[ad_1]

software company Palantir Technologies (NYSE:PLTR) and chip companies Nvidia (NASDAQ:NVDA) are two of the hottest stocks on Wall Street. Both stocks are up more than 240% in the past year and are enthusiastically loved by investors.

Are some artificial intelligence (AI) stocks better than others? To find out, I’m comparing them head-to-head to find out why they’re thriving and whether they can continue. confirmed. It was a very close battle, but one stood out with a slight edge over the other.

Here’s what you need to know:

Encounter with two completely different companies

Both stocks soared due to strong performance in their underlying businesses. However, these two AI companies are very different. Nvidia has spent years working on high-performance GPUs that are ideal for data centers and AI. Nvidia’s high-quality products and CUDA software, which allows customers to efficiently use the power of their GPUs, gave Nvidia early on an estimated 80% to 90% dominance in the AI chip market.

Meanwhile, Palantir builds custom software applications for both government and commercial applications. He runs three of his software platforms: Gotham, Foundry, and AIP for AI applications. Palantir can be thought of as an operating system that helps organizations use their data. The company’s purpose is to extend human intelligence. It is no substitute.

A detailed look at each company’s growth

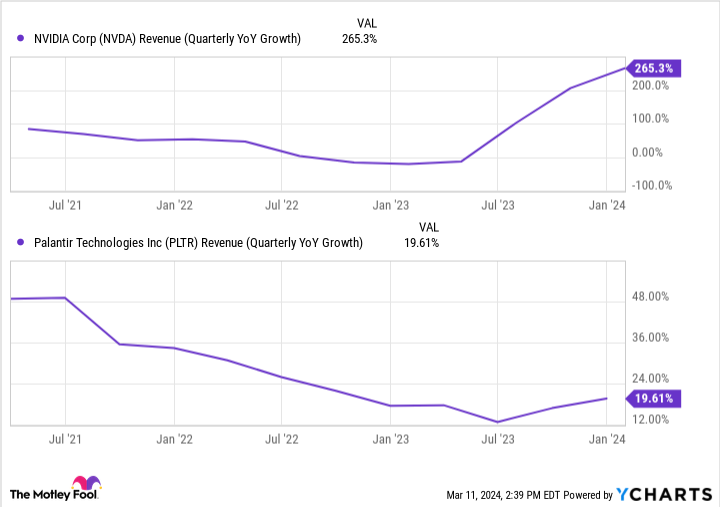

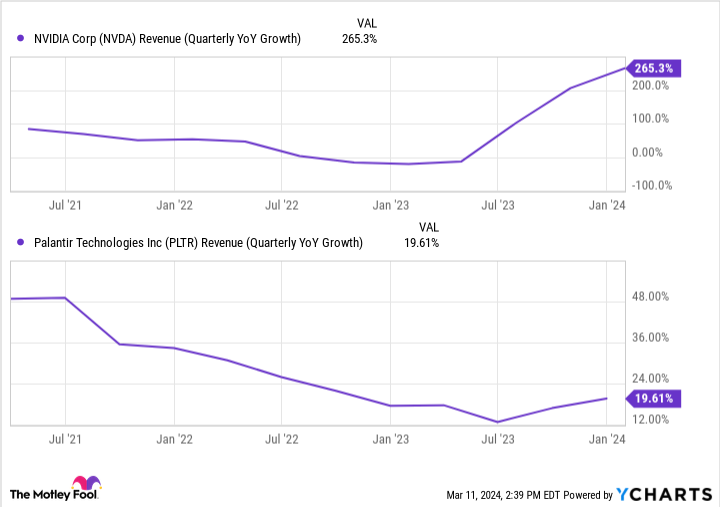

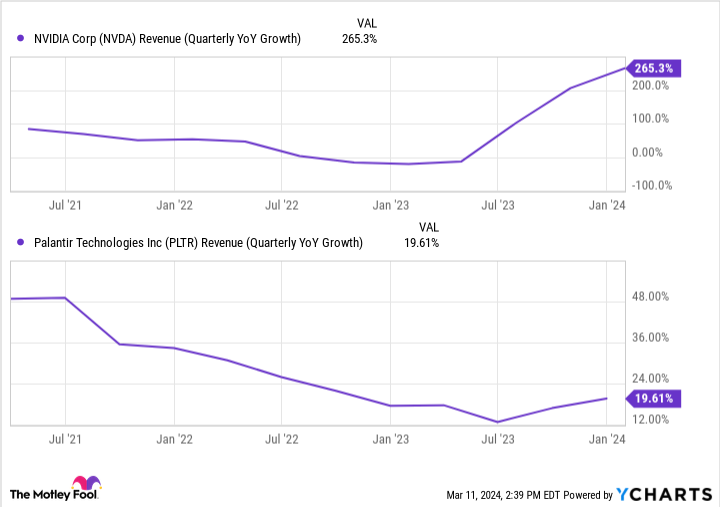

From a pure numbers standpoint, Nvidia is growing faster than Palantir. Below, we see that both companies started accelerating their revenue growth from mid-2023 onwards, but NVIDIA soared mainly due to huge data center spending from the “Magnificent Seven” big technology customers. It may be natural to wonder how long this significant increase in data center spending by major technology companies will continue.

One possibility is that these companies break away from Nvidia and start producing custom chips in-house. For companies that currently derive most of their revenue from a small number of customers, this could hurt long-term growth.

As for Palantir, it’s not as explosive a company as Nvidia. But what I’m impressed with is that the company’s customer base is growing. Palantir’s U.S. customer numbers grew 55% and 22% year-over-year in the fourth quarter. quarterly. This cannot be accurately translated because customers come in all shapes and sizes. Such customer growth bodes well for long-term revenue growth.

Perhaps Nvidia’s customer concentration won’t be an issue and Nvidia’s chips will maintain market share. Still, I hope that it will expand its customer base like Palantir.

What is the most cost-effective option?

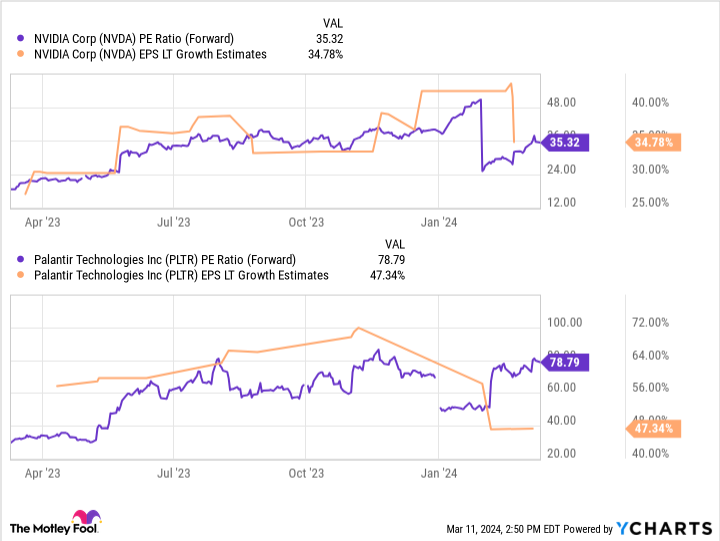

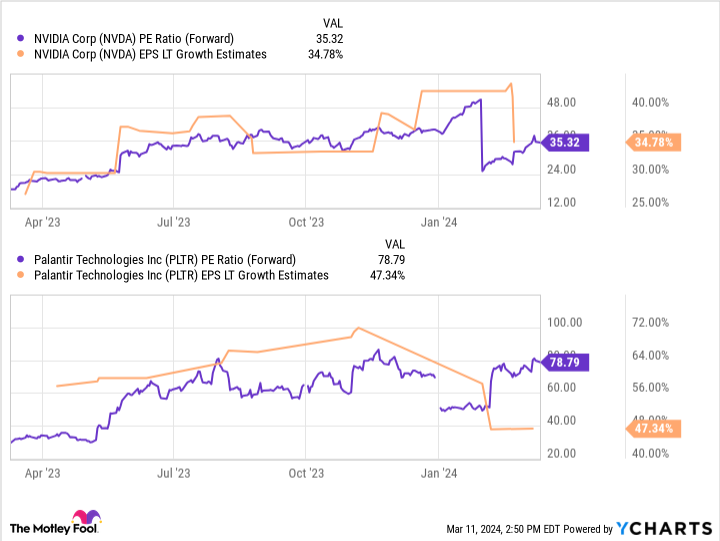

Analysts expect both companies to see strong revenue growth going forward. On a forward basis, both stocks are cheaper than expected after his 200% run. I like to use the PEG ratio to compare how much you pay for a company’s earnings growth. The lower the PEG ratio, the better, so you want it to be less than 1.5 if possible.

Nvidia fits this criteria with a PEG ratio of just over 1. Palantir has a PEG ratio of 1.6, which is not a perfect match.

Based on each company’s projected long-term earnings growth, it’s clear that Nvidia is currently worth more. Of course, the important thing to watch out for is whether each company will perform as expected.

The verdict is…

Both companies are great AI stocks and leaders in their respective fields. Both companies are experiencing accelerating revenue growth. Unsurprisingly, analysts are very optimistic about the companies’ future earnings growth. The winners will likely be those that we believe are more likely to meet growth expectations over the next three to five years.

This idiot gives Palantir a slight edge. why?

Palantir derives about half of its revenue from government contracts. The company’s long history with governments could give Palantir some leverage, plus the upside of a growing customer base. On the other hand, Nvidia’s customer concentration could be in trouble if key customers choose another chip.

While the numbers say NVIDIA is a better buy, there’s also an argument that investors should have a little more faith in Palantir’s long-term growth, especially over the long term.

Should you invest $1,000 in Palantir Technologies right now?

Before buying Palantir Technologies stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Palantir Technologies wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 11, 2024

Justin Pope has no position in any stocks mentioned. The Motley Fool has a position in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

Better Artificial Intelligence (AI) Stocks: Palantir vs. Nvidia was originally published by The Motley Fool.

[ad_2]

Source link