[ad_1]

Vanguard Investment Stewardship Program

Vanguard’s Investment Stewardship Program has a clear mission to protect and promote long-term shareholder interests on behalf of Vanguard-advised funds and their investors. We accomplish this mission by promoting governance practices that are relevant to the long-term investment returns of the companies in which our funds invest. Vanguard-advised funds benefit investors if the portfolio companies they hold generate shareholder returns over the long term.

Vanguard Recommended Funds

Funds advised by Vanguard are primarily index funds managed by Vanguard’s Equity Index Group. These funds track specific benchmark indices constructed by independent third parties. This structure means that index fund managers do not make active decisions about where investors’ money is allocated. As a result, Vanguard-advised equity index funds are constructed to track specific benchmark indices, follow strictly prescribed strategies, and adhere to clearly articulated and published policies.

Vanguard’s Equity Index Fund makes long-term investments in a large number of publicly traded companies around the world. A small portion of the funds advised by Vanguard are managed by Vanguard’s Quantitative Equity Group, which uses proprietary quantitative models to select a broadly diversified portfolio of securities to meet the fund’s investment objectives.

what we do

All aspects of Vanguard’s Investment Stewardship Program are focused on protecting and promoting long-term investment returns, with the goal of giving investors in Vanguard-advised funds the best chance of investment success. . This is done as follows:

attractive Meet with portfolio company directors and executives to learn about each company’s corporate governance practices and share their views on corporate governance practices as they relate to long-term investment returns.

vote Based on each fund’s voting policy, they will be represented at shareholder meetings of portfolio companies.

Promote Through our published materials and participation in industry events, we demonstrate governance practices that are relevant to long-term investment returns.

On behalf of Vanguard-advised funds, we monitor how effectively portfolio company boards, elected on behalf of all shareholders, including Vanguard-advised funds, carry out their responsibilities. I’m trying to understand. We understand how each board is structured, how it consults with management on strategy and oversees material risks, and how each board is structured to achieve the company’s long-term success. Investigate how incentives are aligned with shareholder interests and how shareholder rights are protected.

our four pillars

The portfolio construction process for Vanguard-advised funds is passive in nature, and equity index funds seek to track benchmarks determined by unaffiliated index providers. Our approach to investment management works in that context. Therefore, we do not direct the strategy or operations of companies owned by Vanguard-advised funds, nor do we submit shareholder proposals or nominate directors. we, The exact strategies and tactics to maximize long-term investment returns must be determined by a company’s board of directors and management. Similarly, Vanguard does not use its investment management activities to pursue public policy objectives. We believe that setting public policy, including policy on environmental and social issues, is the proper responsibility of elected officials.

Our analysis of companies’ corporate governance practices focuses on four pillars of good corporate governance:

Composition and effectiveness of the board of directors

Good governance starts with a company’s board of directors. Our primary focus is on understanding the extent to which individuals serving as board members have the appropriate independence, competency and experience.

Oversight of strategy and risk by the board of directors

The board must be meaningfully involved in shaping and overseeing strategy, and must provide ongoing oversight of material risks to the company. We strive to understand how boards of directors are involved in shaping strategy, overseeing corporate strategy, and identifying and managing material risks to long-term shareholder returns.

Executive compensation (remuneration or remuneration)

A sound pay program linked to relative performance drives long-term shareholder returns. We require companies to provide clear disclosure about their compensation practices, the board’s oversight of those practices, and how those practices align with the long-term interests of shareholders.

shareholder rights

We believe that governance structures should enable shareholders to effectively exercise their fundamental rights. Shareholder rights enable owners of a company to use their voice and vote to effectuate and approve changes in corporate governance practices, depending on their economic ownership of the company’s shares.

Overview of investment stewardship activities

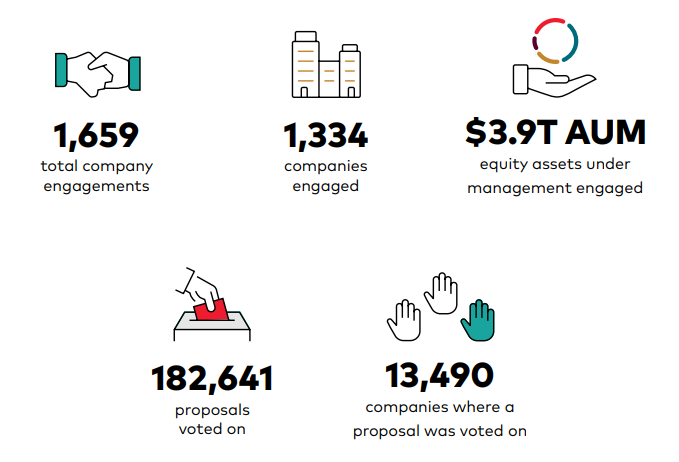

In 2023, our team of more than 60 investment management professionals engaged with 1,334 companies in 31 different markets representing 69% of the total assets under management (AUM) of Vanguard-advised funds.

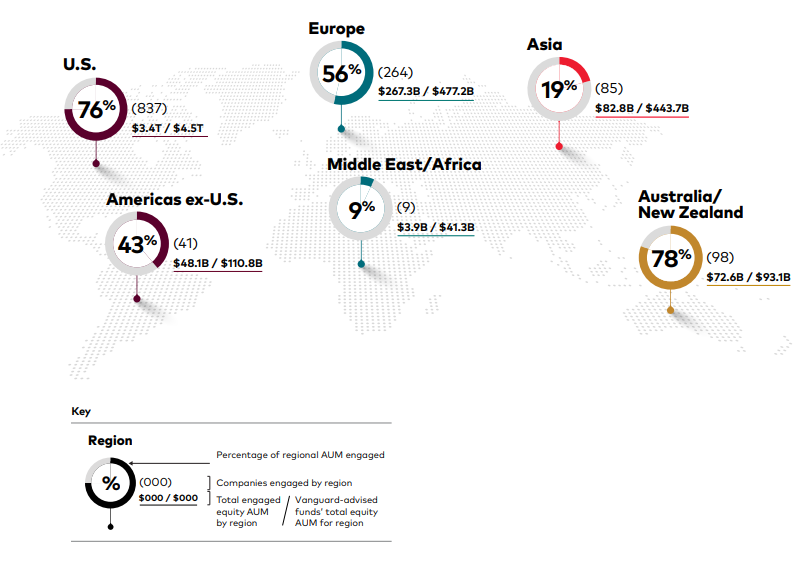

Summary by region

This section highlights notable corporate governance topics and trends that Vanguard’s Investment Stewardship team observed in different regions of the world in 2023.

We use this and other reports to help investors in Vanguard-advised funds and other market participants understand the engagement and voting activities we conduct on behalf of Vanguard-advised funds. We offer publications and summaries.

Regional engagement numbers for 2023

The numbers below represent the Vanguard Investment Stewardship team’s global engagement efforts representing Vanguard-advised funds in 2023.

Americas

During the 2023 proxy year in the Americas (U.S., Canada, and Latin America), we will continue to engage our portfolio company directors on topics such as board and committee leadership innovation, onboarding processes for new directors, and oversight of material risks. and senior management. We believe that many U.S. boards are implementing new measures in response to the universal proxy card, such as enhanced disclosure of board skills matrices, director competency and commitment policies, and board effectiveness evaluations. We’ve seen them implement practices and revised practices. Some shareholders in the United States and Canada continued to express concern about how the board was managing material environmental and social risks. This is reflected in the increase in shareholder proposals submitted on environmental and social topics. In Latin America, many of our conversations centered on issues of board independence, risk oversight, and disclosure.

In 2023, we engaged with 878 companies across the Americas on a variety of governance and risk oversight topics, and the Fund voted on more than 47,000 proposals from approximately 4,800 portfolio companies across the region. In addition to our direct engagement with companies, the Investment Stewardship team travels across the United States to promote corporate governance practices associated with long-term investment returns and to share our perspectives and approaches. He also regularly attended industry events.

Composition and effectiveness of the board of directors

In our conversations with corporate leaders in the United States and Canada, we frequently discussed the evolution of board composition over time and board self-assessment processes.

We have seen many companies implement board skills matrices, director competency and commitment policies, practices related to board effectiveness assessments, and enhance disclosure. We believe that these changes and related disclosures will provide shareholders with greater visibility into the Board’s operations and improve their understanding of how the Board fulfills its oversight role. We shared this view with companies.

Across the Americas, independence was the main factor where funding did not support the election of directors. The Fund may not support the election of a particular director if board independence is observed to be insufficient and/or if there are concerns related to the independence of key committees. .

Additionally, in the United States and Canada, funds did not support compensation committee members if the issuer did not adequately address significant concerns about executive compensation expressed in a prior year’s say-on-pay vote. While disclosures about board composition for U.S. and Canadian companies have improved in recent years, we find that Latin American companies continue to have opportunities to improve timely disclosure of director candidates and their backgrounds, particularly their independence. . As a result, the Fund voted against a number of directors in the Latin American market.

Oversight of strategy and risk by the board of directors

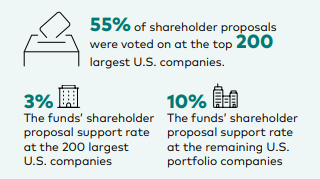

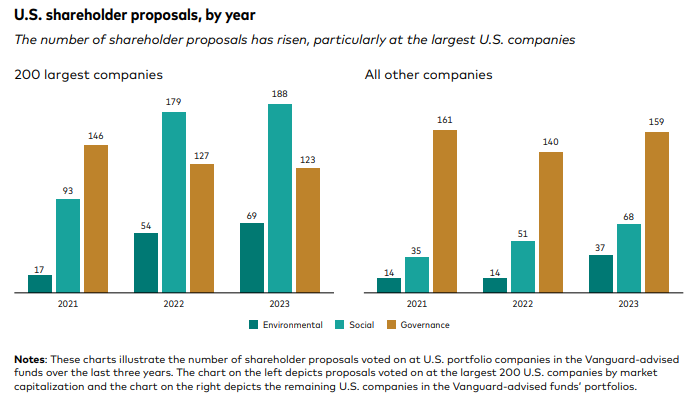

Among publicly traded companies in the United States, the number of shareholder proposals related to environmental and social issues increased by approximately 21% in 2023. This upward trend is due in part to the Securities and Exchange Commission’s changes to its issuer capacity guidance in 2022, and continues to be a continuing trend. To remove proposals from the ballot. As part of our process to evaluate shareholder proposals, we provide prioritization to help each board identify, define, and mitigate material risks to the company in areas such as cybersecurity, operations, human capital management, and posts. We spoke with company directors about how to conduct the exercise. -Pandemic supply chain.

We find that shareholder proposals are primarily filed by the largest U.S. issuers, which generally have more developed governance. They have specialized practices and more resources for relevant disclosures than smaller issuers. Through a case-by-case analysis of each shareholder proposal, we often observe evidence of adequate risk oversight, board governance, and disclosure, which often results in the Fund voting against the shareholder proposal in question. Ta.

Officer remuneration (remuneration)

We continued to observe that certain U.S. companies utilize one-time incentives as part of their compensation programs. This practice has increased during the COVID-19 pandemic and remains above pre-pandemic levels even as the business environment has stabilized for many issuers. In many of our initiatives related to this practice, directors cited talent retention concerns and recruitment challenges as the rationale.

The Fund supported more than 96% of executive pay (say-on-pay) advisory votes in the United States and Canada. This is largely due to companies’ ability to clearly articulate the need for such compensation through disclosure and engagement. It is hoped that the award will align with the company’s long-term performance.

shareholder rights

We have learned that many U.S. companies, in response to changing laws and regulations, unilaterally amend provisions in their corporate charters to limit executive liability, request specific jurisdiction for litigation, or We have observed companies adopting advance notice clauses that impact the ability of shareholders to make proposals and nominate directors. Voting at a company’s general meeting. In these cases, we have considered the impact of these changes on shareholder rights and worked with companies to understand the rationale for adopting the provisions. If we determined that this provision was unduly burdensome and/or alienated shareholder rights, the Fund expressed its concerns by voting against the relevant members of the Board’s governance committee.

Endnotes

1For the year ended December 31, 2023, Vanguard-advised index equity portfolios accounted for 99% of Vanguard-advised equity fund assets under management.(return)

2Vanguard’s recommended equity index funds are constructed using exact replication or sampling approaches. Under a full replication approach, the Fund purchases and holds securities in the Fund’s benchmark index in proportion to each security’s weight in the Fund’s benchmark index. Under a sampling technique, a Fund purchases and maintains a representative sample of securities within an index that approximates the complete index with respect to key characteristics.(return)

3In total, as of December 31, 2023, funds managed in whole or in part by Vanguard’s Quantitative Equity Group represented approximately 1% of Vanguard-advised funds’ equity assets under management. .(return)

FourData shown is for the 12 months ending December 31, 2023. Numbers and percentages reflect rounding.(return)

FiveSee www.sec.gov/corpfin/staff-legal-bulletin-14l-shareholder-proposals.(return)

[ad_2]

Source link