[ad_1]

Even though Nike NKE beat expectations for quarterly sales and bottom line Thursday. and lululemon LULU The stock fell in today’s trading due to softer-than-expected guidance.

Still, with Nike stock down -13% year-to-date and Lululemon stock down -20%, investors may be wondering if it’s time to buy into these big-name retailers. .

Image source: Zacks Investment Research

good quarterly results

Yesterday, Nike announced its third quarter results, posting earnings of $0.98 per share. That’s up 24% year-over-year and 42% below his third-quarter estimate of $0.69 per share. Quarterly revenue was $12.42 billion, up slightly from $12.39 billion in the year-ago period and 1% above expectations. Notably, Nike has exceeded earnings estimates in three of its last four quarterly reports, posting an average return surprise of 22.55%.

Image source: Zacks Investment Research

Turning to Lululemon, it reported fourth-quarter earnings of $5.29 per share, 5% above expectations and up 20% from $4.40 per share in the comparable quarter. Fourth-quarter sales rose 15% to $3.2 billion, slightly above expectations of $3.18 billion. What’s even more impressive is that Lululemon has now exceeded earnings estimates for 15 consecutive quarters, with an average return of 9.68% over the past four quarterly reports.

Image source: Zacks Investment Research

weak sales guidance

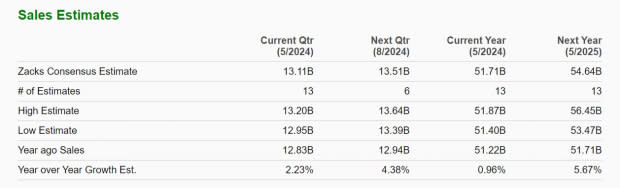

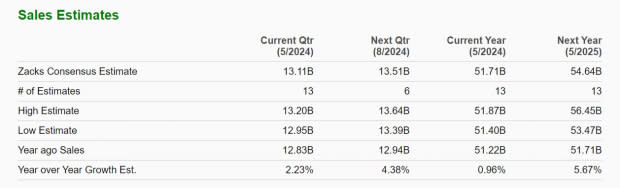

Concerns about Nike and Lululemon losing their mojo came as both apparel giants gave softer earnings outlooks. Nike still expects its fiscal 2024 total sales to increase 1%, which is in line with the Zacks Consensus Estimate. However, the iconic gym shoe designer warned of a single-digit decline in revenue for the first half of FY25 as it works to innovate its product portfolio in what it calls a weak economic environment.

Image source: Zacks Investment Research

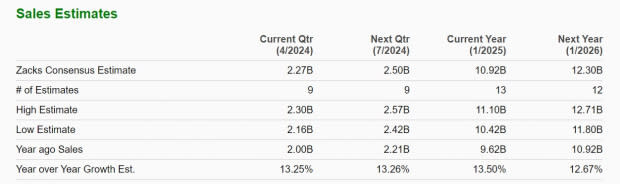

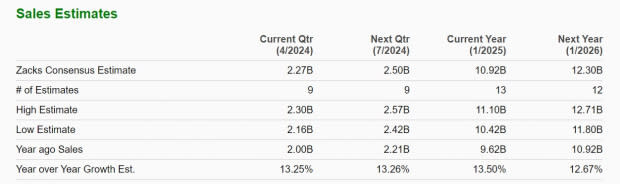

Meanwhile, Lululemon blamed slower-than-expected sales forecasts for the next quarter on a slowdown in consumer demand. The yoga-inspired apparel company expects first-quarter sales to increase from $2.17 billion to $2.2 billion, compared with the Zacks Estimate for first-quarter sales of $2.27 billion. quarter). Further, Lululemon expects its fiscal year 2025 total sales to be in the range of $10.7 billion to $10.8 billion, an increase of 11% to 12%, compared to the Zacks Estimate of $10.92 billion. USD or 13% growth.

Image source: Zacks Investment Research

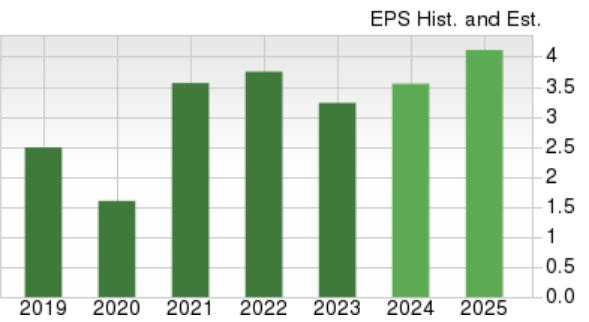

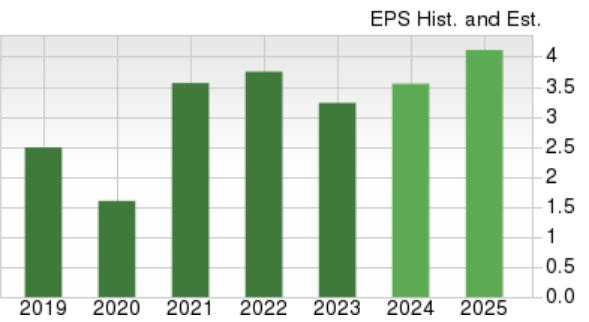

Earnings forecast

Nike maintained its full-year net income forecast for fiscal 2024, with EPS expected to increase 9% to $3.54 per share, based on Zacks estimates. Earnings for fiscal 2025 are now expected to increase an additional 16% to $4.12 per share.

Image source: Zacks Investment Research

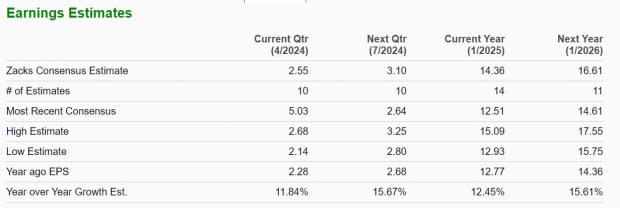

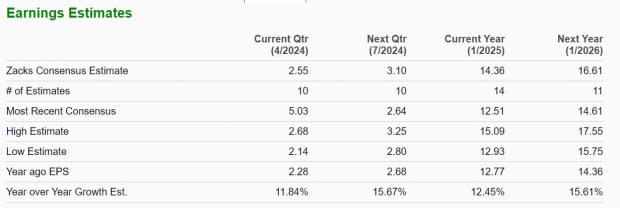

Focusing on Lululemon, the company is offering first-quarter EPS guidance in the range of $2.35 to $2.40, with Zacks Estimates projecting earnings of $2.55 per share, or 12% growth. Lululemon is expected to report full-year EPS of $14.00 to $14.20 for FY25, below the current Zacks Consensus of $14.36 per share and growth of over 12%. Additionally, EPS in fiscal 2026 is expected to expand 15% to $16.61 per share, based on Zacks Estimates.

Image source: Zacks Investment Research

conclusion

Nike and Lululemon seem to be struggling with growth expectations, but both stocks currently have a Zacks Rank #3 (Hold). That said, long-term investors could be rewarded for holding shares in these large consumer-focused companies at current levels, although near-term economic headwinds could change their growth trajectory. be.

Want the latest recommendations from Zacks Investment Research? Today you can download 7 Best Stocks for the Next 30 Days.Click to get this free report

Nike Corporation (NKE): Free Stock Price Analysis Report

Lululemon Athletica, Inc. (LULU): Free Stock Analysis Report

Click here to read this article on Zacks.com.

Zacks Investment Research

[ad_2]

Source link