[ad_1]

Unlike many other metropolitan areas across the country, the Southwest Florida housing market has a relatively large amount of inventory for sale.

“I think one of the key trends we’re seeing is that our overall inventory is up 60% year over year compared to 2023,” said President P.J. Smith. Masu. Naples Area Realtors Board and the broker owner From Naples Golf to Gulf Real Estate. “Inventory was steadily increasing and we really needed it.”

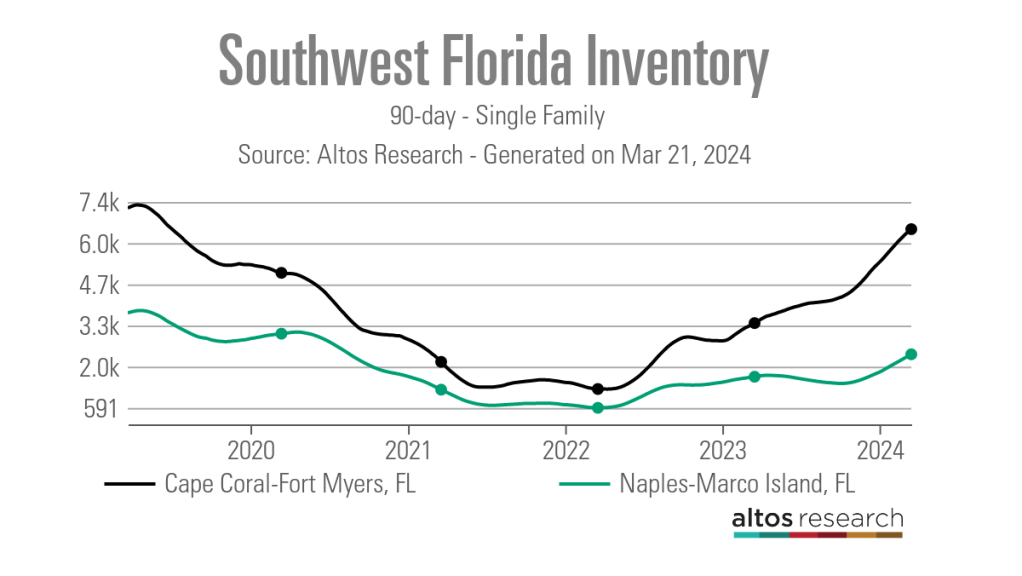

According to data from Altos Research As of March 15, the 90-day average number of active single-family listings in the Naples-Marco Island metropolitan area was 2,362, up from 1,605 a year ago, but compared to 2019 before the spread of COVID-19. This is down from the 3,760 properties recorded in late March. 19 pandemic.

In the Cape Coral-Fort Myers metropolitan area, active single-family home inventory over the past 90 days averaged 6,500 listings as of March 15, up from the March 2020 level of 5,044 listings and up from March 2019. This is approaching the monthly level of 7,243 cases.

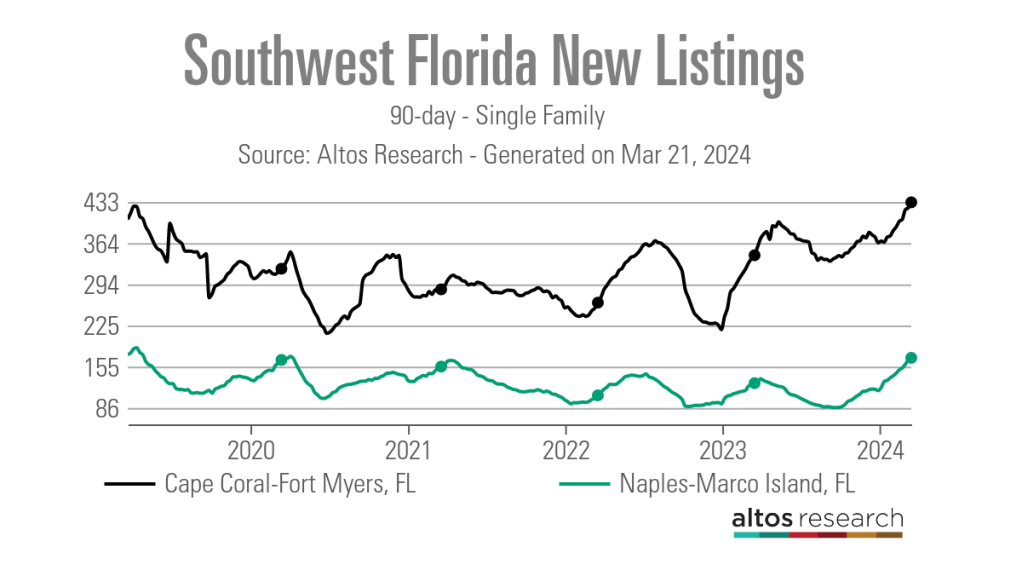

Smith attributes the increase in inventory to an increase in new listings. As of mid-March 2024, his 90-day average number of new listings was 170 in Naples-Marco Island and 432 in Cape Coral-Fort Myers. In addition, the stabilization of the interest rate environment and the overall slump in the market may release pent-up selling appetite.

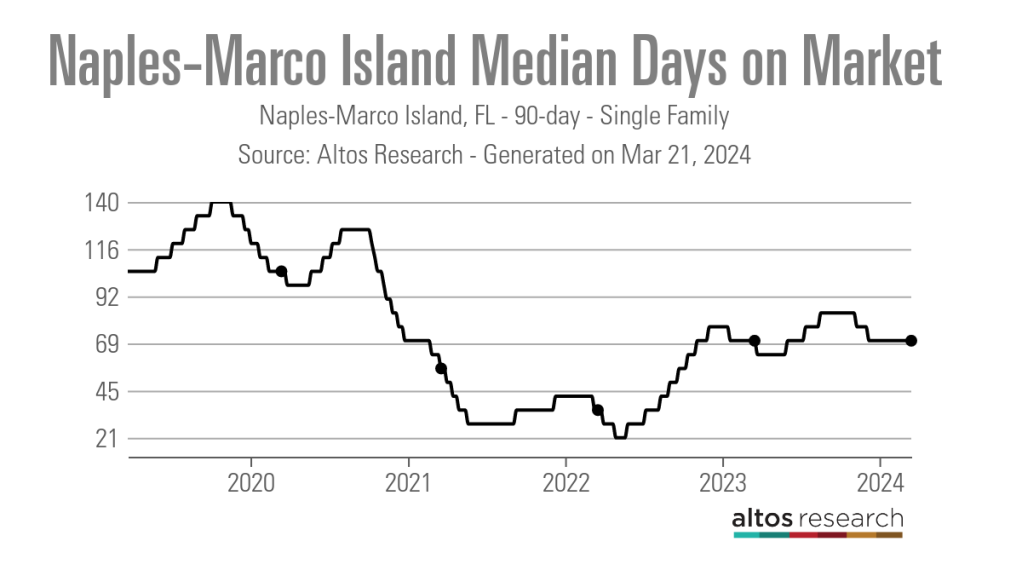

“Last year was still adjusting from the effects of the pandemic market, but now trends seem to be returning to baseline, which is similar to the 2019 market,” Smith said. “Days on the market are also trending back to more normal conditions for our market.”

The average 90-day median days on market in the Naples-Marco Island metropolitan area was 70 days as of mid-March, up from a record low of 21 days in mid-May 2022, according to data from Altos Research. are doing.

Smith noted that while some properties sit on the market for too long, those in good condition, reasonably priced and in desirable locations are still selling quickly.

“We just sold the property after it was on the market for two days,” Smith said. “We are still seeing properties go pending quickly and properties with multiple offers.”

Local real estate experts say the market weakness is due to a variety of factors, including rising home prices that have remained stable despite the economic slowdown, rising interest rates, and rising costs for homeowners and flood insurance. thinking.

“In Florida, like in many places, the component insurance portion is impacting people’s payments and making it difficult for people to navigate the market,” said the Seminole-based insurance agent. said Cindy Haydon. future residential real estate Agent.

According to an analysis by S&P Global, between 2018 and 2023, homeowners insurance premiums in Florida increased by 43.2%. From 2022 to 2023 alone, interest rates have increased by 15%.And data from Insurance Information Association According to , Florida homeowners pay an average of nearly $6,000 a year for insurance, which is nearly three times the premiums they paid in 2019. By comparison, the average homeowners insurance policy in the United States was approximately $1,700 in 2023.

Rising insurance costs are compounded by the fact that many insurance and reinsurance companies have decided to exit the state. The companies cite a recent increase in the number and severity of hurricanes and other weather-related disasters impacting the Sunshine State.

“Florida has seen a significant increase in hurricane frequency, and years of poor experience mean losses for insurance companies, who have no choice but to raise premiums.” said Sean Kent, senior vice president. First Service Financial.

“Furthermore, there are only a few carriers willing to participate and provide insurance for some of these units, significantly reducing service availability.”

It’s no surprise that these rising costs are impacting some buyers’ ability and willingness to purchase certain properties.

“Insurance is an expected expense, but nothing as large as we see today,” says Tampa-based Cheryl Hawk. Exp Realty Agent. “We are seeing contracts being canceled during the due diligence period due to high insurance cost shocks. This is definitely an issue.”

Because of this, real estate professionals are bringing insurance partners into transactions much earlier than before.

“This is definitely a significant concern and issue,” Smith said. “Our recommendation is to consult and get a quote to find out what your potential insurance costs will be before committing to a property.”

In addition to dealing with rising insurance costs with buyers, agents also have to respond to questions from past customers about rising premiums, and they need help finding ways to lower costs. He said he needed it a lot.

“Customers sometimes contact us and ask why their premiums have increased by 62%. “I was able to do that,” Hock said.

Even though rising insurance premiums are making home ownership more expensive in these markets, local real estate experts don’t feel that’s behind the recent increase in new listings.

“We’ve seen a lot of people move out of state to more affordable markets,” Hock said. California. “

Still, the agency feels this could become a bigger problem if premiums continue to rise, especially for the area’s many retirees.

“When you look at people who are nearing retirement or have a certain income, that becomes more of a concern,” Haydon said. “People are really struggling with affordability.”

But while rising insurance costs are certainly a challenge for owners and buyers in Southwest Florida, Haydon said the downturn in the housing market is good news for many buyers.

“I have negotiated some of the best deals for buyers currently on the market since the 2008 housing market crash,” Haydon said. “We found a buyer last month, and the property was priced at $475,000, but with the necessary repairs, it was worth $410,000, so we were able to negotiate an offer for $410,000.

“Typically, I tell buyers that if they get 10% off list price, they are dealing with a different reality than the seller.”

Haydon said offers with sales contingencies, closing cost coverage and various other seller concessions have also been accepted recently.

Although things have slowed down from the frenetic post-pandemic height of the market, local agents are optimistic about where the market will go this spring and summer.

“It’s been very busy. Literally, the faucets have been open since January 1st,” said Diane Pizzars, co-founder of Tampa-based Pizzars Group. coldwell banker realty-Intermediary company. “There are a lot of buyers on the market, but we’re focused on showing value to sellers and getting properties out there that buyers can buy. It’s going to be a really strong spring and summer.”

related

[ad_2]

Source link