[ad_1]

Maher Canadian Equity Fund (Trade, Portfolio), known for its disciplined approach to investing in large Canadian companies, has revealed its moves for the fourth quarter of 2023. The fund is designed for investors looking for long-term growth and can handle stock volatility. focuses on wealth-producing companies with strong management teams and buys companies at a discount to their intrinsic value. The fund’s strategy includes a research-driven, bottom-up process that maintains long holding periods to optimize investor returns and minimize transaction costs.

Summary of new purchases

Mawer Canadian Stock Fund (Trade, Portfolio) has expanded its portfolio with the addition of five new stocks:

-

Intact Financial Corp (TSX:IFC) now holds 452,126 shares, representing 2.61% of the portfolio, and is valued at CA$92.17 million.

-

Restaurant Brands International Inc (TSX:QSR) holds 602,600 shares, representing about 1.77% of the portfolio, and is valued at CA$62.39 million.

-

Stella-Jones Inc (TSX:SJ) added 433,224 shares, representing 0.95% of the portfolio, with a value of CA$33.41 million.

Key position rises

The fund also significantly increased its stake in 10 stocks, the most notable of which are:

-

In AltaGas Ltd (TSX:ALA), the fund increased its holdings by an additional 3,661,827 shares for a total of 4,012,234 shares. This is a staggering 1045.02% increase in the number of shares for him, giving him a 2.88% impact on his current portfolio (valued at CAD 111.62 million).

-

RB Global Inc (TSX:RBA) added 289,100 shares, increasing its total to 937,300 shares. This adjustment increases the number of shares by 44.6% and amounts to C$83.11 million.

Overview of sold out positions

The fund completely sold four holdings in the fourth quarter of 2023, including:

-

BCE Inc (TSX:BCE) sold all 1,360,018 shares, impacting the portfolio by -2.24%.

-

Enbridge Inc (TSX:ENB) liquidated all 898,588 shares, resulting in a portfolio impact of -1.21%.

Reduction of key positions

Prices were reduced for 27 stocks, and the following items were significantly changed.

-

Bank of Montreal (TSX:BMO) was reduced by 364,640 shares, reducing the number of shares by -28.85% and having a portfolio impact of -1.19%. Shares traded at an average price of C$115.82 during the quarter.

-

Suncor Energy Inc (TSX:SU) was reduced by 1,021,800 shares, decreasing the number of shares by -33.22% and having a portfolio impact of -1.08%. The stock has posted a solid return of 17.94% over the past three months.

Portfolio overview

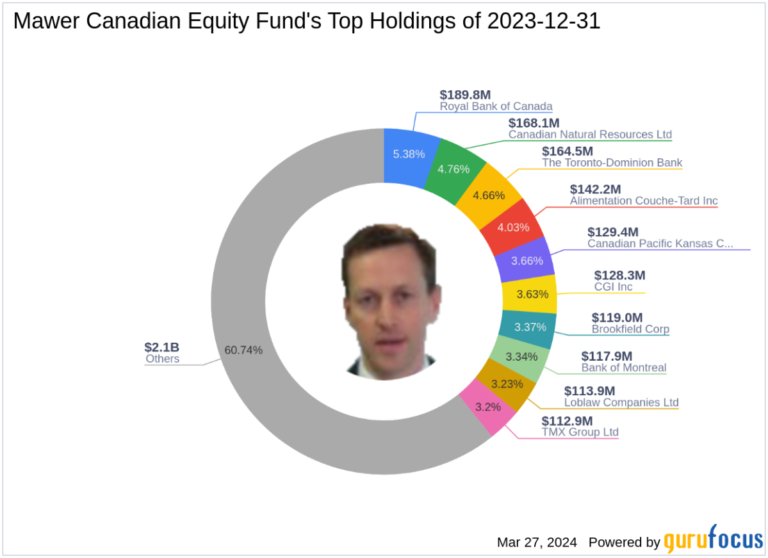

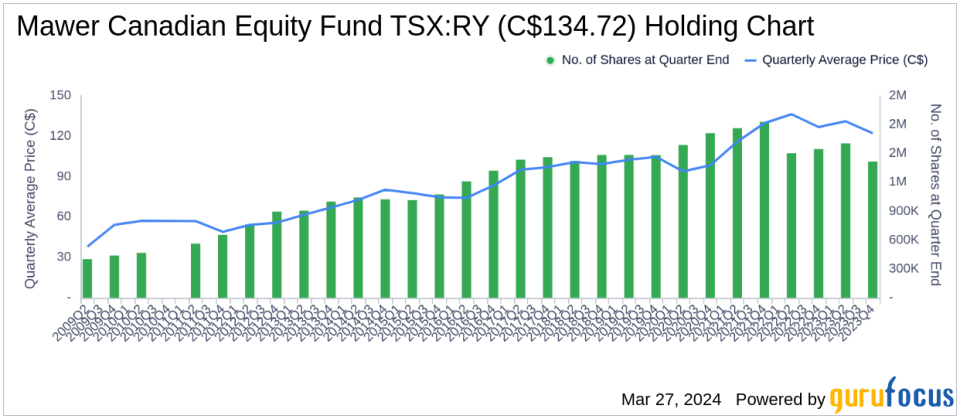

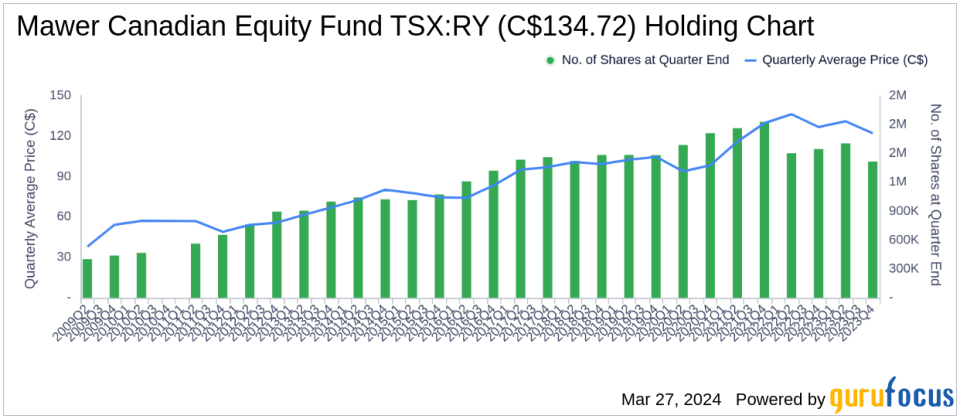

As of the end of Q4 2023, the Maher Canada Equity Fund (Trade, Portfolio) portfolio consisted of 42 stocks, with top holdings including Royal Bank of Canada (TSX:RY). 5.38% and Canadian Natural Resources Inc. (TSX:RY) at 4.76%. TSX:CNQ) and 4.66% for Toronto-Dominion Bank (TSX:TD). The fund’s investments are primarily concentrated in his 10 industries, reflecting his diverse approach to sector allocation.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

[ad_2]

Source link