[ad_1]

(Bloomberg) — Stocks rise and bond yields fall as the U.S. Federal Reserve maintains its outlook for three rate cuts in 2024, easing concerns that a reversal of the steepest rate hikes in a generation will be delayed. did.

Most Read Articles on Bloomberg

Stocks rose again to new highs on expectations that policy easing would boost prospects for American companies. The rebound in U.S. Treasuries has narrowed this year’s decline stemming from concerns about prolonged high interest rates.

Policymakers have signaled they are on track to cut interest rates this year for the first time since March 2020, but expect only three rate cuts in 2025, up from four expected in December. Diminished. The central bank also reiterated its intention to continue shrinking its balance sheet. That’s as much as $95 billion per month. Wall Street is currently awaiting remarks from Jerome Powell at a press conference starting at 2:30 p.m. in Washington.

The S&P 500 index briefly exceeded 5,200. The yield on two-year government bonds fell 6 basis points to 4.62%. The dollar fluctuated.

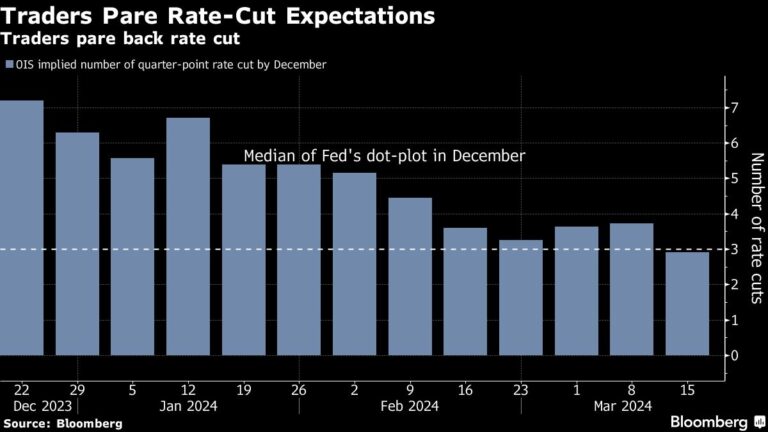

Ahead of the Fed’s decision, bond traders had stepped up short bets on Treasuries and bought derivatives to protect against declines.

Meanwhile, U.S. funding markets are showing signs of encouraging the Fed as it decides exactly when and how to slow the pace of excess capital leaving the financial system. The short-term funding market is stable and not stressed at the moment. This provides considerable flexibility and a positive backdrop when Fed officials meet, likely to discuss the path forward for QT.

An informal survey of bond underwriters found that no companies were considering selling bonds in the U.S. high-end bond market on the day of the Fed’s decision.

Year-to-date sales have reached $501 billion, the fastest pace ever, according to data compiled by Bloomberg News. This is significantly higher than the $342 billion average over the past five years.

Company highlights:

-

The U.S. plans to give Intel $8.5 billion in grants and up to $11 billion in loans to help fund semiconductor factory expansion, the largest award ever for a program aimed at revitalizing the nation’s chip industry. becomes.

-

Boeing Co. said regulatory scrutiny after a midair crash in January and a slowdown in production of its 737 Max jetliner have taken a huge toll on its finances, predicting a huge cash outflow in the first quarter.

-

Reddit Inc. and its selling shareholders have given guidance that the social media company’s initial public offering could be priced at or above the highest market price, according to people familiar with the matter.

-

Short seller Hindenburg Research targeted data center owner Equinix on Wednesday, claiming the company manipulates accounting and sells an “AI pipe dream.” An Equinix representative said the company is investigating the allegations.

-

Chipotle Mexican Grill’s board of directors has proposed a 50-for-1 stock split to expand the burrito chain’s investor base after its stock has risen 13,000% since its initial public offering.

-

JPMorgan Chase & Co. unexpectedly raised its dividend by 9.5% after posting record annual profits, but also signaled regulators may reconsider proposals to tighten capital controls.

This week’s main events:

-

Eurozone S&P Global Services PMI, S&P Global Manufacturing PMI, Thursday

-

Bank of England interest rate decision Thursday

-

U.S. Conference Board Leading Index, Existing Home Sales, New Unemployment Insurance Claims, Thursday

-

Nike, FedEx earnings, Thursday

-

Japan CPI, Friday

-

Germany IFO Business Environment, Friday

-

Atlanta Fed President Rafael Bostic speaks on Friday

-

ECB’s Robert Holzmann and Philip Lane speak on Friday

The main movements in the market are:

stock

-

As of 2:08 p.m. New York time, the S&P 500 was up 0.3%.

-

Nasdaq 100 rose 0.4%

-

The Dow Jones Industrial Average rose 0.4%.

-

MSCI World Index rose 0.3%

currency

-

The Bloomberg Dollar Spot Index fell 0.1%.

-

The euro rose 0.2% to $1.0886.

-

The British pound rose 0.2% to $1.2743.

-

The Japanese yen fell 0.4% to 151.43 yen to the dollar.

cryptocurrency

-

Bitcoin rose 1.3% to $64,571.01

-

Ether rose 1.7% to $3,335.11

bond

-

The 10-year Treasury yield fell 3 basis points to 4.26%.

-

Germany’s 10-year bond yield fell 2 basis points to 2.43%.

-

The UK 10-year bond yield fell 4 basis points to 4.02%.

merchandise

-

West Texas Intermediate crude oil fell 2% to $81.83 a barrel.

-

Spot gold rose 0.6% to $2,170.57 an ounce.

This article was produced in partnership with Bloomberg Automation.

Most Read Articles on Bloomberg Businessweek

©2024 Bloomberg LP

[ad_2]

Source link