[ad_1]

a city Analysts recently raised their price targets for high-yield energy stocks devon energy (NYSE:DVN) It rose from $52 to $55, suggesting a 13.6% upside potential. Coupled with his current 5% dividend yield, this presents a promising opportunity for investors. Let’s take a look at what makes Devon Energy such an attractive stock for Wall Street and individual investors.

city upgrade

This upgrade is interesting because it highlights improvements to Devon Energy’s assets, particularly its natural gas assets. This is often overlooked by investors when evaluating stocks. This shouldn’t be because Devon has significant gas reserves and the collapse in gas prices is a big reason for the company to cut its 2023 dividend.

Devon Energy reserves

The Company has significant developed and undeveloped proven reserves of gas and natural gas liquids.

|

resource |

Developed and undeveloped proven reserves as of 2023 |

Proved and undeveloped reserves (billions of barrels of oil equivalent*, MMBoe) |

|---|---|---|

|

oil |

786 million barrels |

786 Mboe |

|

gas |

3,182 billion cubic feet |

530MM boe |

|

Natural gas liquids (MMBbls) |

500 million barrels |

500MM boe |

Data source: Devon Energy presentation. *Oil equivalent is the conversion of all resources to an equivalent measure based on their energy output.6,000 cubic feet of natural gas = 1 barrel of oil

Why Devon Energy’s 2023 dividend decreased

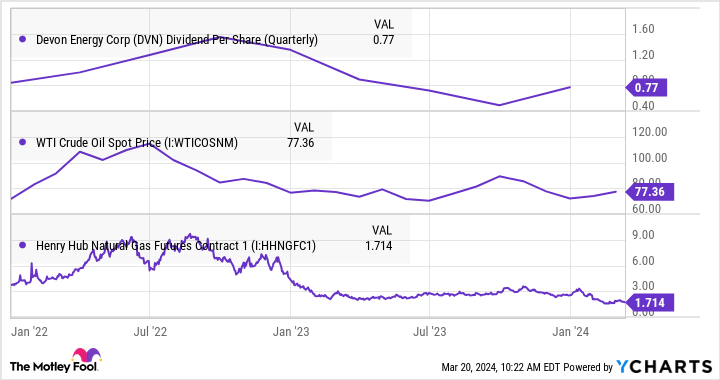

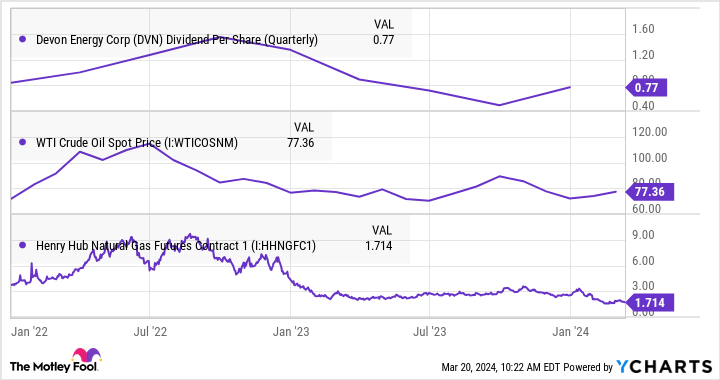

The graph below shows the significant drop in gasoline prices since the beginning of 2022 (down more than 50% over the same period, while oil prices have increased by double digits over the same period). This decline had an impact on the reduction in Devon Energy’s variable dividend. For reference, the company pays him a fixed quarterly dividend of $0.22 per share and a variable dividend from the remaining free cash flow (FCF) after fixed dividend payments and share buybacks are made.

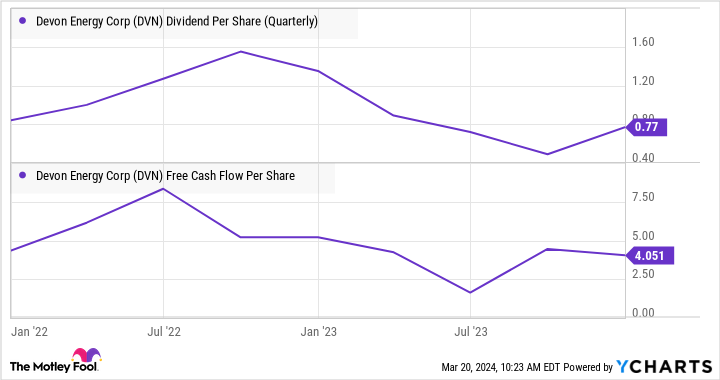

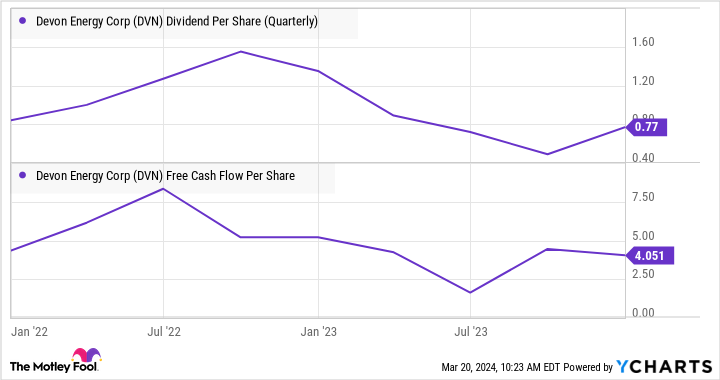

The graph below shows how lower FCF per share led to lower dividends. We also included Devon’s number of outstanding shares to show that the number of shares decreased as a result of share buybacks by management. This is beneficial for continuing holders as the claim on cash flow increases.

Importantly, the main reason for the dividend decline from 2022 to 2023 (and in part contributing to the disappointing stock price performance) is a decline in FCF due to lower gas prices. Devon experienced an increase in revenue from oil production from the first quarter of 2022 to the fourth quarter of 2023 (the realized price of crude oil fell by 6%).

Why Devon Energy could outperform in 2024

I’ve focused on the Devon gas business and looked at why this stock is currently attractive to investors.

First, lower gas prices mean oil now makes up a more significant portion of overall revenue. According to my calculations, Devon’s oil production has increased from 75% of revenue in Q1 2022 to 82% in Q4 2023. With oil prices above $80 per barrel, his 2024 outlook for Devon looks good.

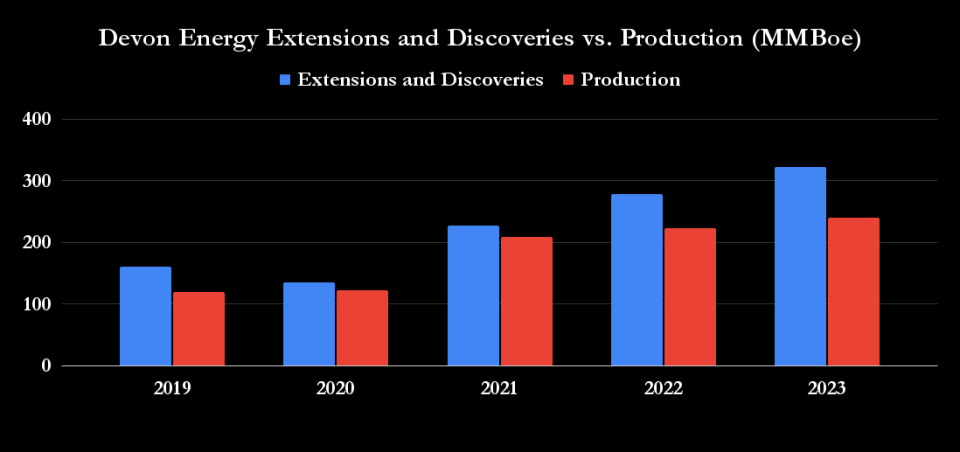

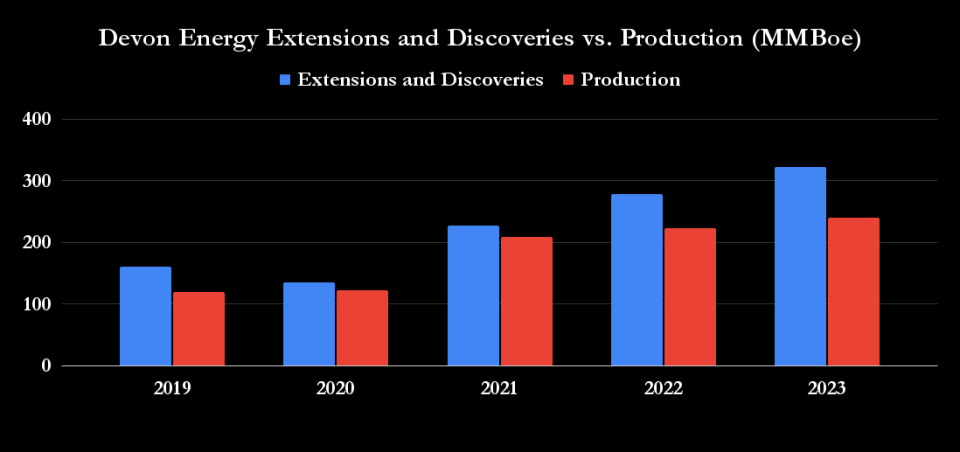

Second, as Citi analysts have hinted, Devon is good at managing assets and is good at improving reserves. As you can see below, its expansion and discoveries have outpaced production over the past five years.

Third, in the fourth quarter earnings call, management stated that assuming an oil price of $75 per barrel, the FCF yield (at a stock price of approximately $44 at the time) was 9%; I was estimating 13% on price. $85. Interpolating these numbers with today’s stock price of $48.30 gives an FCF yield of approximately 10% at an $80 per barrel oil price. This suggests that Devon will be able to pay a very attractive dividend in 2024 while carrying out share buybacks.

Is Devon Energy a stock to buy?

Overall, investors should not underestimate the impact of falling gas prices on Devon’s 2023 dividend cut. But with gas making up a portion of its revenue and oil prices remaining relatively high, the company should generate significant returns for investors. this year.

So Citi’s analysts are right to highlight the investment case for the stock, and Devon shares have upside potential.

Should you invest $1,000 in Devon Energy right now?

Before buying Devon Energy stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks What investors can buy right now…and Devon Energy wasn’t among them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor returns as of March 21, 2024

Citigroup is an advertising partner of The Motley Fool’s Ascent. Lee Samaha has no position in any stocks mentioned. The Motley Fool has no position in any stocks mentioned. The Motley Fool has a disclosure policy.

Wall Street is increasingly bullish on this high-yield energy stock Originally published by The Motley Fool

[ad_2]

Source link