[ad_1]

Mandy Pan thought it was a good idea to make her first big purchase after graduating from college: a silver plug-in hybrid car from BYD, China’s leading electric car maker. A compact sedan called Qin Plus was popular due to its affordable price and low energy consumption. Pan, a 22-year-old from eastern China’s Zhejiang province, asked his father for the down payment on a five-year loan for a 94,800 yuan ($13,168) car.

But less than four months later, the price of BYD’s Qin Plus model has fallen by 15,000 yuan ($2,084) amid fierce price competition among Chinese EV makers. That’s more than Pan earns in three months at an entry-level job. She was also shocked by the high insurance premiums and long charging times for plug-in hybrid cars.

“I feel like I was scammed out of 15,000 yuan,” Pan said. Rest of the worldHe added that he had not expected such a drastic price drop. “They should at least give us some compensation. I really regret getting this car.”

“We feel like we were scammed out of 15,000 yuan. They should at least give us some compensation.”

The world’s largest EV market has seen rapid growth for years with government support, but is facing a slowdown as consumers cut back on spending in the uncertain post-pandemic economy. As automakers lower prices further to maintain sales, some car owners are seeing the value of their vehicles plummet in the months and even weeks after purchase. Several EV companies are also in crisis, leaving thousands of buyers without access to after-sales service or software maintenance services.

EV startups HiPhi, Baidu-backed WM Motor, and Tencent-backed Aiways lack funding to sustain their operations. Other brands such as Levdeo and Singulato Motors have also entered bankruptcy proceedings.

China’s EV industry is transitioning from a period of unchecked growth to a period of consolidation, analysts say Rest of the world. Annual sales of new energy vehicles in China, including EVs and plug-in hybrid vehicles, are expected to increase by 22% to 11 million units in 2024. This is slower than last year. EV sales increased by 36% in 2023, with 7.7 million units sold, and by 90% in 2022, with 5.7 million units sold. Although the government stopped providing purchase subsidies at the end of 2022, some other EV support measures remain in place, such as tax incentives and license plate incentives.

Automakers are now aggressively cutting prices to compete for limited growth space. Since February, BYD, China’s top-selling brand that sold about 2.4 million cars in 2023, has reduced the prices of almost all its models. In February, it launched a hybrid plug-in priced at 79,800 yuan ($11,112) under the slogan, “Batteries are cheaper than engines.” More than 10 other EV brands also fought back by lowering their prices. Tesla also introduced new discounts and subsidies.

“The overall outlook for the Chinese economy is not good,” said Tu Lee, founder of consultancy Sino Auto Insights. Rest of the world. “There are still too many brands and products.”

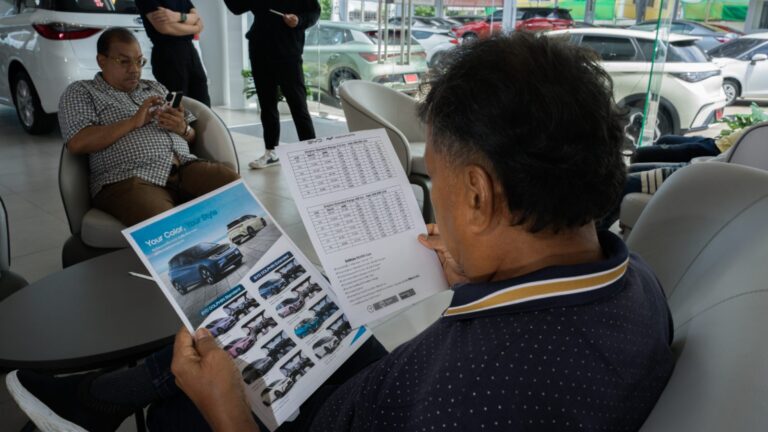

Frequent price cuts are frustrating EV owners, especially those who recently bought their cars. In February, auto quality monitoring platform 12365auto.com announced that it had received 6,884 complaints about price changes, most of which targeted domestic EV brands, accounting for 45% of all auto-related complaints. There is. On the social media site Xiaohonshu, BYD owners have formed a group to discuss ways to request compensation, including calling sales representatives and contacting consumer rights groups. Car owners joked that they had been “stabbed in the back” by the EV company. Price fluctuations in the past have also led to small-scale demonstrations, which are rare in China. In early 2023, Tesla buyers gathered at stores to protest sudden price cuts.

said Ming Yan, a car owner in eastern Anhui province. Rest of the world She bought the BYD Seal sedan at the end of 2022 for 240,000 yuan ($33,337) to take advantage of government subsidies. Surprisingly, BYD continued to lower the price of its Seal models while adding exciting new features over the coming months. By February, the sedan, with leather seats and child safety locks, was priced about 40,000 yuan ($5,556) cheaper. The price reduction has also made this model significantly cheaper on the second-hand market. “An ordinary person like me worked hard for months to earn this money,” Yang wrote on her Xiaohongshu page. BYD did not respond to a request for comment. Rest of the world.

To support the EV industry, the Chinese government has offered buyers generous subsidies, tax incentives, and favorable license plate policies over the past decade. At a time when several lucrative private sectors have come under government crackdown, EV startups have become a safe option for internet giants, smartphone makers and even real estate developers launching their own car businesses. The number of registered EV manufacturers reached 486 in 2019, but this will decrease to about 100 in 2023.

Zhang Xiang, a visiting professor at the Faculty of Engineering at Yellow River University of Science and Technology, said price competition is helping China’s crowded EV industry weed out smaller players and consolidate resources. Rest of the world. Of China’s more than 160 electric vehicle brands, only 25 to 30 may be financially viable by 2030, according to consulting firm AlixPartners.

Doon

Compared to traditional gasoline vehicles, EVs rely more on software to run their charging and drive systems, as well as in-car entertainment and navigation. EV manufacturers can continue to fix bugs and upgrade services through wireless technology. However, when a company goes out of business, it is often unclear who will manage the software. According to Chinese media reports, owners of WM Motor (which sold nearly 100,000 vehicles but began running out of funds in 2023) are complaining of system glitches. “This is something very new to the whole world,” Lee said. “If the bug is serious and not patched quickly, it could lead to further problems and even turn your car into bricks.”

HiPhi, a luxury brand that makes electric cars with refrigerators and champagne holders, is the latest company to run into trouble. Since HiPhi launched its first model in 2020, it has not been able to sell more than a few thousand units a year. In February, parent company Human Horizons ceased operations. Founder Ding Lei told staff he would spend the next three months considering new investment and acquisition options.

Nya Li, who bought HiPhi Y in 2023 for 369,000 yuan ($51,263), said: Rest of the world She is now extra careful while driving. She is worried that she will not be able to repair the car if an accident occurs. Ms Wang, who owns the HiPhi X and only gave her family’s name for privacy reasons, has to buy spare parts for her car worth 570,000 yuan ($97,174) online. She said she was deaf. Hi-Fi did not respond to a request for comment.

China’s car sales regulations require suppliers to guarantee parts will be available for at least 10 years even if production of a particular model is discontinued, but enforcement can be difficult. “Purchasing from an EV startup is like making a risky investment,” said Sun Fangyuan, an auto industry advisor and influencer. Rest of the world. “If you bet on something bad, you will suffer a loss.” After witnessing the collapse of HiPhi and WM Motor, consumers are likely to stick with the most established brands, Sun said.

HiPhi is so cash-strapped that employees appear to be hawking frozen meals on livestreams to make extra cash. During a recent livestream on TikTok’s sister app Douyin, Yang Yueqing, HiPhi’s project director, cooked a steak on an electric stove powered by HiPhi Y SUV. Yang also showed off a frozen shrimp cake taken from HiPhi’s in-car refrigerator. “Shrimp is healthier than other meats,” he told the audience in his car. All proceeds from food sales will be used to support HiPhi’s after-sales service, Yang said.

[ad_2]

Source link