[ad_1]

Hennepin County leaders are asking the state Legislature to make the sales tax used to build Target Field permanent so that most of the future revenue will go toward the county’s health infrastructure. .

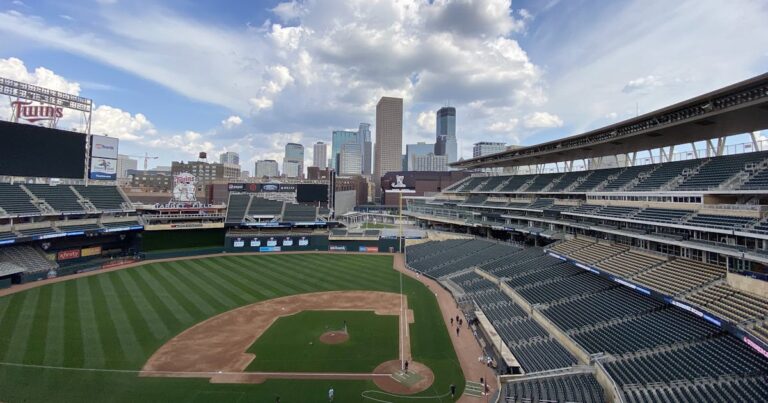

The proposal also creates a dedicated funding source for stadium maintenance and improvements and includes a guarantee from the Twins that it will remain at Target Field for decades to come.

This idea has some hurdles. It requires support from the Legislature, and tax changes are always controversial at statehouses, especially if they include an extension until the tax expires. Although Hennepin County’s role in the sales tax and construction of Target Field was initially controversial, the project is now widely acknowledged to have helped revitalize the North Loop.

The money Hennepin County borrowed to cover its $355 million share of the $555 million stadium construction is nearly being repaid. If nothing changes, the 0.15% sales tax, which has been levied since 2007 and collects more than $50 million annually, will be phased out by the end of the decade.

A bill introduced in Congress on Monday would earmark about $40 million a year from sales taxes for future improvements to Ho Chi Minh City and other county-owned medical facilities. County officials estimate that Minneapolis’ safety-net hospitals and trauma centers will need more than $1.5 billion in renovations over the next 15 years.

“This is an important asset. It’s extremely important to the county and the state,” County Executive David Huff said of the need to continue meeting Ho Chi Minh City’s infrastructure needs.

County officials and leaders of Ho Chi Minh City and Hennepin Healthcare System, which oversees several clinics, want to build a new inpatient hospital tower at the corner of South Eighth Street and Chicago Avenue. There is. But first the parking ramp there needs to be demolished and replaced.

Facility needs are also anticipated at some of the more than a dozen other medical offices and health care clinics owned by the county.

Joe Matthews, the county’s chief financial officer, estimates that reallocating existing sales taxes could raise enough money to cover about $800 million worth of annual debt payments. This means county officials will rely less on property taxes to pay for needed improvements.

“This will cover a significant portion of (the costs),” Huff said.

For the Twins, the change would send $9 million a year to a capital improvement fund administered by the Minnesota Ballpark Authority. The county will also allocate him $3 million in upkeep payments three times a year and $1 million annually thereafter.

In return, the Twins would extend their current 30-year contract, keeping the team in Minneapolis until at least 2059. Additionally, the team will continue to contribute $4.5 million annually to the Capital Improvement Fund.

Twins President and CEO Dave St. Peter said the proposal would be welcomed as a continuation of the successful public-private partnership with Hennepin County. He said the team is committed to maintaining the best ballpark in Major League Baseball.

“We welcome efforts to protect Target Field for future generations of fans,” St. Peter said. “We think this is a great success story both on and off the field.”

Other spending commitments made when the sales tax was approved remain unchanged. The $2 million a year separate from the tax for youth sports and activities and the $2 million a year earmarked for extended county library operations will continue as long as the sales tax is collected.

The Twins technically lease Target Field from the Stadium Authority, the oversight committee established to manage the stadium. Hennepin County currently sends about $3 million a year to cover the agency’s operating and other costs.

Dan Kenney, executive director of the Ballpark Authority, said the team has spent about $60 million on improvements to Target Field since it opened. Stadium officials spend about $20 million, and the cost is often split 50-50 between the two parties.

For example, in January, officials and the team split the $350,000 cost of hiring a consultant to determine the ballpark’s overall condition, how it compares to other major league facilities, and what will be needed in the future to maintain the ballpark. Agreed. Be at the top of your game.

[ad_2]

Source link