[ad_1]

College may be expensive, but generations of young people have been sold the promise of big returns once they hit the job market.

But that’s not the case for Helen, from Atlanta, who currently has $311,000 from three different degrees.

Do not miss it

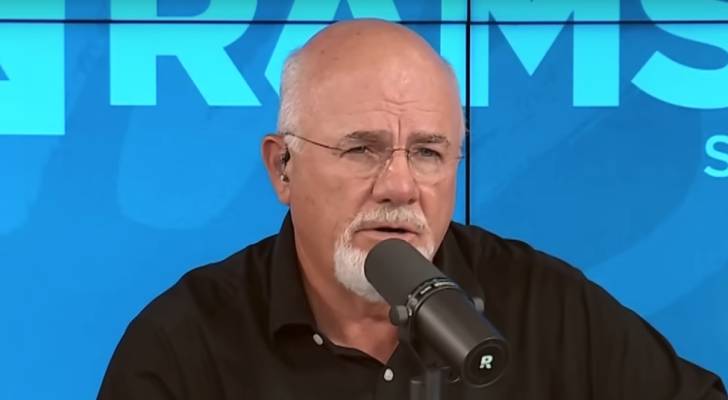

she recently called ramsey show She asked economic commentator Dave Ramsey for his opinion on her situation.

True to his style, Ramsay pulled no punches when he urged Helen to change her outlook on work, money and relationships after telling her that she was “collecting degrees like thermometers.”

overeducation and underemployment

Helen has degrees in law, conflict management and information technology. She admits that her conflict management degree was “a waste of money”, while her information technology degree is now outdated. Her only direct path to income would be to earn a law degree.

However, after working as a litigator for three years, Helen quit her job because she “didn’t like it.” She is currently employed as a staff attorney at a nonprofit firm and her annual salary is $85,000.

Unfortunately, that’s not enough to pay off her debt. Helen says her student loan interest rate is 7.6%, down from 6.8%, and she also has a mortgage, which brings her total debt to about $500,000.

Helen is at the crossroads of two crises. According to the Education Data Initiative, the burden of student loans falls on approximately 43.6 million Americans, and according to research from ResumeBuilder.com, one-third of college graduates work in jobs that don’t require a degree. . Too much debt and too little income due to underemployment are overlapping problems.

Fortunately for Helen, there are several options to quickly increase her income and escape from this situation.

read more: Thanks to Jeff Bezos, you can now turn prime real estate into cash without the hassle of being a landlord.Here’s how to do it

Increase “Shovel Size”

Helen’s income decreased because she refused to work as a litigator. At the same time, her husband earns only $50,000 (he doesn’t have a degree that would dramatically increase her income overnight) and has other debts. Mr. Ramsey summarized their key issues as follows: “You have deep, deep holes and medium to small shovels. You need to increase the size of your shovel and increase your income.”

The income a legal professional can earn varies depending on location, type of law practice, and years of experience. But even an entry-level associate in major markets could earn him as much as $215,000, according to a new report from the National Association for Law Placement (NALP). With Helen’s three years of experience, she should be above this salary range.

Ramsey estimates that Helen could earn an additional $100,000 a year working as a lawyer and pay off her debt within about three years. He says this may serve as a temporary measure rather than a permanent career shift because she doesn’t enjoy her job.

To be fair, Helen isn’t the only one who doesn’t enjoy being a lawyer. A recent study from the University of Minnesota found that lawyers are at increased risk of stress, overwork, and loneliness due to the high-stakes nature of their jobs. Ramsey acknowledges this, but argues that “dealing with a lawsuit is less depressing than dealing with $311,000 in student loan debt.”

He also recommends that couples consolidate their debts and work together to increase their income. Helen can repay the loan with her current income without her husband’s help, but “it would take three or four times as long.”

What to read next

This article is for information only and should not be construed as advice. PROVIDED WITHOUT WARRANTY OF ANY KIND.

[ad_2]

Source link