[ad_1]

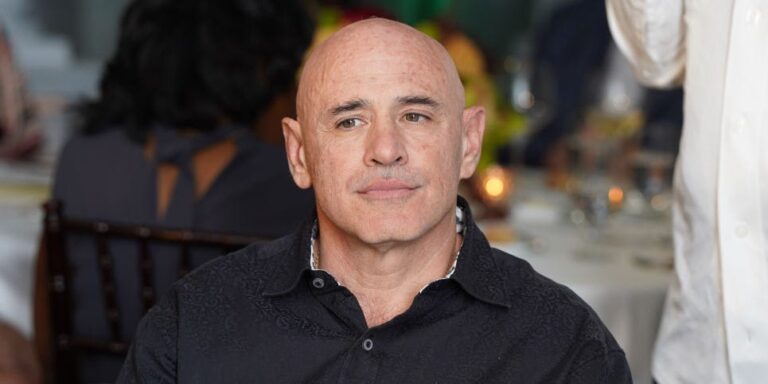

- Discovery Capital Management’s macro fund, led by “tiger cub” Rob Citron, returned 48% in 2023, Bloomberg reported.

- The fund was one of Wall Street’s best-performing funds and weathered a tough year for the market.

- The volatile $1.5 billion fund made a huge comeback after losing 29% in 2022.

Discovery Capital Management’s macro hedge fund, led by “tiger cub” Rob Citron, returned an impressive 48% in 2023, Bloomberg reported on Tuesday.

This is a sharp recovery from the 29% loss the fund recorded in 2022. The fund’s resurgence has made it one of the best-performing companies on Wall Street, according to Bloomberg.

One of the sources told Bloomberg that the $1.5 billion fund’s performance was primarily driven by both long and short bets on Latin American stocks and government bonds, U.S. credit and financial stocks.

This isn’t the first turnaround for the volatile fund. The fund, which has been around since 1999, soared 55% in 2020 after falling 23% in 2019.

Discovery Capital’s bet last year was strong enough to outperform the broader market in turmoil. The Fed continued to raise interest rates at the fastest rate in 40 years, sending the bond market into a tailspin, culminating in a historic bond collapse. The interest rate hike also caused mortgage rates to rise sharply, leading to a wave of bankruptcies. Needless to say, three banks failed in March 2023, causing turmoil in the market.

But over the past few months, the market has boomeranged, embarking on a monster rally starting in November. In fact, the gains burned out some hedge fund short sellers, who lost about 43% as the stock recovered.

[ad_2]

Source link