[ad_1]

When we invest, we typically look for stocks that outperform the market average. And while active stock selection involves risk (requiring diversification), it can also yield excess returns.For example, in the long run Pfeiffer Vacuum Technology AG (ETR:PFV) shareholders have enjoyed a 39% share price increase over the past five years, which significantly outpaces the market return of around 7.0% (not including dividends).

It’s also worth looking at the company’s fundamentals here. That’s because it helps determine whether long-term shareholder returns are consistent with the performance of the underlying business.

Check out our latest analysis for Pfeiffer Vacuum Technology.

In Buffett’s words, “Ships will sail around the world, but a flat-earther society will thrive.” There will continue to be a wide discrepancy between prices and market values. ..” By comparing earnings per share (EPS) and share price changes over time, we can see how investor attitudes to a company have changed over time.

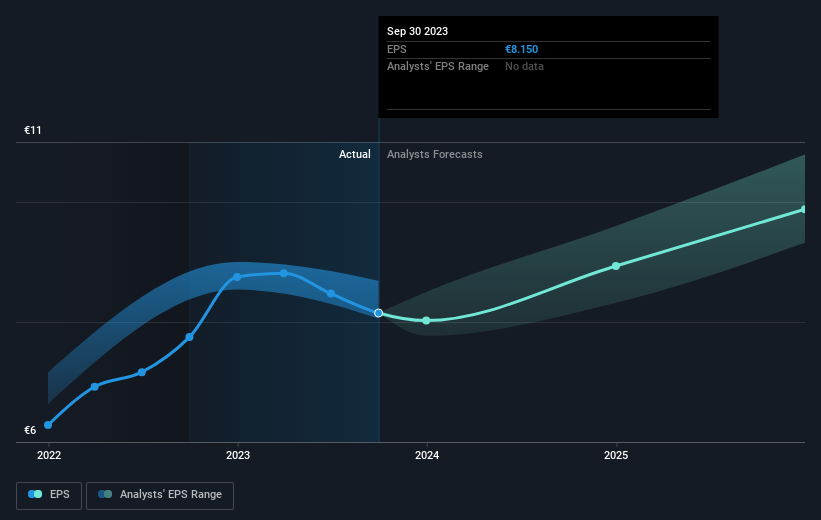

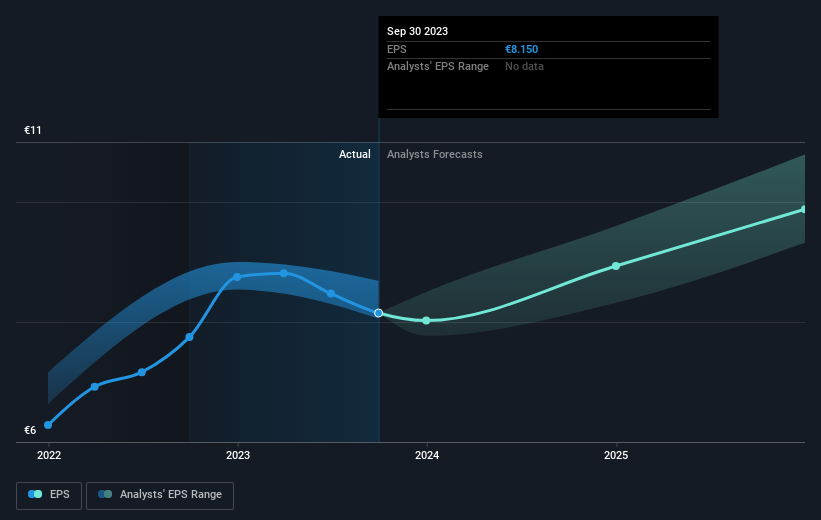

Pfeiffer Vacuum Technology achieved compound earnings per share (EPS) growth of 4.8% per year during the five-year share price growth period. This EPS growth is slower than the 7% annual growth in the share price over the same period. So it’s fair to think the market has a higher valuation for this business than it did five years ago. And this is not surprising given its track record of growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worth taking a look at ours free Pfeiffer Vacuum Technology earnings, revenue and cash flow report.

What will happen to the dividend?

It’s important to consider not only the share price return, but also the total shareholder return for a particular stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often much higher than the share price return. We note that Pfeiffer Vacuum Technology’s TSR over the last five years was 48%, which is better than the share price return mentioned above. Therefore, the dividend paid by the company is total Shareholder returns.

different perspective

While the broader market is up about 13% in the last year, Pfeiffer Vacuum Technology shareholders are down 10% (even including dividends). Even blue-chip stocks can see their share prices drop from time to time, and we like to see improvement in a company’s fundamental metrics before we get too interested. On the bright side, long-term shareholders have made money, with a return of 8% per year over 50 years. If fundamental data continues to point to long-term sustainable growth, the current selloff could be an opportunity worth considering. It’s always interesting to track stock performance over the long term. However, to better understand Pfeiffer vacuum technology, many other factors need to be considered.Case in point: we discovered 1 warning sign for Pfeiffer Vacuum Technology you should know.

If you want to buy stocks with management, you might like this free List of companies. (Hint: Insiders are buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.

[ad_2]

Source link