. The Motley Fool has a disclosure policy.

Do you have $1,000?These 2 Stocks Could Be Great Bargains in 2024 and Beyond Originally published by The Motley Fool

[ad_2]

Source link